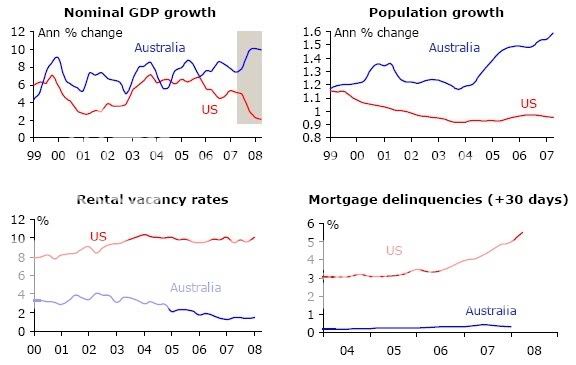

If the rate of population growth is the primary driver of prices (which it isn't), we should expect prices to grow more slowly than at any other time in history except the two world wars (falling nominal and real prices), the great depression (falling nominal and real prices), the mid 1970s (price growth < inflation) and the 1990s (price growth < inflation).

Hi MaxCarnage,

Shadow is only looking at the Demand/Supply side of the equation without taking any note of the debt to equity that many Australians have recently binged on. Debt and Unemployment are the key drivers that will bring house prices down. This is going to be long and drawn out as Governments try to inject stimulus packages and confidence back into the economy. Can they get the mix right? I doubt it very much.

Cheers markcoinoz

Hi MaxCarnage,

Shadow is only looking at the Demand/Supply side of the equation without taking any note of the debt to equity that many Australians have recently binged on. Debt and Unemployment are the key drivers that will bring house prices down. This is going to be long and drawn out as Governments try to inject stimulus packages and confidence back into the economy. Can they get the mix right? I doubt it very much.

Cheers markcoinoz