http://www.businessspectator.com.au/bs.nsf/Article/The-mercurial-Shadow-LP-blogs-pd20090430-RL9CN

Link to part 1: http://www.somersoft.com/forums/showthread.php?t=52058

Link to part 3: http://www.somersoft.com/forums/showthread.php?t=52062

An analysis of the Australian Property Market

Part 2: What does the future hold for the Australian property market?

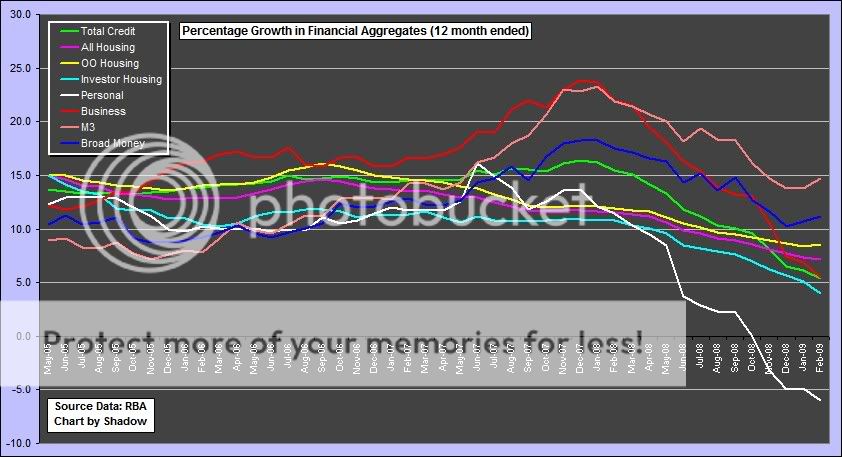

Nominal house prices are always increasing as inflation devalues the currency, and in recent times the money supply has been increasing at a much higher rate than CPI. The latest RBA figures indicate that the money supply (M3) is growing at 15% year-on-year, which is very strong growth (although not as strong as it had been previously). Interestingly, although the rate of growth in some categories is still in decline, the rate of growth in Owner Occupied housing finance has started to accelerate. If the money supply is increasing at a faster rate than the increase in prices of consumable goods (as measured by CPI) then this excess money has to go somewhere, and it tends to go into asset prices.

Source: http://www.rba.gov.au/Statistics/financial_aggregates.html

House prices in desirable locations such as major cities can and will continue to outstrip average incomes due to the following factors:

- Shortage of supply in desirable locations means that sought after properties tend to flow towards those with most wealth.

- Existing stock is passed down to children, which captures past property wealth for future generations to build upon.

- Natural population increase and immigration, without adequate supply-side response, increases demand for existing stock.

- Disposable household income has been rising faster than wages, and there is a natural tendency to direct this excess income towards housing.

In addition, there are many unique characteristics of the Australian property market that tend to suggest a positive outlook over the medium term.

- Interest rates falling to record lows.

- Investors need somewhere to park their cash, and are wary of equity markets due to the global stock market crash.

- Very high overseas immigration.

- Trend towards fewer persons per household.

- Already very high current pent-up demand for housing.

- Not enough new houses being built.

- Many properties are now cashflow positive.

- Cheaper to buy than rent in many suburbs.

- Australian median prices are still very low compared to many other countries.

- The falling Australian dollar has made Australian more affordable to foreign investors.

- Rapidly increasing rents encourage investors back to property.

- First Home Owners Grant boosted.

- Banks have agreed to mortgage payment holidays for the unemployed.

Furthermore, the Sydney market in particular demonstrates some additional positive characteristics:

- Geographic expansion constraints (Ocean/Mountains/National Park bordering Sydney).

- Resistance to high-density development.

- Prices set to rise after past 6 years of falling prices and stagnation.

- Real prices are 20% below their previous peak level.

- Current Sydney median price is historically low compared to other Australian cities.

- Reversal of the past internal migration trend from NSW to other states.

- Very strong auction clearance rates throughout 2009.

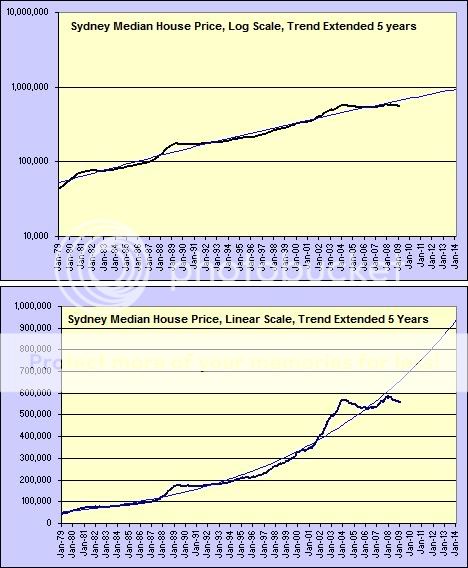

The chart below illustrates the fact that house prices in Sydney are below trend and potentially due for a major upwards correction.

It is also worth noting that the response to the Westpac Melbourne Institute survey question 'is it a good time to buy a house' has jumped again recently, after massive jumps in previous months, to the highest reading for almost a decade. Clearly the majority of Australians are beginning to realise that this is an excellent time to buy.

Additionally, AFG recently announced that March 2009 home loan approval volumes (by number and value) were the highest on record.

Finally, probably the most positive sign for Australian property is the recent uptick in housing finance commitments after the sharp decline during 2008, which history shows is always a precursor to an extended period of further growth. In all six of the previous six major housing finance downturn events over 34 years, the first uptick has been a precursor to an extended period of growth. We are now at number seven. This is a very bullish signal for the property market as the chart below demonstrates.

Source: http://www.abs.gov.au/AUSSTATS/[email protected]/DetailsPage/5609.0Feb 2009?OpenDocument

So, does this mean that property prices in Australia will never crash? No, in my opinion there will be a crash sometime, but just not yet. Prices will crash when the fundamentals change. I believe a property crash may occur after the forthcoming boom. As the credit crunch eases, and house prices start rising strongly again, there is a real possibility that a construction-led boom will kick off in Australia. However, there also is a good chance that we will make the same mistake as the US made - i.e. we will eventually build too many new houses (there are currently approx. 18.6 million empty houses in the USA). This oversupply will create a massive glut of property late next decade, just as the baby boomers start to die off, further increasing supply and reducing demand, and this is what may eventually trigger a crash. But it won't happen until after the next boom.

Link to part 1: http://www.somersoft.com/forums/showthread.php?t=52058

Link to part 3: http://www.somersoft.com/forums/showthread.php?t=52062

Last edited: