Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

3 years fixed 4.59%

- Thread starter Mick C

- Start date

More options

Who Replied?ME BANK Drops 3 Year Fixed - 4.59%!! ( CR 5.18%)!!

Keeping the fix rate thread alive

Any other banks following their lead?

Waiting for 3.99%.

Do they know something we do not ?

Must makes sense for them to secure numerous loans at that rate.

What are the Futures saying ?

Or is it just a quick drive for more business.

Keith had a great post on this

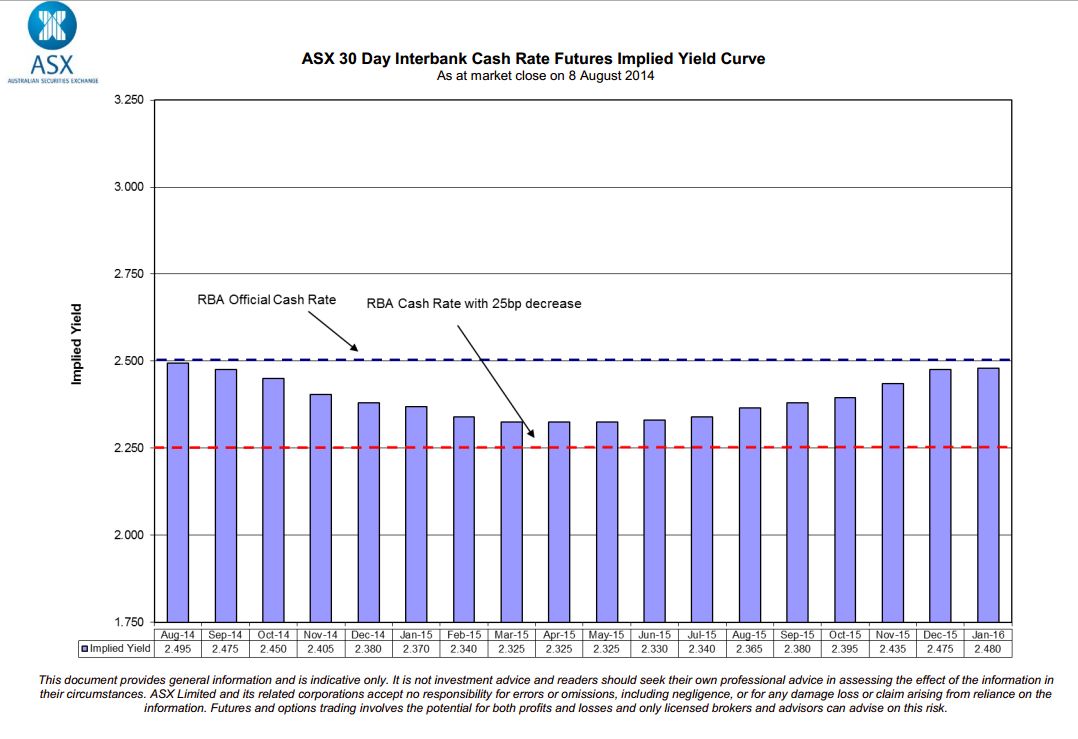

Listen to the market. It's dictated by the best brains that manage trillions of $$ so they have the most to win/lose. The market says no rise in rates for 18 months... and a cut is far more likely.

I'm happy to watch this graph change every week - I'm 90%+ sure that it will give me a 6yr fixed rate below 5%, and even if the 5yr rate does go up unexpectedly, based on past experience it's likely to go up by only a few bps before it really increases. I reckon you should be guided less by your fears and more by your dreams.

As an aside, I noticed yesterday that someone predicted a 0% cash rate by 2016! However, I'd be v. surprised it that happened.

Do they know something we do not ?

Must makes sense for them to secure numerous loans at that rate.

What are the Futures saying ?

Or is it just a quick drive for more business.

Cheaper funding costs being passed on. We've seen it through big movements in the 5 year rates and some of the shorter term rates have fallen too.

Not sure anyone can say with much certainty when they'll bottom out, but there is a pretty interesting thread on fixed rates where the SS community share their predictions!

great rate but the revert rate is not the best so if you are paying LMI and plan to keep topping up be aware.

Just wondering if this fix rate can be interest only with offset?

i need good fix rate for interest only with offset for my PPOR

nah

no offset

ta

rolf

Just wondering if this fix rate can be interest only with offset?

i need good fix rate for interest only with offset for my PPOR

ME bank does not allow offset accounts against fixed rate loans which is common with lenders. There is a couple that do allow it namely cua.

ABL is another of the semi majors

ta

rolf

ta

rolf

I rang St George Bank on Saturday to discuss converting to 5 year fixed @ 4.99%. They have been a bit slow in emailing the paperwork but I am going to fix for that period.

5 years @ 4.99%, no switching fee (I have an advantage package for about $395 pa) with the ability to pay up to $10,000 pa off the principal per year.

I see the risk in respect of interest rates on the upside, but not too great, however, much can happen in 5 years and I would think it would be northwards for rates.

The property is an IP so any rate rises / falls are buffered by tax rates but I am happy to lock in.

Any extra funds will go to super and margin loan (conservatively geared). However, will be happy to enter market again if interest rates do rise and a tipping point is reached.

Best to all

5 years @ 4.99%, no switching fee (I have an advantage package for about $395 pa) with the ability to pay up to $10,000 pa off the principal per year.

I see the risk in respect of interest rates on the upside, but not too great, however, much can happen in 5 years and I would think it would be northwards for rates.

The property is an IP so any rate rises / falls are buffered by tax rates but I am happy to lock in.

Any extra funds will go to super and margin loan (conservatively geared). However, will be happy to enter market again if interest rates do rise and a tipping point is reached.

Best to all

5 years at 4.99 sounds like a pretty good deal Bunlee! I know Westpac is offering that deal as well, has anyone seen a 5 yr fixed rate lower that 4.99?

Similar threads

- Replies

- 9

- Views

- 2K