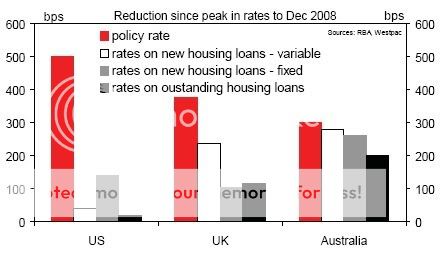

zero rates will only help lenders, not individuals / companies.

the banks wont go giving ANYONE a 2% mortgage rate.

Yup. No bank here is going to offer that rate.

Even in Singapore (where I come from), I purchased a Off-the-Plan 3 bedrm higher end public housing apartment back in Feb 2008 using the subsidized fixed interest rate of 2.6% for the life of the loan (30 yrs).

The lowest private banking rates in Singapore currently are around 3.75%.

Regards

Daniel