Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Australia Post to become a bank?

- Thread starter buzzlightyear

- Start date

More options

Who Replied?They should do it.

The banks are a cartel.

I dont have any problem with the govt running a bank.

It can make a profit but it doesnt have to make huge profits so we can all benefit with lower costs.

Banks use to not charge any fees remember?

Kiwibank is really good and popular so now the new conservative NZ govt wants to sell it which a lot of people are unhappy about. Kiwibank runs at a profit.

The banks are a cartel.

I dont have any problem with the govt running a bank.

It can make a profit but it doesnt have to make huge profits so we can all benefit with lower costs.

Banks use to not charge any fees remember?

Kiwibank is really good and popular so now the new conservative NZ govt wants to sell it which a lot of people are unhappy about. Kiwibank runs at a profit.

I think they should get their core business sorted properly first. With their distribution and logistics they could make a killing against some of the big transport giants, but alas they still operate like the public service.

I hate going into the Post Office to get a stamp or something from my PO Box, and the queue is huge with people paying the Car Registration, Electricity bills, Passports etc etc. Get the Post Office duties right first then diversify but only if they are prepared to properly resource it. Which they wont.

Many post offices are now franchised, so it is hard to see how this could be set up. Just imagine getting the thousands of individual francisees trained etc., to say nothing of security concerns.

Marg

I'm already doing most of my counter transaction with Australia Post because it beats queuing up at the Commbank branch. A lending office in each capital city could take care of some old fashion basic no frills home loans, the only choice being a fixed or variable loan.

As for any security concerns I'd rather have my details handled by some local working at Aussie Post then someone in Bangalore working for one of the big 4.

there was talk of floating aus post a while back and that held merit too. With a labor govt I think this idea (becoming a bank) could gain traction - perhaps why they are so blase and are letting the banks hang themselves by not passing on rate cuts? The public would be very supportive of any new competition

It's interesting that Fujitsu Consulting, a Jp Co is talking about this ... Japan has a long experience with PO being banks. Franchised or not isn't a problem, Japan's PO have been franchised for a long time and yes people go there to pay the elect bills etc but there aren't long waiting times, possibly since you can pay almost everything at the convenience stores too.

An interesting point is that Japan only recently privatised all the PO ... yes they are still banks and yes still franchised ... not much changed from the consumers' point of view. Also the PO bank has the lion share of people's money in Jp ... possibly due to being branches almost everywhere.

As a side comment I wonder just how many banks a country with a relatively small population, like Oz needs.

An interesting point is that Japan only recently privatised all the PO ... yes they are still banks and yes still franchised ... not much changed from the consumers' point of view. Also the PO bank has the lion share of people's money in Jp ... possibly due to being branches almost everywhere.

As a side comment I wonder just how many banks a country with a relatively small population, like Oz needs.

Patosan,

Using Japans PO system is not a good example.

The reason for the PO becoming a bank in Japan was so the govt could have access to peoples savings for govt spending and also funds the unofficial Japanese budget (ZAITO). The govt has spent all the savings and if the Japanese people ever decided to withdraw all their money out in a crisis there wouldn't be any.

The PO has the lions share of savings because it offered higher returns than the banks. The returns came from other peoples saving. Basically a Ponzi sponsored govt scheme.

Using Japans PO system is not a good example.

The reason for the PO becoming a bank in Japan was so the govt could have access to peoples savings for govt spending and also funds the unofficial Japanese budget (ZAITO). The govt has spent all the savings and if the Japanese people ever decided to withdraw all their money out in a crisis there wouldn't be any.

The PO has the lions share of savings because it offered higher returns than the banks. The returns came from other peoples saving. Basically a Ponzi sponsored govt scheme.

They could set up a team of mobile lenders, that might be handy!

That could be interesting

Dave

Attachments

It's the second time it's been done in NZ, the first was many years ago and it was called Post Bank, and guess what? It was then sold to ANZ.

Now they have Kiwi Bank, they have seperate counters at the post offices where you can do banking. It was brought in after I had left so I can't comment on it's service or fees but from what I can see it's rates don't seem any cheaper/better than any of the majors.

http://www.kiwibank.co.nz/about-us/

Now they have Kiwi Bank, they have seperate counters at the post offices where you can do banking. It was brought in after I had left so I can't comment on it's service or fees but from what I can see it's rates don't seem any cheaper/better than any of the majors.

http://www.kiwibank.co.nz/about-us/

but from what I can see it's rates don't seem any cheaper/better than any of the majors.

http://www.kiwibank.co.nz/about-us/

I can't comment on kiwibank per se as I don't really follow the NZ market, but the comparison shouldn't be between kiwibank and the majors, but rather between the behaviour of the majors with and without kiwibank.

I can't comment on kiwibank per se as I don't really follow the NZ market, but the comparison shouldn't be between kiwibank and the majors, but rather between the behaviour of the majors with and without kiwibank.

Here here! Exactly the same principle that Virgin Blue's affect had on Qantas and the domestic air market. The same affect that Aussie Home Loans, Wizard et al had on mortgage rates.

The banks cite their average margins being sqeezed, but they fail to mention fees income.

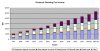

Source: Fujitsu Consulting - Australian Bank Fee Survey 2009