I came across this article yesterday. Does it appear to be accurate?

Any thoughts ?( based in USA)

here is a sample of the story:

Baby Boomers are Poised to Create the Greatest Depression in History

"THE FUTURE:

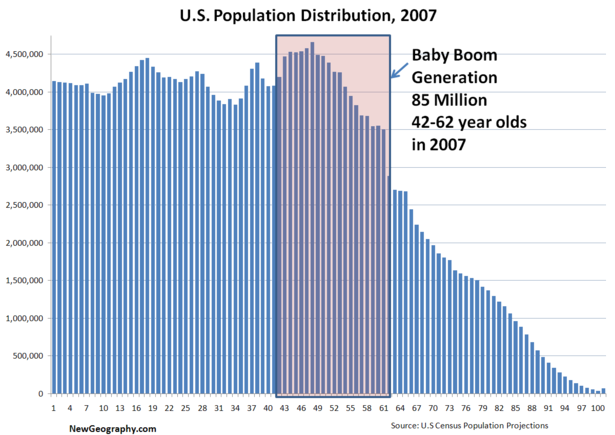

2012: By looking at the chart it is now quite clear that the USA may only have left a year or so at most of demographically driven growth with an accompanying rise in the economy and DJIA. This is clearly being muted currently by the manmade sub-prime and debt crises and their ongoing aftermath. As noted earlier, there may in fact be no years left and the economic decline could begin at any time. In the chart compare the drop in the demographic curve in the 1930-35 period of the Great Depression to the monstrous drop coming in 2013-2025. 2013 to 2025: The show is well and truly over. Just like Japan in the 1990s, no amount of stimulation or any form of economic mouth-to-mouth is going to make a bit of difference. As the chart shows, from 2013 latest to 2025 the big-spending 45 to 54 year-olds that history clearly shows control the long-term trend of the economy, are only there in relentlessly declining numbers. Just how big is this catastrophic depression going to be financially? In the US stock market crash from 1929 to 1932, the value of stocks dropped approximately $90 billion. When expressed in year 2000 dollars and adjusted to match the size of the US population now versus then (300M vs 123M), this is a drop of about 2.6 Trillion dollars. It directly affected the less than five percent of the US population who owned stocks at the time. The population at large was affected by job loss, bank failures and the ensuing poverty. When the 2013 to 2025 markets’ decline shown in the chart is converted with simple arithmetic to the loss in the value of all stocks in the same year 2000 dollars it is a staggering 14 Trillion dollars. This is over five times as bad as 1929 to 1932. This time the loss will directly affect the more than fifty percent of the US that now own stocks either directly or in mutual funds, pension plans, IRAs and 401K type savings plans. It will be a financial holocaust. In the depths of the Great Depression of the 1930s, US unemployment reached 25%. With a depression that is financially much deeper than the 1930s, what will unemployment reach this time?"

More of the story is here

http://economyincrisis.org/content/...-to-create-the-greatest-depression-in-history

Any thoughts ?( based in USA)

here is a sample of the story:

Baby Boomers are Poised to Create the Greatest Depression in History

"THE FUTURE:

2012: By looking at the chart it is now quite clear that the USA may only have left a year or so at most of demographically driven growth with an accompanying rise in the economy and DJIA. This is clearly being muted currently by the manmade sub-prime and debt crises and their ongoing aftermath. As noted earlier, there may in fact be no years left and the economic decline could begin at any time. In the chart compare the drop in the demographic curve in the 1930-35 period of the Great Depression to the monstrous drop coming in 2013-2025. 2013 to 2025: The show is well and truly over. Just like Japan in the 1990s, no amount of stimulation or any form of economic mouth-to-mouth is going to make a bit of difference. As the chart shows, from 2013 latest to 2025 the big-spending 45 to 54 year-olds that history clearly shows control the long-term trend of the economy, are only there in relentlessly declining numbers. Just how big is this catastrophic depression going to be financially? In the US stock market crash from 1929 to 1932, the value of stocks dropped approximately $90 billion. When expressed in year 2000 dollars and adjusted to match the size of the US population now versus then (300M vs 123M), this is a drop of about 2.6 Trillion dollars. It directly affected the less than five percent of the US population who owned stocks at the time. The population at large was affected by job loss, bank failures and the ensuing poverty. When the 2013 to 2025 markets’ decline shown in the chart is converted with simple arithmetic to the loss in the value of all stocks in the same year 2000 dollars it is a staggering 14 Trillion dollars. This is over five times as bad as 1929 to 1932. This time the loss will directly affect the more than fifty percent of the US that now own stocks either directly or in mutual funds, pension plans, IRAs and 401K type savings plans. It will be a financial holocaust. In the depths of the Great Depression of the 1930s, US unemployment reached 25%. With a depression that is financially much deeper than the 1930s, what will unemployment reach this time?"

More of the story is here

http://economyincrisis.org/content/...-to-create-the-greatest-depression-in-history