Why ? Isn't it simply a function wages growth and inflation ?

the long extremely important factor that is in function of wages and inflation is productivity (is also a function of progress and unemployment rate)

I agree that IRs & exchange rates will change discretionary income. But they have a relatively small influence. Only 10% of total income goes towards housing (rent & P&I), so a change in IRs has a small effect. And exchange rates have varied by 50% over the last 15 yrs with little effect on trend discretionary income.

Not sure how this is relevant. Are you saying cost of foreign debt changed discretionary income or vice versa ?

Iceland disposable income slumped because of drop in the exchange rate that got everything they imported unaffordable (same thing can happen to australia as we pretty much import everything of everyday use), theur disposable income dropped also because foreigners stop lending to them, the source of all this was a huge foreign debt (in relation to gdp)

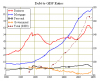

I'd agree if the O/S lenders lost confidence in our ability to repay the loans, refused to renew them or applied exorbitant rates, then our IRs would rise significantly & then our discretionary income would fall. However, we do have the ability to service the loans (thanks WA), because our discretionary income is growing sufficiently in proportion to mortgage debt. When the dirt runs out in 300 years, then we may have a problem (assuming nothing else changes).