From today's herald.

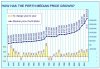

That will not help property investors sentiment in Sydney.

http://www.smh.com.au/articles/2006/05/16/1147545326435.html?from=top5

AUSTRALIA could be on the cusp of a sustained resources boom but it will have a dark side - depressed wages, stunted manufacturing and an exodus of workers and investment from Sydney to the mining states, the Government's chief economic adviser has warned.

The Treasury secretary, Ken Henry, said yesterday that property prices would fall and Sydney professionals would shift to Perth as the country continued its adjustment to "extraordinarily high" resources prices.

Dr Henry said China's industrialisation could yield high export prices and low import prices for much longer than commonly thought. These profound changes would raise Australian profits and lift consumption but, counter-intuitively, weigh on national employment and depress wages and economic growth.

In a speech in Sydney, Dr Henry delivered a blunt and controversial warning that governments should help, rather than resist, the shift from manufacturing and services in south-eastern Australia to mining in the the west and north. A retreat to corporate welfare or a failure to invest in education and retraining would make the adjustment more painful, he said.

Dr Henry set the test of good policy: "Proposals that resist the changes I have outlined here should themselves be resisted."

Dr Henry's speech to Australian Business Economists, follows the Government's $50 million subsidy to Ford Australia, and the budget's confirmation that spending on defence would outstrip spending on education.

Dr Henry showed the resources boom had produced a "two-speed" economy, with unemployment rising in the south-eastern states but falling in the west and north. But this might be a preview of what was to come, as investment and workers continued to leave places such as Sydney.

Dr Henry said Sydney was a "pretty good" place to visit - but would nevertheless lose professionals: "I don't think everybody in this room should be moving to Perth. But let me make this prediction: some of you will."

Sydney's manufacturers, stuck on the dark side of the resources boom, could face years of pressure. "Even if the exchange rate were not to appreciate they would eventually feel the squeeze because they would find it increasingly difficult … to compete with the construction and resources sectors for [capital and labour]," he said.

"That's going to have implications for asset prices, particularly property prices, in the resource-rich areas and in the non-resource rich areas."

Dr Henry said commentators had not realised exports could fall or remain flat in a sustained mining boom.

He said the current account deficit would be permanently higher as large dividends were paid to overseas investors.

Demand for labour would fall - after an initial boom - as the economy moved from labour to capital-intensive industries.

Treasury is acutely aware that Australia has never handled a terms of trade boom gracefully and has usually plunged into recession after the bust.

While Dr Henry assumed a sustained mining boom, Treasury's budget forecasts assume commodity prices will fall rapidly. He said the "prudent" tax revenue forecasts were "insurance" against a terms of trade bust and played down the need for larger budget surpluses, saying the Government's debt-free balance sheet gave it "enormous flexibility" to allow the budget to go into deficit if necessary.

Treasury's acceptance of a diminishing manufacturing industry attracted a withering response. "It is so sad to be revisiting this economic museum - to think it's all going to be coal and iron ore is just nuts," said an HSBC economist, John Edwards.

THE GREAT DIVIDE

- NSW's unemployment rate is 5.6 per cent; Western Australia's is 3.9 per cent.

- Manufacturing has fallen to 13 per cent of the economy from 15 per cent 10 years ago and 18 per cent 20 years ago.

- Manufacturing exports are worth $2 billion a year less than five years ago.

- One-third of companies say they are "very concerned" about manufacturing prospects.

That will not help property investors sentiment in Sydney.

http://www.smh.com.au/articles/2006/05/16/1147545326435.html?from=top5

AUSTRALIA could be on the cusp of a sustained resources boom but it will have a dark side - depressed wages, stunted manufacturing and an exodus of workers and investment from Sydney to the mining states, the Government's chief economic adviser has warned.

The Treasury secretary, Ken Henry, said yesterday that property prices would fall and Sydney professionals would shift to Perth as the country continued its adjustment to "extraordinarily high" resources prices.

Dr Henry said China's industrialisation could yield high export prices and low import prices for much longer than commonly thought. These profound changes would raise Australian profits and lift consumption but, counter-intuitively, weigh on national employment and depress wages and economic growth.

In a speech in Sydney, Dr Henry delivered a blunt and controversial warning that governments should help, rather than resist, the shift from manufacturing and services in south-eastern Australia to mining in the the west and north. A retreat to corporate welfare or a failure to invest in education and retraining would make the adjustment more painful, he said.

Dr Henry set the test of good policy: "Proposals that resist the changes I have outlined here should themselves be resisted."

Dr Henry's speech to Australian Business Economists, follows the Government's $50 million subsidy to Ford Australia, and the budget's confirmation that spending on defence would outstrip spending on education.

Dr Henry showed the resources boom had produced a "two-speed" economy, with unemployment rising in the south-eastern states but falling in the west and north. But this might be a preview of what was to come, as investment and workers continued to leave places such as Sydney.

Dr Henry said Sydney was a "pretty good" place to visit - but would nevertheless lose professionals: "I don't think everybody in this room should be moving to Perth. But let me make this prediction: some of you will."

Sydney's manufacturers, stuck on the dark side of the resources boom, could face years of pressure. "Even if the exchange rate were not to appreciate they would eventually feel the squeeze because they would find it increasingly difficult … to compete with the construction and resources sectors for [capital and labour]," he said.

"That's going to have implications for asset prices, particularly property prices, in the resource-rich areas and in the non-resource rich areas."

Dr Henry said commentators had not realised exports could fall or remain flat in a sustained mining boom.

He said the current account deficit would be permanently higher as large dividends were paid to overseas investors.

Demand for labour would fall - after an initial boom - as the economy moved from labour to capital-intensive industries.

Treasury is acutely aware that Australia has never handled a terms of trade boom gracefully and has usually plunged into recession after the bust.

While Dr Henry assumed a sustained mining boom, Treasury's budget forecasts assume commodity prices will fall rapidly. He said the "prudent" tax revenue forecasts were "insurance" against a terms of trade bust and played down the need for larger budget surpluses, saying the Government's debt-free balance sheet gave it "enormous flexibility" to allow the budget to go into deficit if necessary.

Treasury's acceptance of a diminishing manufacturing industry attracted a withering response. "It is so sad to be revisiting this economic museum - to think it's all going to be coal and iron ore is just nuts," said an HSBC economist, John Edwards.

THE GREAT DIVIDE

- NSW's unemployment rate is 5.6 per cent; Western Australia's is 3.9 per cent.

- Manufacturing has fallen to 13 per cent of the economy from 15 per cent 10 years ago and 18 per cent 20 years ago.

- Manufacturing exports are worth $2 billion a year less than five years ago.

- One-third of companies say they are "very concerned" about manufacturing prospects.