Hey all,

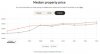

I have a 5 year old townhouse in Underwood, Logan (southern border of Brisbane) which has not grown in value since I purchased it for $364k in 2009.

It rents for $410 a week (5.8% yield) which has increased from $375/week when I bought it. It has had virtually no vacancy in that time which is great.

I am wondering what peoples opinion on Underwood are for capital growth in the near term and long term? I am hoping some of Brisbanes capital gains will start to filter out to this area soon.

My parents had a house nearby which more than doubled between 2002 and 2012, so the suburb has grown well in recent years.

Some more information about the property:

3 BR, 2.5 Bath, 1 Garage (air conditioned, modern design)

Across the road from Woolworths, servo, shops and Bunnings.

5 min drive to Kuraby train station

5 min drive to Springwood bus station (soon to be part of the south east busway)

7 min drive to Eight mile plains bus station (already part of busway with lots of carparking)

High rental demand

5 min drive to shops/services/aquatic centre on Logan rd

22 min drive to Brisbane CBD (no traffic)

About 35 townhouses in the development, with another similar sized devlopment across the road

Good depreciation, but still a small negative cashflow

Cheers,

Darren.

I have a 5 year old townhouse in Underwood, Logan (southern border of Brisbane) which has not grown in value since I purchased it for $364k in 2009.

It rents for $410 a week (5.8% yield) which has increased from $375/week when I bought it. It has had virtually no vacancy in that time which is great.

I am wondering what peoples opinion on Underwood are for capital growth in the near term and long term? I am hoping some of Brisbanes capital gains will start to filter out to this area soon.

My parents had a house nearby which more than doubled between 2002 and 2012, so the suburb has grown well in recent years.

Some more information about the property:

3 BR, 2.5 Bath, 1 Garage (air conditioned, modern design)

Across the road from Woolworths, servo, shops and Bunnings.

5 min drive to Kuraby train station

5 min drive to Springwood bus station (soon to be part of the south east busway)

7 min drive to Eight mile plains bus station (already part of busway with lots of carparking)

High rental demand

5 min drive to shops/services/aquatic centre on Logan rd

22 min drive to Brisbane CBD (no traffic)

About 35 townhouses in the development, with another similar sized devlopment across the road

Good depreciation, but still a small negative cashflow

Cheers,

Darren.