I have a question for history buffs and older members of the forum. Do rents ever go down sharply? IE. like the stock market or what happened to house prices in the USA in the last few years.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Do rents ever go down significantly

- Thread starter pickle pickle

- Start date

More options

Who Replied?Yes. Wasn't it around 2000 when there were instances of giving away 2-4 weeks free rent?

In over 30 years of having an IP we have probably lowered the rent three times when times were hard to get a tenant. Two years ago we reduced rent in Coorparoo from $430 to $420 per week just to get a tenant whilst going through a family trauma. We didn't have time to pfaff about and lowering it by $10 did the job.

Generally when a tenant leaves, we re-let at a slighly higher amount. This particular house went back up to $430 after the first twelve month lease expired and has just increased to $440 per week, but the tenant is leaving (nothing to do with the rent increase) and the agent who is finding us a tenant said $440 to $445 is about right. We will ask for $450 as we look after the mowing. It costs us about $10 a week for mowing (little more, little less) but if we don't include mowing, this large block can put tenants off.

Generally when a tenant leaves, we re-let at a slighly higher amount. This particular house went back up to $430 after the first twelve month lease expired and has just increased to $440 per week, but the tenant is leaving (nothing to do with the rent increase) and the agent who is finding us a tenant said $440 to $445 is about right. We will ask for $450 as we look after the mowing. It costs us about $10 a week for mowing (little more, little less) but if we don't include mowing, this large block can put tenants off.

How far back are you willing to look? did you want data from anywhere or Australia only?

Anecdotally a lot of new developments around Adelaide have seen rents stagnate and fall over the last year.

The old tenants of my current rental were paying $600pw (confirmed by them while collecting mail). When we first saw it, it was advertised for $650, it did not move, it dropped to $600 then $550. At that point we offered $500 which they took after sitting on it for a week.

Almost a year on similar places all try for $550ish but have been coming down as low as $450-480.

I'm sorry to say but our land lord will be dropping the rent $20 or we will be moving to the nicer place 3 doors down that's been empty 2 months and is now at $500 as well.

Anecdotally a lot of new developments around Adelaide have seen rents stagnate and fall over the last year.

The old tenants of my current rental were paying $600pw (confirmed by them while collecting mail). When we first saw it, it was advertised for $650, it did not move, it dropped to $600 then $550. At that point we offered $500 which they took after sitting on it for a week.

Almost a year on similar places all try for $550ish but have been coming down as low as $450-480.

I'm sorry to say but our land lord will be dropping the rent $20 or we will be moving to the nicer place 3 doors down that's been empty 2 months and is now at $500 as well.

Hi, $500 pw is NOT the norm for Adelaide. A lot of renters earn $500 pw.

2 BR flats are renting for $240 pw in Prospect. My 'students' rent a ground floor flat, one of 8 attached to the back of a house.

Those working in Parafield pay $250 pw for an older house with a yard.

So far, the rent around $300 pw have not been dropping.

KY

2 BR flats are renting for $240 pw in Prospect. My 'students' rent a ground floor flat, one of 8 attached to the back of a house.

Those working in Parafield pay $250 pw for an older house with a yard.

So far, the rent around $300 pw have not been dropping.

KY

Hi, $500 pw is NOT the norm for Adelaide.

I don't dissagree, my statment was about the "new developments around Adelaide."

Rents around here (Ipswich) have been pretty static for quite a while now. There have been a heap of new houses coming onto the market and ending up as rentals and now the Government is getting into the act as well offering new houses at low rentals to people who qualify for assistance.

We got our first IP here back in 1998 and at that time rentals were a bit slack too. I remember our first tenants offering less than we were asking at the time and we accepted it rather than have the place empty. Mind you houses were dirt cheap here then too, so the rent we were getting, even with the reduction, was really good as a ratio to the purchase price.

Houses are still cheaper than Brisbane but not as much as they were back then. Rents on the other hand have stayed considerably cheaper and that ratio of purchase price to rent received is nowhere near as lucrative. I guess it all comes down to supply and demand.

We got our first IP here back in 1998 and at that time rentals were a bit slack too. I remember our first tenants offering less than we were asking at the time and we accepted it rather than have the place empty. Mind you houses were dirt cheap here then too, so the rent we were getting, even with the reduction, was really good as a ratio to the purchase price.

Houses are still cheaper than Brisbane but not as much as they were back then. Rents on the other hand have stayed considerably cheaper and that ratio of purchase price to rent received is nowhere near as lucrative. I guess it all comes down to supply and demand.

I guess it all comes down to supply and demand.

Yep - and competing against old buggers who paid 50K for the place 25 years ago, and therefore have no mortgage to pay back, plenty of time on their hands, and therefore are quite willing to let their place for $ 30 or $ 40 per week under market and throw in free gardening and lawns as well.

Tenants point to them and say - see - that's what we want as well.

Residential renters in Australia get it extremely easy. The law is totally on their side....but they hardly ever know it, the bedroom rate per night is insanely low....usually less than $ 20 per room per night....and they know to demand all the fruit on top for free like DW, big yards, DLUG, new carpets, new paint....it goes on and on and on.

We had one couple paying $ 820 pw in a nice 4x2 B/T home only 6km from the CBD. They left after 4 years and now can't even get a sniff at $ 700 pw. $ 25 per room per night for top accomodation and bugger all to do only 6km from the CBD too expensive - nahh, get out of that market...it sux. With the new laws coming in, we can only charge them $ 2,800 in Bond and we don't even get to hold it.

In comparison, we just had a company sign on for 8 years to rent our rusty old sheds that leak like a sieve and need probably $ 150K in repairs done to them. Designed the Lease so they only officially lease the vacant block. All of the sheds are considered a bonus so we aren't responsible for anything other than the dirt, but they are willing to repair the sheds for us at their cost over the 8 years. Joy. 8km from the city, rent at $ 4,000 per week for the vacant block and they do everything. Security Bond paid to us was $ 80,000 and we get to keep it in our Bank account earning us interest.

There is no comparison. Begone whinging **** lowly paying residential snots.

In comparison, we just had a company sign on for 8 years to rent our rusty old sheds that leak like a sieve and need probably $ 150K in repairs done to them. Designed the Lease so they only officially lease the vacant block. All of the sheds are considered a bonus so we aren't responsible for anything other than the dirt, but they are willing to repair the sheds for us at their cost over the 8 years. Joy. 8km from the city, rent at $ 4,000 per week for the vacant block and they do everything. Security Bond paid to us was $ 80,000 and we get to keep it in our Bank account earning us interest.

There is no comparison. Begone whinging **** lowly paying residential snots.

Sounds good. 95% lend with LMI capitalized?

There is no comparison. Begone whinging **** lowly paying residential snots.

Ya good value Dazz but I would never wish to snuggle up to you hoping for some warmth. Methinks I'd freeze.

I would never wish to snuggle up to you hoping for some warmth. Methinks I'd freeze.

Thank you. If that is the impression I give, then I'm close to where I wish to be.

I've done my best to model my business ethics on the Banks. They are the true Masters. They have been my hard nosed teacher, and I've been their whipping boy for waaaay too long.

As they say, **** rolls downhill.

That's why I don't like the RTA contorting things with housing, such that it rolls downhill from the Banks and the Govt unnaturally force it to also roll downhill from the Tenants. As the Landlord, you end up drowning in a vortex of your own goop. Not for this little black duck.

You're making me want to go out and buy a few commercial properties if/when we sell our houseThere is no comparison. Begone whinging **** lowly paying residential snots.

You're making me want to go out and buy a few commercial properties if/when we sell our house

He's being doing that to me for years - put I haven't the balls that he has!

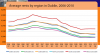

If you are interested in overseas figures - In Ireland they did. I have attached a figure showing the sharp drop in Dublin rental prices since the housing bubble collapsed.

Fortunately for Irish landlords, government rental assistance does put a bottom on how low rents can drop. Though given the parlous state of Irish government finances I wouldn't bet on that staying.

The American figures I've seen suggest American rental prices, even the bad areas seem to have held up relatively well. And these are *real* rental indices, so adjusted for inflation.

So the real question is - will Australia's experience be closer to America or Ireland.

It seems to me, from the American data which covers a number of cities, is that the rental declines are seen most in areas which have seen large run ups in rents during the bubble years. Miami and LA were some of the worse hit by house price declines but rents had been pretty flat during the bubble years. In recent years their rents had been going up a fair bit, despite the bad economic conditions of those cities. San Fran and Boston had seen large rental increases during the bubble. Their real rents have been going down/flat. I think Dublin also see a large increase in rents during the bubble years.

However, the American data does confuse me because I've head anecdotal stories about rent declines in LA. However it may be because the data in the figures ends in 2008. What we are seeing in the America figures is just the beginning of the economic crash. Later data show rents in LA for example going down with the increasing bad economic conditions. For example:

http://www.multihousingnews.com/news/southern-california-apartments-to-see-further-rental-declines/

So those areas with cheap rents may see an initial increase in rents as house prices flatten/decline and then large drops as unemployment hits.

Looking at America BLS data, it looks like unemployment didn't really start skyrocketing until mid-2008 so the American chart shows how rents go with flattening/declining house prices but decent employment. And then high unemployment hit.

Though rents then increased again (nation-wide) as the employment situation improved and people were unwilling to buy:

http://www.huffingtonpost.com/2011/04/06/housing-crisis-leads-to_n_845686.html

That didn't help LA rents much though because of bad employment:

http://articles.latimes.com/2011/apr/07/business/la-fi-0407-rents-20110407

So in the end it comes down to - rents increase/decrease with employment. If house prices go down but employment remains good then rents will increase (even more than normal as buyers stay out of the market). If house prices go down and employment crashes too then rents will crash (because people start living with relatives, in share houses or leave the area or just plain can't afford to pay higher rents), just not as much as house prices. The real problem is that in places like Dublin and LA, it was the high house prices that created the low unemployment in the first place due to their reliance on construction and immigration for their economic growth during the bubble years. So the real question of how rental prices will fair in any house price downturn is - how much of each Australian city's economic growth has been due to construction and immigration i.e. catering to population growth? Melbourne - stand up and take your prize as Australia's LA/Dublin!

Fortunately for Irish landlords, government rental assistance does put a bottom on how low rents can drop. Though given the parlous state of Irish government finances I wouldn't bet on that staying.

The American figures I've seen suggest American rental prices, even the bad areas seem to have held up relatively well. And these are *real* rental indices, so adjusted for inflation.

So the real question is - will Australia's experience be closer to America or Ireland.

It seems to me, from the American data which covers a number of cities, is that the rental declines are seen most in areas which have seen large run ups in rents during the bubble years. Miami and LA were some of the worse hit by house price declines but rents had been pretty flat during the bubble years. In recent years their rents had been going up a fair bit, despite the bad economic conditions of those cities. San Fran and Boston had seen large rental increases during the bubble. Their real rents have been going down/flat. I think Dublin also see a large increase in rents during the bubble years.

However, the American data does confuse me because I've head anecdotal stories about rent declines in LA. However it may be because the data in the figures ends in 2008. What we are seeing in the America figures is just the beginning of the economic crash. Later data show rents in LA for example going down with the increasing bad economic conditions. For example:

http://www.multihousingnews.com/news/southern-california-apartments-to-see-further-rental-declines/

The Los Angeles County apartment market is a prime example of lost jobs depressing rents, with over 142,000 positions eliminated by employers in 2009. “Average rents have fallen… 8.0 percent from their peak in Q2 of 2008,” notes the Casden Real Estate Economics Forecast, with the largest declines seen in Intown (9.9 percent), West LA (6.9 percent) and Antelope Valley (6.7 percent). In 2010, the forecast predicts an average 3.5 percent decline in rents throughout LA County. Some LA submarkets, including East LA and the Santa Clarita Valley, that have suffered less than others, however, and they may even see modest rebounds in rents in 2010 as jobs trickle back.

In Orange County, more than 53,000 people lost their jobs in 2009, and rents are down 7.7 percent from their peak in 3Q08. The forecast predicts that rents will fall 2.5 percent in Orange County in 2010. The Inland Empire, which lost 55,000 jobs in 2009, will see rental declines of only about 1 percent in 2010, partly because the delivery of new units this year is expected to be half the total of last year.

San Diego County is the only part of southern California expected to see rental increases this year, notes the forecast, in part because its 2009 jobs losses (43,000) were the lowest in southern California relative to the size of its labor market, and in part because rents are still fairly high for shadow-market homes and condos. Apartment rents dropped by 1.3 percent in 2009 in San Diego County, but will rise 0.7 percent this year.

Though the overall 2010 outlook for rents isn’t promising for SoCal landlords, there are also factors at work that will help raise rents eventually, especially the sharp drop in new multifamily construction throughout southern California. “Declines in new construction in these areas ranges from 15 percent in Los Angeles County to 60 percent in Orange County,” Tracey Seslen, assistant professor of clinical finance, USC Marshall School of Business, and one of the co-authors of the study (with Richard K. Green), tells MHN. “As time passes, the amount of new supply owing to conversions of condominiums into rental units will decrease, and the new supply coming online will be a better reflection of developers’ true expectations of demand.”

Selsen adds that the reduction in new supply is one of only a number of factors that will help determine future rents in the region. “Employment is arguably the most important factor–after devastating job losses in 2009, employment is expected to flatten out in 2010,” she posits. “If individuals have jobs and money to spend, we will see less doubling-up and exiting of the rental market to live with relatives. This will, in turn, support rents.”

So those areas with cheap rents may see an initial increase in rents as house prices flatten/decline and then large drops as unemployment hits.

Looking at America BLS data, it looks like unemployment didn't really start skyrocketing until mid-2008 so the American chart shows how rents go with flattening/declining house prices but decent employment. And then high unemployment hit.

Though rents then increased again (nation-wide) as the employment situation improved and people were unwilling to buy:

http://www.huffingtonpost.com/2011/04/06/housing-crisis-leads-to_n_845686.html

That didn't help LA rents much though because of bad employment:

http://articles.latimes.com/2011/apr/07/business/la-fi-0407-rents-20110407

So in the end it comes down to - rents increase/decrease with employment. If house prices go down but employment remains good then rents will increase (even more than normal as buyers stay out of the market). If house prices go down and employment crashes too then rents will crash (because people start living with relatives, in share houses or leave the area or just plain can't afford to pay higher rents), just not as much as house prices. The real problem is that in places like Dublin and LA, it was the high house prices that created the low unemployment in the first place due to their reliance on construction and immigration for their economic growth during the bubble years. So the real question of how rental prices will fair in any house price downturn is - how much of each Australian city's economic growth has been due to construction and immigration i.e. catering to population growth? Melbourne - stand up and take your prize as Australia's LA/Dublin!

Attachments

Last edited by a moderator:

I'm not much help with this, my experience has been, I never have difficulties renting out IP's and the rents continue to increase. (It is regional areas of Victoria.)

I'm curious to hear opinions on something I've been pondering...

House in our street didn't sell and was placed back on the rental market. It is a nice stucco place, three bedrooms, one nice bathroom, nice kitchen, crappy laundry in a hobbit hole under the house. Probably worth about $800K in the current market.

When I looked to see what they wanted in rent, I was surprised to see it sitting among four bed/two bath places that had much larger living areas. However, it was listed for rent with one of the more upmarket, ritzy agents, not local to the area but based in a ritzy, upmarket area.

I would have thought people going into this agency would be looking for houses in the ritzy, upmarket area, but it has now been rented. I don't know whether the rent was reduced or not, but cannot imagine anybody would rent this place for the asking rent when it is $100 per week higher than similar quality places, and the same price as houses nearly twice the size?

Do you believe that anybody looking to rent would be silly enough to not check out what else is available?

Do you believe that anybody looking would be fooled by the ritzy, glamorous agency?

I wish there was a way to find out what they actually are paying in rent (without knocking on the door and asking them ).

).

If this house is getting asking ($700 per week) then we should get at least $800 per week with the extra bedroom and bathroom, pool plus an extra level of living, but I know my dad's huge house with four bedrooms, three bathrooms, pretty glamorous struggled to get $750.

I just cannot understand why (if?) this place has rented for $700 and feel sure that perhaps they dropped the figure to get it rented. I just cannot find out and am a bit frustrated.

House in our street didn't sell and was placed back on the rental market. It is a nice stucco place, three bedrooms, one nice bathroom, nice kitchen, crappy laundry in a hobbit hole under the house. Probably worth about $800K in the current market.

When I looked to see what they wanted in rent, I was surprised to see it sitting among four bed/two bath places that had much larger living areas. However, it was listed for rent with one of the more upmarket, ritzy agents, not local to the area but based in a ritzy, upmarket area.

I would have thought people going into this agency would be looking for houses in the ritzy, upmarket area, but it has now been rented. I don't know whether the rent was reduced or not, but cannot imagine anybody would rent this place for the asking rent when it is $100 per week higher than similar quality places, and the same price as houses nearly twice the size?

Do you believe that anybody looking to rent would be silly enough to not check out what else is available?

Do you believe that anybody looking would be fooled by the ritzy, glamorous agency?

I wish there was a way to find out what they actually are paying in rent (without knocking on the door and asking them

If this house is getting asking ($700 per week) then we should get at least $800 per week with the extra bedroom and bathroom, pool plus an extra level of living, but I know my dad's huge house with four bedrooms, three bathrooms, pretty glamorous struggled to get $750.

I just cannot understand why (if?) this place has rented for $700 and feel sure that perhaps they dropped the figure to get it rented. I just cannot find out and am a bit frustrated.

Back in 2002, I settled on an apartment. I had a rental evaluation of $350pw, even though I lived in it as a PPOR. In early 2004, i rented it out for $350pw and the rent remained in the same until early late 2005.

CPI over that time was cumulatively ~8%, so a real loss of 8%. That doesn't take into account opportunity cost.

I currently have a 3br IP (house) in Windsor (Melbourne) that is rented for $720pw. There are four people living there sharing the rent (2 single and a couple). Across four people $180pw is a great deal for them. I suspect if it was rented today to a traditional couple it would rent for mid 600's.

CPI over that time was cumulatively ~8%, so a real loss of 8%. That doesn't take into account opportunity cost.

I currently have a 3br IP (house) in Windsor (Melbourne) that is rented for $720pw. There are four people living there sharing the rent (2 single and a couple). Across four people $180pw is a great deal for them. I suspect if it was rented today to a traditional couple it would rent for mid 600's.

Yep - and competing against old buggers who paid 50K for the place 25 years ago, and therefore have no mortgage to pay back, plenty of time on their hands, and therefore are quite willing to let their place for $ 30 or $ 40 per week under market and throw in free gardening and lawns as well.

Tenants point to them and say - see - that's what we want as well.

Residential renters in Australia get it extremely easy. The law is totally on their side....but they hardly ever know it, the bedroom rate per night is insanely low....usually less than $ 20 per room per night....and they know to demand all the fruit on top for free like DW, big yards, DLUG, new carpets, new paint....it goes on and on and on.

We had one couple paying $ 820 pw in a nice 4x2 B/T home only 6km from the CBD. They left after 4 years and now can't even get a sniff at $ 700 pw. $ 25 per room per night for top accomodation and bugger all to do only 6km from the CBD too expensive - nahh, get out of that market...it sux. With the new laws coming in, we can only charge them $ 2,800 in Bond and we don't even get to hold it.

In comparison, we just had a company sign on for 8 years to rent our rusty old sheds that leak like a sieve and need probably $ 150K in repairs done to them. Designed the Lease so they only officially lease the vacant block. All of the sheds are considered a bonus so we aren't responsible for anything other than the dirt, but they are willing to repair the sheds for us at their cost over the 8 years. Joy. 8km from the city, rent at $ 4,000 per week for the vacant block and they do everything. Security Bond paid to us was $ 80,000 and we get to keep it in our Bank account earning us interest.

There is no comparison. Begone whinging **** lowly paying residential snots.

Hi Dazz,

Would love to be in your boat and have had a number of investors in commercial property point me that way over the years, though they are talking monopoly money figures to me. The complexity of your leases would probably bamboozle me three ways to Sunday and drive me to derision also, it's not for everyone and a far cry from bread and butter properties

What kind of tenant would the 4x2 B/T home only 6km from the CBD attract?

And what type of property is most in demand in that area?

I'm presuming once your paying $700 -$800 p/wk + your expectations are also somewhat higher and location is only but one factor?

At that level I'm envisaging river views, home theatre, electric everything and the whole shebang...but then again I'm not paying, or considering paying $800+ in rent each week and am not within spitting distance of 6km city limits

Has the Capital Growth been reasonable over the years whilst you've owned the property?

The rent would seem cheap in comparison to some others in the suburb, a quick look at realestate.com.au at 4 + Bedroom 2 + bathrooms rentals shows

- 9 Rockton Road $1,500 p/wk 5x2

- 51 Mountjoy Road $1,050 p/wk 5x2+study

- 24 Hillway $1,300 p/wk 5x3

- 10 Tyrell St $985 p/wk 5x3

- 24 Bruce St $950 p/wk 3x2

- 39 Merriwa St $750 p/wk 3x2

One would hope that the CG of past years has made up for the low yields touted?

By the room comparisons is just depressing

I was living in Coogee (NSW) in 2004 and was renting a 3 bed ocean view apartment for $450 per week. The price was over $600 the year before. There was a huge slump for about 12 months around that area.

I also noticed a difference in the rents when the government brought out the

14K FHOG as a lot of renters decided to buy property, bringing down the rents, quite significantly in some areas of Sydney.

I also noticed a difference in the rents when the government brought out the

14K FHOG as a lot of renters decided to buy property, bringing down the rents, quite significantly in some areas of Sydney.

In about 2003 I had a little trouble with a property in Brunswick where we had to offer a few weeks rent free. I think we were asking right on the limit of the market rent at the time.

Additionally it was in the middle of a gloomy winter, there wasn't much activity at all.

We ideally try to let that property in early Feb as it's easy access to Melbourne Uni. At that time of the year we get excellent rent and tons of enquiries. We've never actually rented the property to students, but they tend to push the market up in the area.

Rents can fluctuate at different times of the year as demand changes. If you understand this, you can take advantage of it.

Additionally it was in the middle of a gloomy winter, there wasn't much activity at all.

We ideally try to let that property in early Feb as it's easy access to Melbourne Uni. At that time of the year we get excellent rent and tons of enquiries. We've never actually rented the property to students, but they tend to push the market up in the area.

Rents can fluctuate at different times of the year as demand changes. If you understand this, you can take advantage of it.

Similar threads

- Replies

- 8

- Views

- 3K