Hi guys

About to have a chat with my accountant about my finance structure, and wanted to share with Somersoft my ideas which I hope might help others.

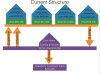

The first diagram explains my current structure. All the rents get placed into an offset account which is linked with my PPOR, then when interest payments are due these are withdrawn from the same account.

The second diagram is my proposed structure. This shows again all the rents getting payed into the same offset account linked with my PPOR. The difference however I'm wanting for all the expenses and interest to be paid by the offset account linked to the investment accounts.

feedback appreciated

7DD4

About to have a chat with my accountant about my finance structure, and wanted to share with Somersoft my ideas which I hope might help others.

The first diagram explains my current structure. All the rents get placed into an offset account which is linked with my PPOR, then when interest payments are due these are withdrawn from the same account.

The second diagram is my proposed structure. This shows again all the rents getting payed into the same offset account linked with my PPOR. The difference however I'm wanting for all the expenses and interest to be paid by the offset account linked to the investment accounts.

feedback appreciated

7DD4

Attachments

Last edited: