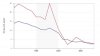

Feb. 16 (Bloomberg) -- Japan’s economy shrank at an annual 12.7 percent pace last quarter, the most since the 1974 oil shock, as recessions in the U.S. and Europe triggered a record drop in exports.

Gross domestic product fell for a third straight quarter in the three months ended Dec. 31, the Cabinet Office said today in Tokyo. The median estimate of 26 economists surveyed by Bloomberg News was for an 11.6 percent contraction.

Exports plunged an unprecedented 13.9 percent from the third quarter as demand for Corolla cars and Bravia televisions collapsed amid a slump that the Group of Seven nations said will persist for most of 2009. Toyota Motor Corp., Sony Corp. and Hitachi Ltd. -- all of which forecast losses -- are firing thousands of workers, heightening the risk a decline in household spending will prolong the recession.

“The economy is in terrible shape and the scary part is that we’re likely to see a similar drop this quarter,” said Seiji Adachi, a senior economist at Deutsche Securities Inc. in Tokyo. “All we can do is wait for overseas demand to pick up.”

The Nikkei 225 Stock Average fell 0.2 percent at the lunch break in Tokyo, extending the year’s losses to 12 percent. The yen rose to 91.62 per dollar from 91.76 on speculation Japan will refrain from taking measures to weaken the currency. The yen’s 18 percent gain over the past year has compounded exporters’ woes by eroding the value of their overseas sales.

Worse Than U.S., Europe

The world’s second-largest economy shrank 3.3 percent from the third quarter, today’s report showed. That compared with the U.S.’s 1 percent contraction and the euro-zone’s 1.5 percent decline, which was the sharpest in at least 13 years.

“There’s no doubt that the economy is in its worst state in the postwar period,” Economic and Fiscal Policy Minister Kaoru Yosano said in Tokyo. “The Japanese economy, which is heavily dependent on exports of autos, electronics and capital goods, has been severely hit by the global slowdown.”

G-7 finance chiefs meeting in Rome last weekend vowed to tackle a “severe” economic downturn.

Japan has been in a recession since November 2007, according to a government panel that dates the economic cycle. The Sept. 15 bankruptcy of Lehman Brothers Holdings Inc. worsened a credit crisis that erased more than $14 trillion from global equity markets and paralyzed world trade.

Yosano said the government has no plans to compile additional stimulus measures before next fiscal year’s budget is passed. Parliamentary gridlock has blocked the passage of Prime Minister Taro Aso’s 10 trillion yen ($111 billion) package, helping his popularity slide ahead of elections due by September.

Unpopular Aso

Aso’s approval rating fell to 9.7 percent, the poorest showing since the Yoshiro Mori administration in 2001, according to a Nippon Television news survey.

The Bank of Japan, which in December cut its key interest rate to 0.1 percent, is trying to get credit flowing by purchasing shares and corporate debt from lenders. It has little means to address what analysts say is the economy’s central problem: a lack of overseas demand.

Net exports -- the difference between exports and imports -- accounted for 3 percentage points of the 3.3 percent quarterly drop in GDP.

Japan has become more dependent on sales abroad for growth over the past decade. Overseas shipments make up 16 percent of the economy today compared with about 10 percent in 1999.

“Japan produces high-end durable goods, which are very, very sensitive to credit conditions,” said Hiroshi Shiraishi, an economist at BNP Paribas in Tokyo. “People normally borrow to buy these things. In that sense, too, Japan was vulnerable.”

Spending Less

Domestic demand, which includes spending by households and companies, made up 0.3 percentage point of the contraction.

Capital investment fell 5.3 percent. Manufacturers cut production by a record 11.9 percent in the quarter, indicating they have little need to buy equipment as factories lay idle. Consumer spending, which accounts for more than half of the economy, dropped 0.4 percent, as exporters fired workers.

Panasonic Corp., Pioneer Corp., Nissan Motor Co. and NEC Corp. announced a combined 65,000 job cuts in the past month. The eliminations may have pushed the recession into a “new phase” in which consumers become more defensive and spend less, according to Martin Schulz, a senior economist at Fujitsu Research Institute in Tokyo.

Sentiment among households is close to the lowest level in at least 26 years. The jobless rate surged to 4.4 percent in December from 3.9 percent, the biggest jump in four decades.

“The best we can expect for this year is to see the collapse stop,” said Kyohei Morita, chief economist at Barclays Capital in Tokyo. For Japan to recover, “we’ll need the U.S. and Chinese economies to take off first.”

Without adjusting for inflation, Japan shrank 1.7 percent from the previous quarter, less than the 2.1 percent analysts estimated. The GDP deflator, a broad measure of price changes, rose 0.9 percent, the first increase in a decade.

To contact the reporter on this story: Jason Clenfield in Tokyo at

[email protected]

Last Updated: February 15, 2009 21:11 EST