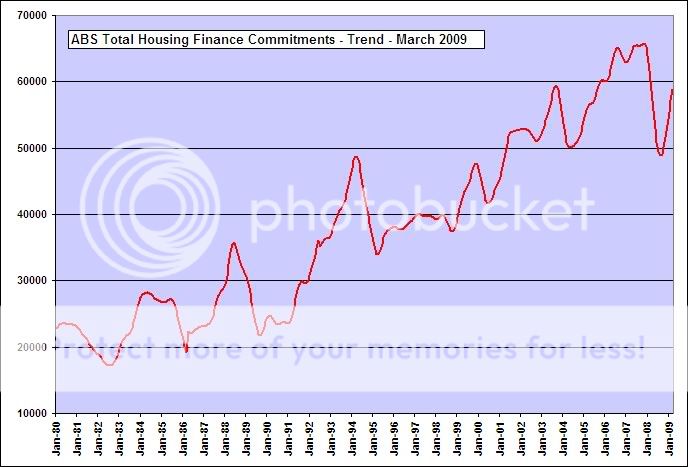

Housing finance commitments continue to rise strongly. The March data was released today.

http://www.abs.gov.au/AUSSTATS/[email protected]/DetailsPage/5609.0Mar 2009?OpenDocument

I have charted the trend below.

The recent uptick in housing finance commitments follows the sharp decline during 2008. History shows that this first uptick is always a precursor to an extended period of further growth. In all six of the previous six major housing finance downturn events over 34 years, the first uptick has been a precursor to an extended period of growth. We are now at number seven. This is a good sign for the property market.

Cheers,

Shadow.

http://www.abs.gov.au/AUSSTATS/[email protected]/DetailsPage/5609.0Mar 2009?OpenDocument

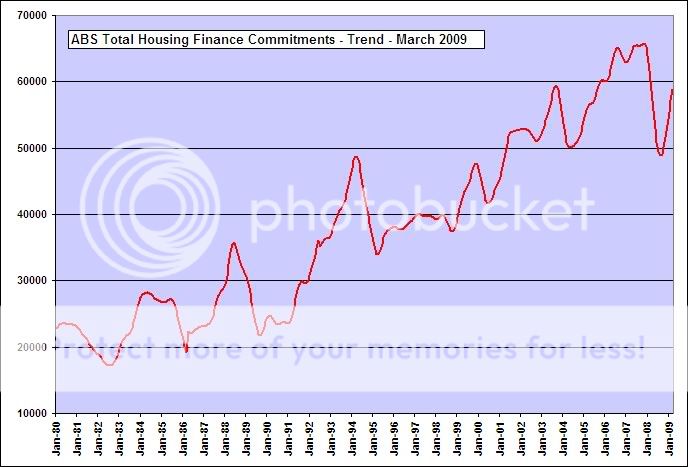

I have charted the trend below.

The recent uptick in housing finance commitments follows the sharp decline during 2008. History shows that this first uptick is always a precursor to an extended period of further growth. In all six of the previous six major housing finance downturn events over 34 years, the first uptick has been a precursor to an extended period of growth. We are now at number seven. This is a good sign for the property market.

Cheers,

Shadow.