I think Australia is now entering its long term deleveraging phase which

where are you seeing deleveraging?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I think Australia is now entering its long term deleveraging phase which

There is no assumption.

It was a factual statement about what happened over the past seven decades.

......

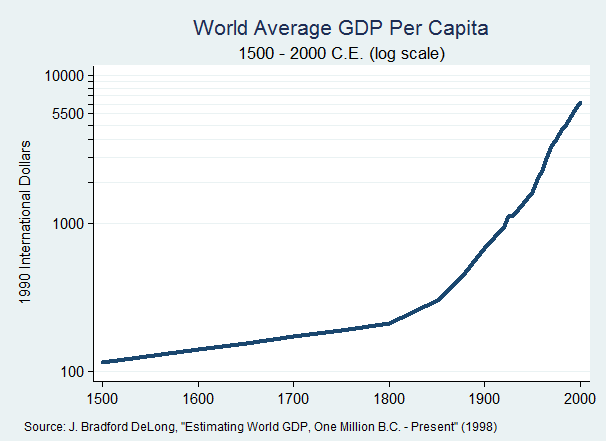

Even 1% growth per annum is exponential growth.

where are you seeing deleveraging?

Even in US asset prices have risen in real terms recently

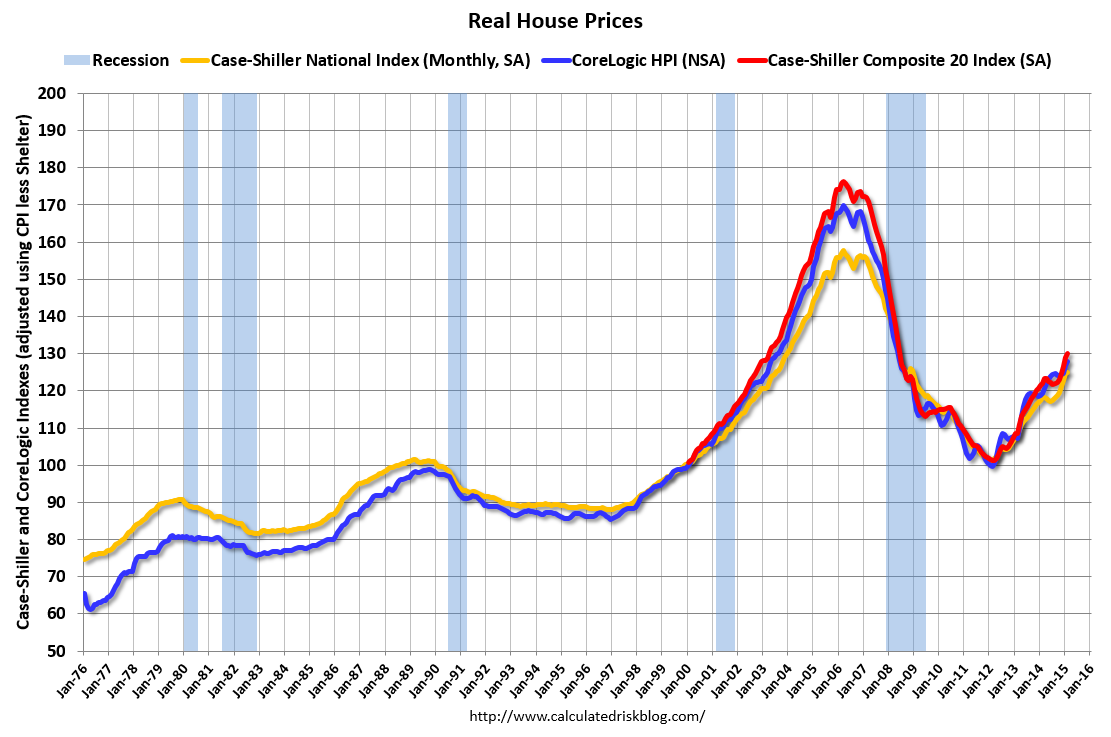

Off the bottom yes, but they are still a long way off the real peak 10 years later. I don't think they'll get back to the real peak for at least another 10 years, maybe longer. This is the best I could dig up - I don't know how to resize images

I think Aus 2015 = US 2006/07 (but probably not as bad peak to trough)

Are you referring to mining towns as cities?Many cities in Australia are already down 20-30% in real terms

Are you referring to mining towns as cities?

Hobart is the only one that comes close (from the capitals):

http://www.businessinsider.com.au/c...tually-declined-in-the-last-five-years-2015-4

Of course. Show me a graph of Mt Isa. And Gold Coast.

Neither of which are capital cities of any of the states in Aus?

You are comparing London/Manhattan with Mt Isa and Gold Coast? lol

But aren't both included in the general definition of "Brisbane"? I could be wrong but I often see people describing "Brisbane" as all of greater Brisbane, one huge pot.

How can Mt Isa be considered part of Brisbane, do you know how far it is from Brisbane?

As per OP - I'm saying the assumption that continued exponential real growth (like the last 50 years) will not hold - not even at 1%. I think next 20 years will be 0%... at best

Interesting. The whole concept of leverage would depend on the cost of servicing leverage.

If you can borrow a lot of money at 0% interest rates, what would you do? Of course that doesn't change a country's economic output, but it changes the relative nominal value between one class of asset (eg properties) and others (eg cash).

If that's what your analysis tells you then so be it. But your conviction is just so strong, that it surprises me you aren't hedging the market in some way. If you're not hedging, then at the very least I can only assume deep down you hope it'll crash so you can buy. I mean otherwise who on earth takes such a keen interest and does all this analysis if you aren't either betting for or against? You say you don't have any skin in the game or really intend to. I don't believe it to be honest, even if you don't see it yourself. You don't need to pretend to play the objective observer - tell us what you really want. If I had to guess, you've been flamed a lot as being a doom and gloomer in other places so you've learned to masquerade behind a veneer of objectivity.

I would likely benefit from a market fall in some way if I upgraded PPOR in the near future (which may be on the cards)

I would have thought these two questions are the first two questions you should ask yourself.This is a significant factor.

I would say a majority of market psychology at the moment is driven by 'how much can I service' by banks, individuals etc which means you can really pay a lot for an asset if you are confident the price will at worst stay flat (ie I can always sell for what I paid)

I think this psychology will transition to 'how am I going to pay this debt back' - then everything changes. Servicibility doesn't drive the asset value any more because the underlying collatoral value is now in question.