Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Interest Rates to Fall Yet Again. Good News For Property Owners.

- Thread starter Lord Shanghai

- Start date

More options

Who Replied?Ah yes they've been saying that for many years in Hong Kong too.

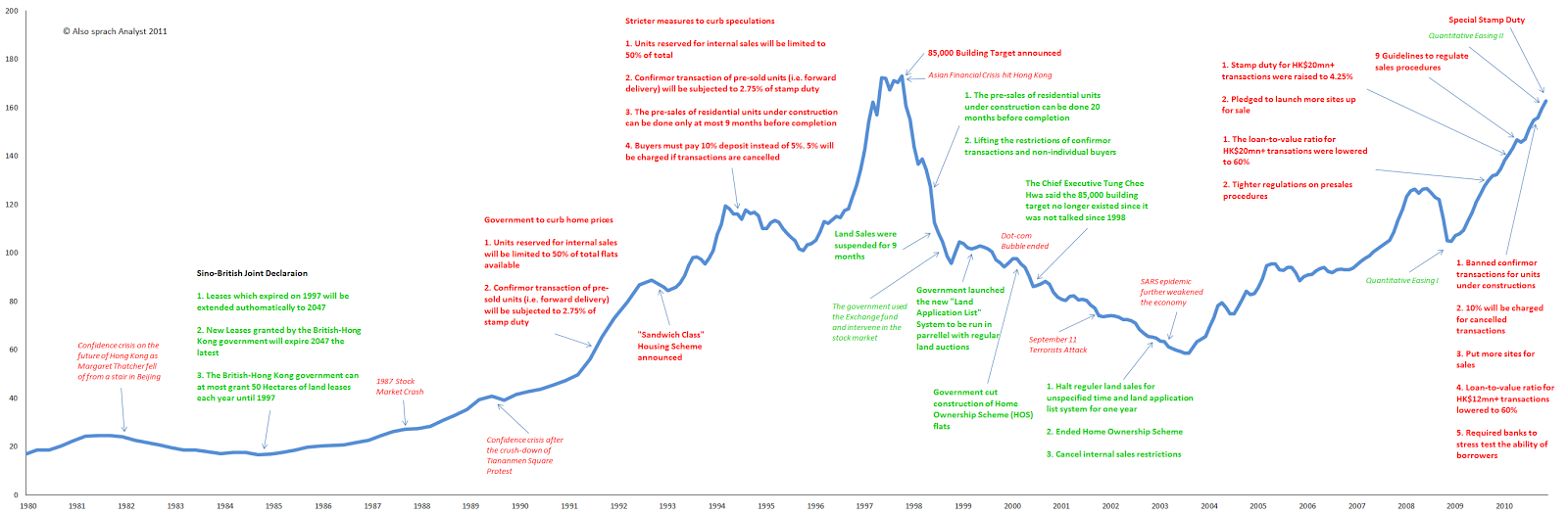

Hong Kong will take a hit soon enough being the most expensive property in the world. The problem is that land release is controlled by a few developers. I'm paying 2.15% on my HK mortgage but can still hold if they go to 3.5%.

Hk take a hit? They've been saying that since 2006

They tend to be a byproduct of financial crashes hence the stimulus package to support economic activity.

The GFC was about the blockage of interbank liquidity as fear mounted as to who was solvent and who wasn't. So what does that tell you. The banksters understand their own operations and how fragile they are. If they're dancing with the devil they know other banks are too.

CBA was secretly at the FEDs back door holding its hand out for a cool billion to keep the pumps going. As far as I know no one has got to the bottom of that one.

Basel III was supposed to improve bank reserves and strengthen their ability to withstand GFC events. Like all regulation it ends up a watered down shell of its original design. AU banks currently back per $100 of mortgage lending with $1.4 in real assets. Jeez 1.4% in reserves!!! So if a property market turns south they're effectively insolvent.

Guess who's going to be bailing them out....

ROFL...

By definition perhaps, by action they're joined at the hip. Politics is all about 'control'.

'ridiculously negative'... interesting phrase

Australia will hold it's own 'if' and that's a big if the rest of the global financial system can stay intact. Given the rate at which economies are falling off the perch and the continued deterioration in virtually all large economies excuse me if I'm not too optimistic on that front.

Watch the banks. They're now pushing for bail-ins. There's something in the wind.

Well you've obivously got your mind made up. Based on your last few posts I think you would do well to learn the difference between reality and conspiracy theory. Good luck!

Well you've obivously got your mind made up. Based on your last few posts I think you would do well to learn the difference between reality and conspiracy theory. Good luck!

I like Freckles analysis! Its always a good idea to start with a strong opinion and try and work out how it makes sense later.

Many of the worst decisions I've ever made have been done that way!

Highly recommended.

Dont lower rates drive up the price of property?

Ideally need to find the best balance of lowish rates with low property price - maybe doesnt occur or rarely so

Lower rates do drive values up - cheaper money leads to higher nominal prices.

The GFC was about the blockage of interbank liquidity as fear mounted as to who was solvent and who wasn't. So what does that tell you. The banksters understand their own operations and how fragile they are. If they're dancing with the devil they know other banks are too.

CBA was secretly at the FEDs back door holding its hand out for a cool billion to keep the pumps going. As far as I know no one has got to the bottom of that one.

Basel III was supposed to improve bank reserves and strengthen their ability to withstand GFC events. Like all regulation it ends up a watered down shell of its original design. AU banks currently back per $100 of mortgage lending with $1.4 in real assets. Jeez 1.4% in reserves!!! So if a property market turns south they're effectively insolvent.

Guess who's going to be bailing them out....

Basel III - banks hold around 8% equity, and have loss absorbency buffers/tools. For example, forced restrictions in dividend payouts for an interim period to absorb any losses made from stress conditions.

APRA's stress testing shows that Australian banks are resilient enough to hold strong against a 20% drop in house values.

Not sure what your saying Freckles - theres too much regulation, theres too little?

Basel III - banks hold around 8% equity, and have loss absorbency buffers/tools. For example, forced restrictions in dividend payouts for an interim period to absorb any losses made from stress conditions.

APRA's stress testing shows that Australian banks are resilient enough to hold strong against a 20% drop in house values.

Not sure what your saying Freckles - theres too much regulation, theres too little?

Spot on Stewart.

Basel III - banks hold around 8% equity, and have loss absorbency buffers/tools. For example, forced restrictions in dividend payouts for an interim period to absorb any losses made from stress conditions.

APRA's stress testing shows that Australian banks are resilient enough to hold strong against a 20% drop in house values.

Not sure what your saying Freckles - theres too much regulation, theres too little?

That would be the banks mark to whatever they think the market value is not mark to market.

Jeez I could go on but my budgy gets it so anyone with half a clue understands that banks are undercapitalised and even a moderate level of stress endangers the financial system let alone another GFC type event.

Believe the bankster and their stooge regulators if you like. Continuing research and criminal investigations keep on revealing how corrupt and compromised the system is.

I think you would do well to learn the difference between reality and conspiracy theory. Good luck!

If its a conspiracy theory I'm in good company.

You keep playing the man and not the ball especially when it's shown that your assumptions are spurious at best or perhaps worse blind faith.

If it helps you sleep at night keep believing the MSM line that AU's banking system is on firm ground... I'm just not that gullible anymore.

Another intellectual response from the bleachers.

Agh yeah we all know that.. well most of us anyway. Some still believe that politicians, bureaucrats and banksters only have our best interests at heart

Have been for a long time.

Always was and always will be.

Agh yeah we all know that.. well most of us anyway. Some still believe that politicians, bureaucrats and banksters only have our best interests at heart

Deal with it.

Have been for a long time.

Hang on, you recently told us that you don't believe anything journalists writeThat would be the banks mark to whatever they think the market value is not mark to market.

Jeez I could go on but my budgy gets it so anyone with half a clue understands that banks are undercapitalised and even a moderate level of stress endangers the financial system let alone another GFC type event.

Believe the bankster and their stooge regulators if you like. Continuing research and criminal investigations keep on revealing how corrupt and compromised the system is.

Do you believe the credit rating agencies ? - they reckon Aus banks are among the best in the world with AA ratings.

And do you believe the banks (the ones that survived the GFC) are stronger or weaker than they were then ?

And do you have any faith in the stress testing that the RBA has done - they modeled unemployment up to 12%, no decrease in interest rates and house prices falling by 25%, and the banks passed.

Unfortunately you'll find zerohedge & macrobusiness are the most bearish commentators out there - they are always expecting D&G - broken clock & conspiracy theory springs to mind.

You keep playing the man and not the ball especially when it's shown that your assumptions are spurious at best or perhaps worse blind faith.

I've consulted to a range of federal government departments professionally for the last 15 years, and I'm telling you that a lot of what you're saying is simply incorrect. I work with the people who have to set, and implement, many of these policies, and it simply doesn't happen as you are saying.

The playing the man rather than the ball came about after your comments responding to my assertion that government works with industry to achieve compliance rather than being run by a shadowy network of business cronies. You have yourself to thank for this.

...

The playing the man rather than the ball came about after your comments responding to my assertion that government works with industry to achieve compliance rather than being run by a shadowy network of business cronies. You have yourself to thank for this.

Most outsiders have not made any differentiation between departmental bureaucrats and elected politicians with mandate to govern. Together, they run government: one decides policies and one implements or executes the policies. The one that decides or formulates the policies is more subject to external influence, when in the process of 'consultation', than the one that merely implements or enforces policies.

Politicians may be in the pockets or beholden to interest groups but seldom career public servants as it is not in their ethos or interest to do so.

Hk take a hit? They've been saying that since 2006

Not really, they've mostly been saying it since 2012 when property prices doubled between then and 2009.

Hang on, you recently told us that you don't believe anything journalists write.

Perhaps you could troll throught the posts and find a quote..

Do you believe the credit rating agencies ? - they reckon Aus banks are among the best in the world with AA ratings.

Would that be the same ones shelling out AAA's just prior to things going belly up in 08. Widely lampooned as sell outs and corrupt stooges to the financial sector since 08 exposed their worthless ratings.

And do you believe the banks (the ones that survived the GFC) are stronger or weaker than they were then ?

Weaker. NAB, CBA and Westpac all took secret bailout loans to prevent a systemic collapse in AU's banking system.

CHRISTOPHER JOYE

Dangerous word games over solvency

Dangerous word games over solvency

And do you have any faith in the stress testing that the RBA has done - they modeled unemployment up to 12%, no decrease in interest rates and house prices falling by 25%, and the banks passed.

broken clock & conspiracy theory springs to mind.

...and cognitive dissonance springs to mine.

The playing the man rather than the ball came about after your comments responding to my assertion that government works with industry to achieve compliance rather than being run by a shadowy network of business cronies. You have yourself to thank for this.

...as I said Resource rent tax, carbon tax... you trying to tell me government 'worked' with business for an amicable outcome.

When government 'works' with business there's usually a sell-out somewhere in there.

This is the Worlds Oldest Bank, Monte -dei -Paschi -di-Siena,and it's in the list of 9 that failed the Italian lenders stress testing ,a continent wide test of 100 Euro Banks and only 24 Banks have enough raw capital to stay above the water line "IF" 2008 "GFC" happens again,,all it would take now is for Russia start to settle their trade deals in Rubles-Yuan when they deal with China and the US greenback loses traction and we may well see it all happen again..imho..

http://english.mps.it/

http://english.mps.it/Investor+Relations/Presentazioni/Dati+di+bilancio/

http://english.mps.it/

http://english.mps.it/Investor+Relations/Presentazioni/Dati+di+bilancio/

all it would take now is for Russia start to settle their trade deals in Rubles-Yuan when they deal with China and the US greenback loses traction and we may well see it all happen again..imho..

These things are already happening and more. The current concern is the strengthening dollar. It's reversing capital flows out of EM's putting downward pressure on their economies right when we need EM's to hold the line globally speaking. They were the last growth centers for global economic recovery and growth.

Another concern building is the deflationary effect of the full on currency war between China, Japan, S Korea and Taiwan. If this gets out of hand then there is according to some commentators, the risk of another Asian Crises.

Throw in an escalating Ukrainian conflict and a northern winter I'd say pull up a chair and grab your popcorn... the next 6 months should be interesting.