Interesting piece just out by Joye in the AFR, who is one of the better market commentators. Not sure exactly how he works out its 10% overvalued. Streched valuations seems to be mainly associated with certain suburbs, not necessarily broadly based.

http://www.afr.com/p/personal_finan...ices_headed_for_record_gSdGyBWsYfyuDcVBwatptN

http://www.afr.com/p/personal_finan...ices_headed_for_record_gSdGyBWsYfyuDcVBwatptN

Property prices headed for record high

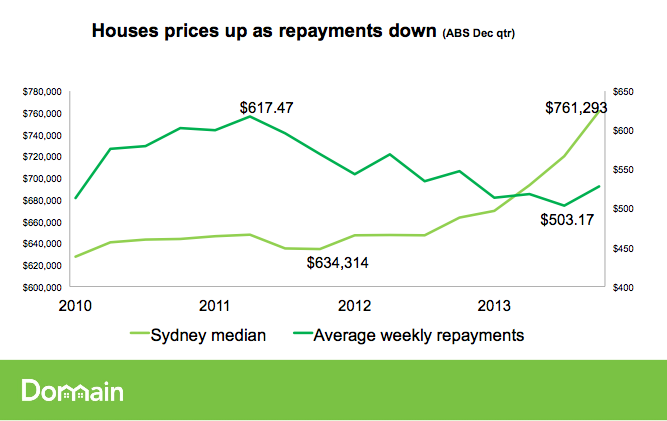

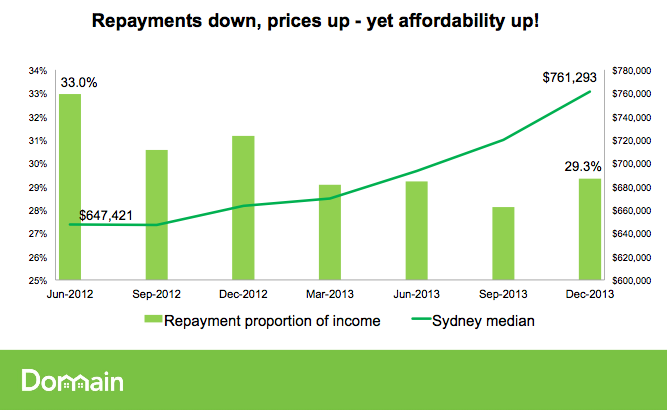

Australian dwelling prices have jumped more than 10 per cent over the year to March 2014. In Sydney and Melbourne, which make up 55 per cent of the metropolitan population, home values leapt by 15 per cent and 11 per cent, respectively. Yet disposable incomes per capita only rose by 1.7 per cent over 2013. Photo: AFP

CHRISTOPHER JOYE

The $4 trillion Australian housing market is now overvalued by at least 10 per cent. Every day, valuations get more stretched. Indeed, Australia is just months away from having the most expensive residential property market in history.

Anyone with exposure to the banks, which account for one-third of the sharemarket's value, or to housing, should be focused on two questions.

When will a bona fide bubble emerge and how steep are the price falls likely to be when borrowing costs are normalised?

Last edited by a moderator: