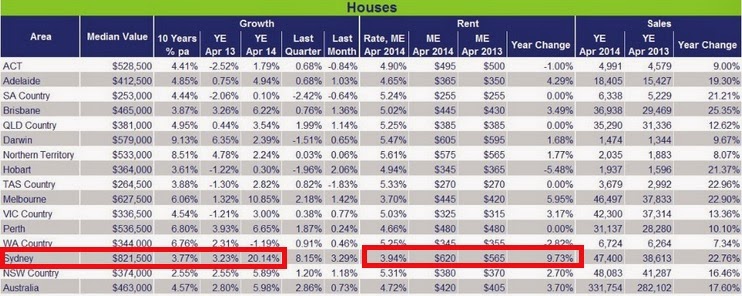

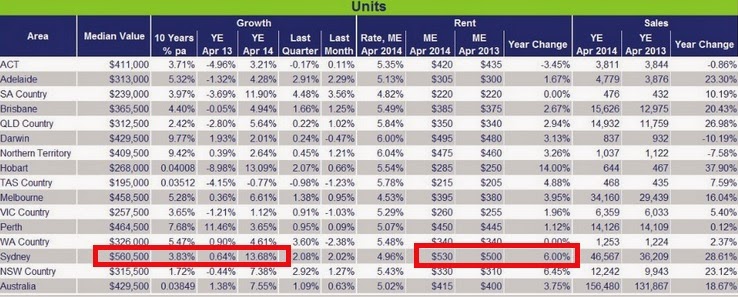

This landed in my inbox. Thought I'd share. Source: http://propertyupdate.com.au/sydney-property-market-cooling-pete-wargent/

In addition to the data, the closing sentence is of particular interest.

In addition to the data, the closing sentence is of particular interest.

There have been a few articles recently suggesting that the Sydney property market is cooling down.

I?d say that on balance, from what I have seen at any rate, there does seem to be a fraction less panic buying than there was in December at the end of last year.

Auction clearance rates were almost certain to slip too as vendors raised their expectations.

I?d caution, though, that much of what gets reported on property markets is half-baked opinion at best, and frequently is based on very little genuine research.

Why so?

Sometimes it?s just laziness, I guess.

On other occasions, it seems to be quite likely that people aren?t really clever enough to interpret data so they just repeat what they hear other people saying until eventually it becomes gospel.

Property markets are much about sentiment so this is certainly important to gauge, but you have to listen to what the data is telling you too.

Lending Finance March 2014

No need to listen to hearsay today, however, let?s just analyse the data for ourselves.

The Australian Bureau of Statistics (ABS) released its Lending Finance March 2014 data today here.

You likely won?t see this widely reported since the ABS time series spreadsheets are notoriously cumbersome and awkward to navigate.

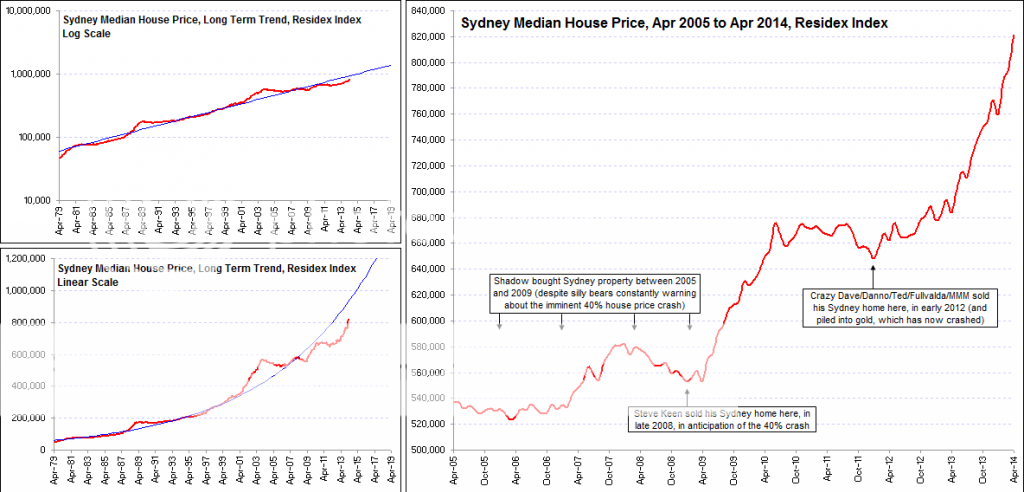

If you?re prepared to dig a little and extend a scintilla of scrutiny, you?ll find that in the year to March 2014 New South Wales property investor lending has increased at a fearsome pace to what is comfortably the greatest level in the entire history of the state.

I mean, by a wide, wide margin.

Not only that, the data produces a chart that is turning full on parabolic, with the pace of property investor lending increasing at an apparently exponential rate.

If you take this as equating to a gently slowing or peacefully cooling property market in Sydney, well, I s?pose you could be right?but I reckon you read the data set slightly differently to the way I do.

Take a look and judge for yourself :

The value of property investor lending in New South Wales on a rolling annual basis is a colossal 43% higher than it was only a year ago, and, outrageously is now almost 75% higher than where it was only at the beginning of 2012.

After their apparently bold 15-20% Sydney 2014 property boom prediction, I suspect that SQM Research are looking at today?s data and reasoning that they may not be too far wide of the mark.