It's a Great Time to Buy a New Home according to the HIA-CBA Affordability Report released today.

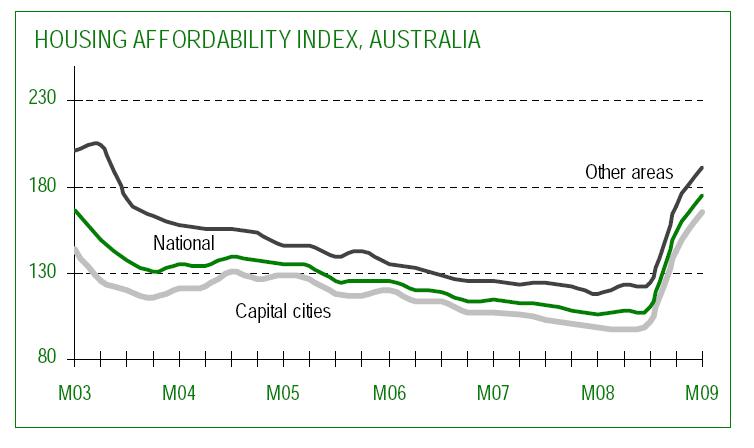

The boost to the First Home Owners Grant, record low interest rates and relatively stable house prices have combined to make housing the most affordable in seven years, according to the HIA-CBA First Home Buyer Affordability Index.

The HIA-CBA First Home Buyer Affordability Report revealed a 14.6 per cent improvement in affordability for the March 2009 quarter which came hot on the heels of a 40 per cent surge at the end of 2008.

......