I thought of China when reading slide 3, though there are others here

Slide 2

Slide 3

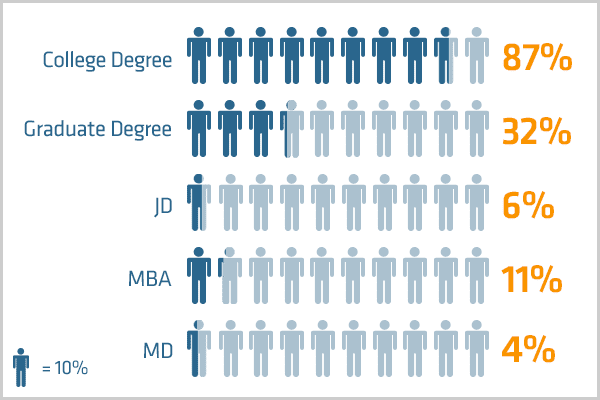

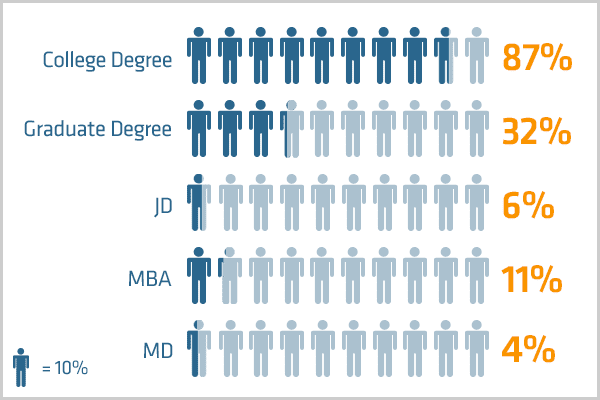

According to the chart only 4% of millionaires are doctors, which is different than saying only 4% of all doctors are millionaires.

Link

The Millionaire Next Door springs to mind when reading the link

Slide 2

Three-fourths of America's millionaires are retired, and nearly 60 percent are grandparents with an income of less than $150,000 per year.

Just under a quarter of the millionaires surveyed had a household income of more than $200,000.

One clear finding from the study: Getting older may have its downside, but when it comes to wealth, being older is a key factor.

Thirty-eight percent of those with $1 million to $5 million are 70 or over, and that goes up to 40 percent for those with more than $5 million in investable assets. Those under 55 comprise 6 percent of households with $1 million to $5 million in assets; 3 percent of households have more than $5 million.

Slide 3

An elite class

With the price of a college education continuing to rise, many more Americans wonder whether the degree is worth it. You can pick your data point to make the pro argument.

This week the Federal Reserve Bank of San Francisco released a study suggesting that a college degree was worth $800,000 in income more than the undereducated will ever be able to garner over a lifetime. You could also look at this survey, showing that 87 percent of millionaires have a college degree. More than half of millionaires also obtained some type of graduate degree.

Becoming a doctor only worked for 4 percent of millionaires?and that was before the Affordable Care Act.

Seventy-eight percent of millionaires believe the cause of income inequality is wealthier households having greater access to education.

Still, education isn't the No. 1 contributor to wealth creation.

According to the chart only 4% of millionaires are doctors, which is different than saying only 4% of all doctors are millionaires.

Link

The Millionaire Next Door springs to mind when reading the link