Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Negative Gearing on chopping block

- Thread starter kamchatsky

- Start date

More options

Who Replied?...

If NG was given the boot, then alot of investors will park their money elsewhere eg shares, bank interest etc for a better return. Also consider that without NG some investors won't have the cashflow to service a loan.

IF NG is abolished on investment properties only, then of course other forms of investment will become more popular. SS would probally become a stock market forum!

When you have around 3 mil renters scrounging around our major big cities and towns, looking for a limited commodity ie a roof over your head, rents will go up not down.

I agree with you that this is likely to happen. Without NG, some investors will not adopt some investment strategies, or some strategies become financially unfeasible.

It would mean one less avenue for some INDIVIDUAL investors to invest, adding more people at risk of being reliant on national welfare. Instead of thinking how to get more people to put more effort into being more self-reliant, it would push people away from investing individually in a significant sector. The Government might think that it would be addressing current problems but should also honestly budget for enlarging demand for welfare for years to come. I doubt a Coalition government led by TA will do this.

Rationally, it is easier for the Government to achieve bipartisan agreement to just raise the bar of threshold age for eligibility of the Age Pension as people are living much longer compared to the age of eligibility. At the same time, it can minimise or defer the big cost item of maternity leave policy.

Keep negative gearing but get rid of depreciation would be a decent move imo

A) its really just giving property holders a few grand a year per property for free

B) itll slow down spruikers that flog otp

The taxman can get-back all the benefit that we got from depreciation schedule, when we sell the property.

No this never happened, just a myth, pushed by vested interests ever since.I'm sure I read somewhere that NG was abolished in the 80s and investors left the market in droves. This created a shortage in housing and rent increases and put pressure on the government to supply housing, so they re-introduced it again.

Without the competition of negatively geared speculators tens of thousands more people could buy their own home. In the long run welfare costs would go down, more people would own their own home and yes there would be less rental properties but also an equally less number of renters.

Yep!Any move by the govt to make property investing less attractive will mean less investors. Less property investors will affect the building industry and cause rents to rise. It will also put a greater strain on public housing. More people will be living on the street, in cars, in factory units, on lounges in friends or relo's place etc. I just cant see the govt doing it.

This is the part I don't understand.

If Neg. Gearing abolished, then the rents will rise?

My understanding, if NG abolishes it means less property investor, then it means a drop in property price. If the property price drop, it means more people (especially first home buyer) can afford to buy a house. If more FHB can afford to a house, it means rents to drop. So, am I correct to assume this?

Its all about supply and demand.

Fewer property investors means fewer rental properties. If there are fewer rental properties, then the demand for those properties increases, driving up the rents.

No matter what you do, many renters will never purchase a home.

The taxman can get-back all the benefit that we got from depreciation schedule, when we sell the property.

Not really provided you hold for the medium to long term. A dollar today is worth more than a dollar tomorrow.

Another thing to look at would be the supply side . If you hold a negatively geared property that is " grandfathered " that a disincentive to sell , and also to pay it down .......

We'd also see more incentive to buy new properties and that would skew the market as well

Cliff

We'd also see more incentive to buy new properties and that would skew the market as well

Cliff

Yep!

Its all about supply and demand.

Fewer property investors means fewer rental properties. If there are fewer rental properties, then the demand for those properties increases, driving up the rents.

No matter what you do, many renters will never purchase a home.

Yep, and that's no myth !

Abolish NG and rents will rise.

Some like to make it sound as though every IP is neg geared and society in general suffers a terrible fate because of it.

As if...?

Keep negative gearing but get rid of depreciation would be a decent move imo

A) its really just giving property holders a few grand a year per property for free

B) itll slow down spruikers that flog otp

I agree with the above, but would go one step further and add that you wouldn't be able to claim borrowing costs.

I believe that you could/ should still be able to claim rates, insurance & body corp etc, this would be a gradual abolishing of NG. I think it would be a brave government to just get rid of NG altogether in one swoop. I reckon it would need to be a gradual process so it doesn't distort the market to much.

Just my 2c

Last edited:

If NG is gotten rid of the only logical way to do it would put an end date. All existing purchases are protected. Only new builds purchased until 2015 are to have NG going forward. Something like that.

This means that rental stock is not diminished (although we are getting 2 stories on that. One is negative gearing will cause mass homelessness, the other is that moat IPs aren't negatively geared) and existing owners are not massively hit hard.

This means that rental stock is not diminished (although we are getting 2 stories on that. One is negative gearing will cause mass homelessness, the other is that moat IPs aren't negatively geared) and existing owners are not massively hit hard.

I'd guess that many investors who have held for 5+ yrs would have neutral c/f at least & not be inclined to sell & incur CGT. I wouldn't expect prices to fall due to removal of NG - possibly a short plateau.

If I were a renter who actually did want to buy, I'd be v. happy the govt is continuing to subsidise investors through NG & that they pass on the subsidy in the form of lower rents enabling me to save a deposit faster. Higher rents means it takes longer to build up a deposit - that is the main hurdle for renters rather than servicability.

If I were a renter who actually did want to buy, I'd be v. happy the govt is continuing to subsidise investors through NG & that they pass on the subsidy in the form of lower rents enabling me to save a deposit faster. Higher rents means it takes longer to build up a deposit - that is the main hurdle for renters rather than servicability.

I favour any law that give less benefits to investors, myself included.

Investors already got money, no need to give them a helping hand.

put the money in public education and health and help older Aussies who cant get by.

No double tax but no hand out either to investors.

share/properties/what ever asset 50% CGT tax concession need to go

no negative gear or margin loan deduction etc...

Carry forward loss is ok with me... I reckon the demographic is changing, lot of FHB out there and renters they will favour abolish of negative gear and these voters are now probably out number investors...if the Lib do this I reckon they already run the number on it.

Investors already got money, no need to give them a helping hand.

put the money in public education and health and help older Aussies who cant get by.

No double tax but no hand out either to investors.

share/properties/what ever asset 50% CGT tax concession need to go

no negative gear or margin loan deduction etc...

Carry forward loss is ok with me... I reckon the demographic is changing, lot of FHB out there and renters they will favour abolish of negative gear and these voters are now probably out number investors...if the Lib do this I reckon they already run the number on it.

....help older Aussies who cant get by.

There will be more of these to "help" if we go down that path.

There will be more of these to "help" if we go down that path.

You never know if you never try, but going by other countries stats that do

not have negative gear, rent is in line with wage ...

you cant charge what your renter cant pay unless you want them to default on your rent and you go through the process of evicting them or they do damage to your properties etc...

They not stopping you from booking your loss, carry them forward until such time your properties is sold for profit.....most heavily negative gear people are speculators anyway

conservative investors don't go down that path.

you kill 2 birds with one stone, get the speculators out or they go bust and what left are genuine investors good for all market

They not stopping you from booking your loss, carry them forward until such time your properties is sold for profit.....most heavily negative gear people are speculators anyway conservative investors don't go down that path.

This is what was to happen last time negative gearing was abolished in the 1980s. Losses were recorded and carried forward until the property made a profit, in which case the losses were to be gradually written off.

Marg

Slightly OT, i cannot believe that someone is suggesting doubling FHB to 30K:

http://smh.domain.com.au/real-estat...p-up-with-prices-research-20140404-3644r.html

It would just line up the pockets of most somersofters or property developers.

http://smh.domain.com.au/real-estat...p-up-with-prices-research-20140404-3644r.html

It would just line up the pockets of most somersofters or property developers.

...It would just line up the pockets of most somersofters or property developers.

Correct...if you can't beat them...join them !

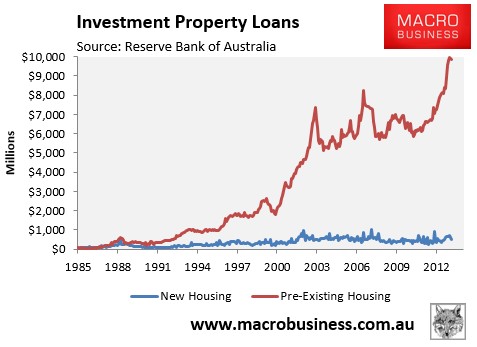

Most property investors buy pre-existing housing, not brand new. They are only increasing the supply if they buy new. All the established homes will still be there regardless of whether an investor buys them or not.I think its all about supply and demand.

Fewer property investors means fewer rental properties (ie supply down). Renters (demand) will be bidding for fewer rental properties, therefore, us greedy landlords will be rubbing our hands together and jacking up the rent as potential tenants jump all over us, wanting to live in our properties lol

Another way to look at it, when banana's were in short supply due to the storms in Qld, prices of banana's in the supermarket shot up.

As suggested earlier in the thread, you could remove the ability to negatively gear pre-existing property, only allowing it for new builds (perhaps with a term limit of 5 years for the first owner only), which would encourage investment in new supply.

Bananas are consumed, so it's a completely useless analogy in comparison to the housing market.

Exactly, it's not about supply and demand at all.Most property investors buy pre-existing housing, not brand new. They are only increasing the supply if they buy new. All the established homes will still be there regardless of whether an investor buys them or not.

The simple question "who did the investor sell to?" kills that argument stone dead.

NG could be available in some form for new builds but for the 95% of investors who buy existing property it's going to have to go.

On another front; Given that many (most?) baby boomers have very little retirement funds, and hold much of their wealth in their home. Why would the government want to reduce housing prices? They would have to pay more in pensions, in addition to the extra social housing that reduced investors would createwouldn't they?

I would say demographically baby boomers would comprise the majority of the voter base. Additionally they would be the age group most likely to hold an investment property at a guess?

I would say demographically baby boomers would comprise the majority of the voter base. Additionally they would be the age group most likely to hold an investment property at a guess?

Last edited: