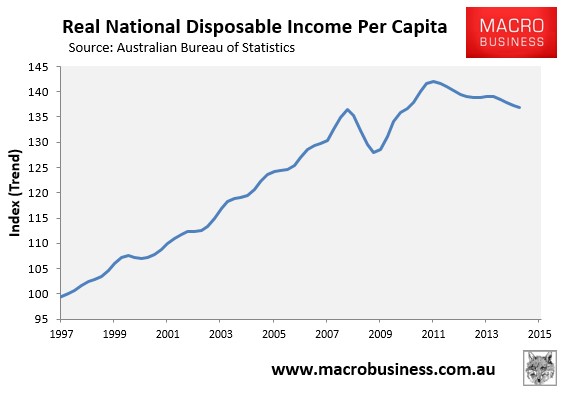

We're going backwards...

The Mining Boom years (2010-13) which we squandered, are well and truly behind us.

The Mining Boom years (2010-13) which we squandered, are well and truly behind us.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

surely we are good for 1 more cut?

Now that the Goverment has introduced a stimulus package to help small business I cannot see the need for further rates cuts. There will be a period of 6 to 12 months to see the effectiveness of the initiative before any decision of interest rate adjustments.

surely we are good for 1 more cut?

Agree.I doubt the small business stimulus is enough to fill the void of the big ticket mining investments no longer happening.

If the RBA uses lagging indicators as you are suggesting, they will be behind the curve and it would be too late if after 6-12 months they find out the stimuli didn't work.

The Smoke And Mirrors of Hockey's GDP Pipedream:

The Blue Line below 0% tells it all.

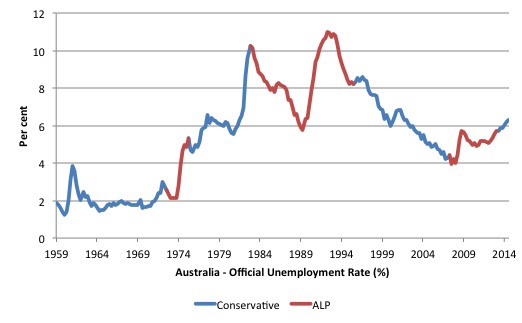

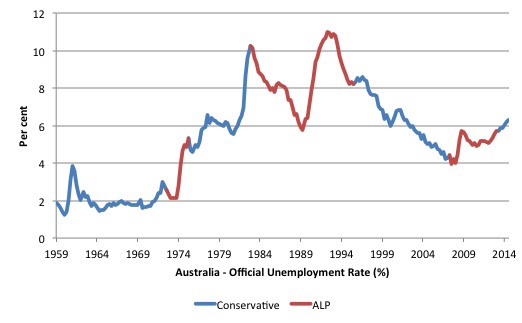

We wouldn't be any better under Labor.

Ever since the mid 1980's Labor has been a party with entrenched high unemployment (while supposedly being a party for the working class). They don't believe in fiscally stimulating the economy either (as witnessed recently by Bowen backing down on the tax cuts, which would've put more money in people's pockets to spend in the economy).

Why would you sell?As always that's all very interesting.

So my question is do we buy sell or hold property now in Syd or Melb metro?

.....

That, and - Oh - S26 baby formula. But that is a whole other story (seriously, I wish I owned shares in this company!)

That, and - Oh - S26 baby formula. But that is a whole other story (seriously, I wish I owned shares in this company!)

Interesting thread .

For me , I'm not sure if your back story is true or just BS , and obviously many of the other posters feel the same .

Instead of my (or your) back story which nobody has a way of verifying anyway, why don't you stick to the topic and refute my economics arguments? Or do you even understand basic economics?

Well I win every day. Last week my trade gave me commissions greater than the rental income of 5 properties. Anyway. . .

though as I've said its triggered an informative debate.

cliff