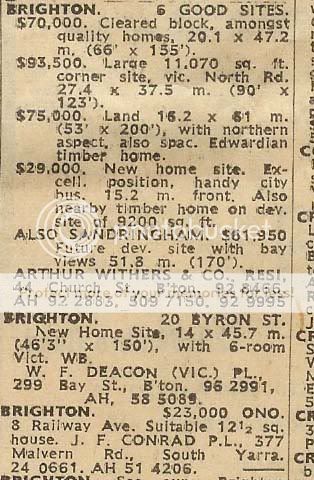

i found a few pages of the property section in a set of draws i got at a garage sale on the Gold Coast. Its from The Age in Melbourne and its dated Saturday, May 28th, 1977. I hope the writing is not too small to read because it has some interesting info about the history.

2 identical house, one has been renovated and is for sale at $75,000 and the other is divided into 2 units and they want $65,000 for it. Although Barkers Rd is busy i reckon they'd have to be worth about $800k+ in Kew if they were still standing (although i could be way out).

2 identical house, one has been renovated and is for sale at $75,000 and the other is divided into 2 units and they want $65,000 for it. Although Barkers Rd is busy i reckon they'd have to be worth about $800k+ in Kew if they were still standing (although i could be way out).

Last edited: