Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strong Growth in Brisbane

- Thread starter Andrew_A

- Start date

More options

Who Replied?virgo said:Very tempted.....

Interesting mkt Brisbane ATM some areas cheaper to buy than rent....

Where, where, where Virgo ? I'm hanging out to hear the details. Most places I've looked are poor yields. Only good yields iveseen are flood affected areas

Ditto! I'm looking in Brisbane too would like to know where you are referring to virgo.

Woodridge comes to mind at first. It was not flood affected either. Of course this comes with an added bonus of being in a low social economic area.

A quick search on Eagleby and there are a few possibilities there too.

This of course was done with a quick search on Real Estate looking at both advertised prices and rents. The real story could be different.

Most places I've looked are poor yields. Only good yields iveseen are flood affected areas

Agree. We're looking at purchasing a house (already reno'd for immediate best rent) in inner city suburbs yet the poor rental yields mean too much of our 'hard-earned' will have to fill the gap between net rent and mortgage repayment. It's a turn-off when I see beautifully renovated homes with 3+ bedrooms, 2 bathrooms, car space, sometimes even a pool, etc, in suburbs less than 5km from the CBD or closer only asking $650 - $700 in rent - considering what these types of homes are on the market for. Not interested in renting out by room to students (been there, done that) so thinking of holding off and looking at other areas but keeping an eye on Brisbane nonetheless.

Prior to purchasing, what date did you put on making a profit by? Sounds like you purchased badly.

I was referring to the ascot property (which i do not intend to buy) not my own portfolio re carrying expenses. My own properties have much higher yields.

As for purchasing badly, probably most people that bought in Brisbane in 2007 / 08 "purchased badly " from a cg perspective and most that bought in Brisbane in 2001 "purchased well". All with the benefit of hindsight which is 20 / 20.

Not the best source if you are looking for this forecasting! What agents are excellent for is a reasonable survey of 'current' market conditions

100 percent agree. It's more "the market has bottomed and is going to climb back up over the next 24 months" that gets me. REAs can tell you what current conditions are. But they can't tell you what is going to happen in six months time.

To answer my own questions, if there was an easy fix to the European debt crisis they would have done it by now which can only mean that tight credit conditions will be with us for awhile. Thermal coal prices have been slowly falling for 12+ months which means the mining boom is still a boom but is slowing at the moment. Thermal coal is used to generate electricity so global electricity demand must be down which means a slowing global economy. So with tight credit conditions and a slowing global economy there is not going to be a house price boom any time soon. But don't expect a REA to tell you that.

The closure of Norwich Park mine should be a wake up call for anyone that thinks the mining boom is going from strength to strength.

Last edited:

Ditto! I'm looking in Brisbane too would like to know where you are referring to virgo.

Woodridge comes to mind at first. It was not flood affected either. Of course this comes with an added bonus of being in a low social economic area.

A quick search on Eagleby and there are a few possibilities there too.

This of course was done with a quick search on Real Estate looking at both advertised prices and rents. The real story could be different.

Carole Park is cheap.

http://www.realestate.com.au/property-house-qld-carole+park-109801751

I was referring to the ascot property (which i do not intend to buy) not my own portfolio re carrying expenses. My own properties have much higher yields.

As for purchasing badly, probably most people that bought in Brisbane in 2007 / 08 "purchased badly " from a cg perspective and most that bought in Brisbane in 2001 "purchased well". All with the benefit of hindsight which is 20 / 20.

Yeah my last purchase in Brisbane in 2007 I bought for $328k...today it sits around just under $400k I reckon.

Yeah my last purchase in Brisbane in 2007 I bought for $328k...today it sits around just under $400k I reckon.

Congrats if you did that with no work at all. If you put sweat equity into it well then the price reflects that. Incidentally, you are probably not in the same category as "most people".

Congrats if you did that with no work at all. If you put sweat equity into it well then the price reflects that. Incidentally, you are probably not in the same category as "most people".

I dont know what same category as 'most people' means. Can you elaborate?

I dont know if jumping on a plane from Perth, hiring a rental car & accommodation for 10 days in Brisbane, then conducting my Micro Due Diligence and then locating IP's and pitching offers is classified as hard work or not.

For some it may be out of their comfort zones (as I know it was for me years ago when I was pushing myself for the first time) but now a days its just something I do.

No sweat equity for me either over those 10 days tho..I simply locate a good deal, buy, hold and then set it on auto-pilot and basically duplicate the same elsewhere.

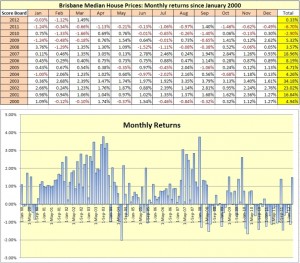

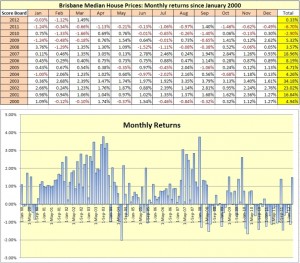

Brisbane records a +1.49% result in March

Brisbane recorded the strongest monthly growth since December 2009 this month. The +1.49% result in March has Brisbane in the black for the year with 0.33% growth in the index.

The turnover has been healthy since December 2011 and not surprised to see this monthly result and the market near balance in prices, the last few weeks have been a little slower but still much better than last year.

I will raise the possibility of a result for Brisbane this year in the mid-high single digit % wise for growth, this is a strong month and I have said to many people offline that if we get a strong quarter watch out to see what happens with all of those people waiting with finance approvals (many around!). Of course this is only a probability and perhaps not the most likely and you need to adjust for hope on the behalf of people predicting!

The interest rate cut/s probably aren't going to hurt either.

larger image

Brisbane recorded the strongest monthly growth since December 2009 this month. The +1.49% result in March has Brisbane in the black for the year with 0.33% growth in the index.

The turnover has been healthy since December 2011 and not surprised to see this monthly result and the market near balance in prices, the last few weeks have been a little slower but still much better than last year.

I will raise the possibility of a result for Brisbane this year in the mid-high single digit % wise for growth, this is a strong month and I have said to many people offline that if we get a strong quarter watch out to see what happens with all of those people waiting with finance approvals (many around!). Of course this is only a probability and perhaps not the most likely and you need to adjust for hope on the behalf of people predicting!

The interest rate cut/s probably aren't going to hurt either.

larger image

Brisbane recorded the strongest monthly growth since December 2009 this month. The +1.49% result in March has Brisbane in the black for the year with 0.33% growth in the index.

The turnover has been healthy since December 2011 and not surprised to see this monthly result and the market near balance in prices, the last few weeks have been a little slower but still much better than last year.

I will raise the possibility of a result for Brisbane this year in the mid-high single digit % wise for growth, this is a strong month and I have said to many people offline that if we get a strong quarter watch out to see what happens with all of those people waiting with finance approvals (many around!).

The interest rate cut/s probably aren't going to hurt either.

The above is great news for investors like me who have a few properties in Brisbane. Getting a mid-high single digit % rise will be a bonus.

I wouldn't get too excited according to Residex it is a slight uptick against constant falling prices since the most recent peak of Feb 2010. And the fall hasn't been a straight line there have been other isolated upticks.

28-Feb-2010 H Brisbane 12.5423

31-Mar-2010 H Brisbane 12.3346

30-Apr-2010 H Brisbane 12.4198

31-May-2010 H Brisbane 12.5138

30-Jun-2010 H Brisbane 12.5122

31-Jul-2010 H Brisbane 12.4304

31-Aug-2010 H Brisbane 12.3976

30-Sep-2010 H Brisbane 12.2235

31-Oct-2010 H Brisbane 12.2309

30-Nov-2010 H Brisbane 12.215

31-Dec-2010 H Brisbane 12.2514

31-Jan-2011 H Brisbane 12.0991

28-Feb-2011 H Brisbane 12.0579

31-Mar-2011 H Brisbane 11.9786

30-Apr-2011 H Brisbane 11.8434

31-May-2011 H Brisbane 11.8188

30-Jun-2011 H Brisbane 11.8039

31-Jul-2011 H Brisbane 11.679

31-Aug-2011 H Brisbane 11.5662

30-Sep-2011 H Brisbane 11.7282

31-Oct-2011 H Brisbane 11.5575

30-Nov-2011 H Brisbane 11.4861

31-Dec-2011 H Brisbane 11.4302

31-Jan-2012 H Brisbane 11.4271

29-Feb-2012 H Brisbane 11.2991

31-Mar-2012 H Brisbane 11.468

28-Feb-2010 H Brisbane 12.5423

31-Mar-2010 H Brisbane 12.3346

30-Apr-2010 H Brisbane 12.4198

31-May-2010 H Brisbane 12.5138

30-Jun-2010 H Brisbane 12.5122

31-Jul-2010 H Brisbane 12.4304

31-Aug-2010 H Brisbane 12.3976

30-Sep-2010 H Brisbane 12.2235

31-Oct-2010 H Brisbane 12.2309

30-Nov-2010 H Brisbane 12.215

31-Dec-2010 H Brisbane 12.2514

31-Jan-2011 H Brisbane 12.0991

28-Feb-2011 H Brisbane 12.0579

31-Mar-2011 H Brisbane 11.9786

30-Apr-2011 H Brisbane 11.8434

31-May-2011 H Brisbane 11.8188

30-Jun-2011 H Brisbane 11.8039

31-Jul-2011 H Brisbane 11.679

31-Aug-2011 H Brisbane 11.5662

30-Sep-2011 H Brisbane 11.7282

31-Oct-2011 H Brisbane 11.5575

30-Nov-2011 H Brisbane 11.4861

31-Dec-2011 H Brisbane 11.4302

31-Jan-2012 H Brisbane 11.4271

29-Feb-2012 H Brisbane 11.2991

31-Mar-2012 H Brisbane 11.468

I'm seeing a definite swing from buyer's market to seller's market at the moment in my target area.. I think the warmer weather and the last rate drop has brought a lot more people to the 'open for inspection's.

Was very keen on one particular unit and thought I'd play it cool waiting for the follow up call on Monday.. nothing. So I call today - "sorry it went under contract during the first viewing".

Anyone else finding similar in their target area in Brisbane?

Was very keen on one particular unit and thought I'd play it cool waiting for the follow up call on Monday.. nothing. So I call today - "sorry it went under contract during the first viewing".

Anyone else finding similar in their target area in Brisbane?

Depends as ever on the area. We looked 2 weekends ago in the Hawthorne area at houses in the $600-700K range and there were lots of others also looking (over 10 parties at 1 ridiculously overpriced property). Last weekend we looked in the Taringa, Chapel Hill areas and there was only 1 other party looking during 4 inspections we attended (2 were 1st time OFI's), with no other names on the registers. Good properties priced to the market are moving well as always, but far too many vendors are living in the past and believing what they read in the papers about the market taking off again.

It is the same story I think where ever you go, in this market in general. Properties that are priced to meet the market will always sell. Vendors who are not priced to sell will eventually meet the market or withdraw. It seems it is a swing as to whether it is a sellers or buyers market...don't you think?

Hi guys,

working the north brisbane market - I can confirm that is going absolutely nuts...in terms on anecdotal evidence i can offer these that we have sold or are selling...

clayfield - 2 bedroom 30yo unit sold november 06 for 235k - rental appraisal indicates 250pw

brand new house and land in Taigum - lowset 4bed aircon - preconstruction prices 366-410k rental around 350-400...

land only in the same estate starts at 180k but backs onto the Gateway Mwy (after a fence, some scrub and a big ditch) - but for rental purposes??!!

pre construction units in McDowall (www.evvien.com.au) selling from 385k - will be finished by june 08 - already around 20 presales - should rent for around the 400 mark without much problem - prices are going up once construction starts and again on completion (about 40-50k in total)

Cashmere - 4 bed three year old home vendors bought oct 06 for 585k its just gone to market at 660k and has offers already

Warner/cashmere/joyner - several new land estates going in lots being sold off the plan and by ballot at an astonishing rate.

Eatons hill - 13month old owner built home - appraised at 650k (and that was a stretch) - sold it for well over 700k

Mcdowall - three bedroom lowset on a main road - sold in two days for 337k, rents for 350k

Everton park - 809m2 dev site just sold mid 500k's - a new high for the area (by 100k) - it will get units on it very soon - developer will sell them for about 380-420each

Bridgeman downs - 10yo two storey, sold 12months ago for 620 - resold few weeks back for 800k

Lutwyche two bed units we manage just went up from 290-320pw in rent - would sell for around 280-300ish - maybe a bit more now i've thought about it with the way things are

there are millons more examples but the point is that good property is hard to find and selling stupidly fast...re returns - 6-7% in raw terms is not hard to hit at all and above 5% is now very common. land prices on average in Nth Bris have gone up about 20k for a 600m2 block in the last few months - good blocks even more.

I have some hectare development sites in Bridgeman Downs priced in the 1-2mill mark - they are not advertised and the developers are still beating down my door...word of mouth is the best advertising - doesn't cost a cent

the numbers we are getting through opens are frightening and we can't keep vacant rentals for more than a few hours before they are snapped up and good rentals and sale homes are often gone within a few phone calls

its a great time to be in the market...for this part of town, i'm not sure even the boom was this good!!

cheers

UC

Interesting to note that Evvien is now having a receivers sales, which they state is $115k below original list price and $60k below replacement cost. Does that mean the developer is only making $55k per apartment?

100 percent agree. It's more "the market has bottomed and is going to climb back up over the next 24 months" that gets me. REAs can tell you what current conditions are. But they can't tell you what is going to happen in six months time.

To answer my own questions, if there was an easy fix to the European debt crisis they would have done it by now which can only mean that tight credit conditions will be with us for awhile. Thermal coal prices have been slowly falling for 12+ months which means the mining boom is still a boom but is slowing at the moment. Thermal coal is used to generate electricity so global electricity demand must be down which means a slowing global economy. So with tight credit conditions and a slowing global economy there is not going to be a house price boom any time soon. But don't expect a REA to tell you that.

The closure of Norwich Park mine should be a wake up call for anyone that thinks the mining boom is going from strength to strength.

Coal prices are down, but there is still a lot [ tens of billions usd worth] mined in qld. The medium and long term outlook for all types of energy is very strong.

Brisbane - and ill only limit it to brisbane [ because i dont know the surrounding areas well enough] is well diversified and has a lot more than resources, so it can definately handle the lower coal and related commodity prices.

QLD also has a vast and untapped CSG reserves. Expect this to eventually take off.

http://www.abc.net.au/news/specials/coal-seam-gas-by-the-numbers/

Last edited:

Acacia Ridge

What are peoples thoughts on Acacia Ridge for the long term - say 7 to 10 years

There is a nice neat little residential pocket.

Also, Salisbury - it seems to be very handy for transport.

What are peoples thoughts on Acacia Ridge for the long term - say 7 to 10 years

There is a nice neat little residential pocket.

Also, Salisbury - it seems to be very handy for transport.

What are peoples thoughts on Acacia Ridge for the long term - say 7 to 10 years

There is a nice neat little residential pocket.

Also, Salisbury - it seems to be very handy for transport.

Providing all the underlying fundamentals remain the same, how it's performed over the past 10-15 years will give you a pretty good indication on its future performance.

Have you checked those, and what have you found?

Similar threads

- Replies

- 0

- Views

- 1K

- Replies

- 11

- Views

- 2K