Nice post Nomadic, loved it.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The 3 decade success story - Housing

- Thread starter Redom

- Start date

More options

Who Replied?Great stuff. Good on you for wheeling and dealing. That's not my thing but I respect people who can do it.Good stuff PG. Near enough can be good enough. It's good to get a broker...saves you doing the run around.

Having said that, I havent used a broker yet. I like doing the wheeling n dealing. When you're holding the aces the other party must bend or bust!

Just before the GFC I refinanced at 95% LVR variable. Apart from LMI and some govt costs I paid zilch and got a swag of loot via cash out. Come GFC rates dropped to below 5%Easy money. I just called the shots and the bank yielded. I know that a good broker can do the same but I like doing the grease work.

Another huge driver to housing prices has been the change to the two income family becoming the norm so that a more expensive house is affordable.

This shift is a one-off that won't be repeated.

Marg.

If polygamy is legalized we could have three or four income families which will push prices even higher. Probably won't happen for a few generations though

I wonder what freckles opinion is?

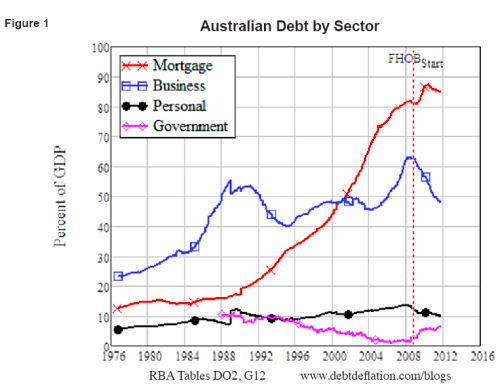

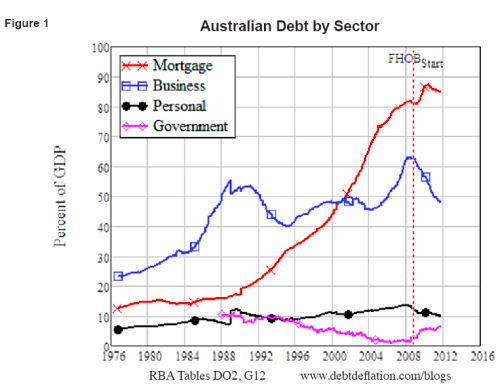

The biggest debt fuel binge in history where greed overtook common sense. The day Nixon closed the gold windows the bankster took the gloves off and it was away to the races.

Some call this a success story but time will show it be what it really is... a disaster in the making.

Things started to break in 08 and have been declining ever since. The first signs of the impending correction.

Those that think there may be even a small chance of a repeat are deluding themselves.

We have so much debt now that we have to lower the cost to accumulate more debt. Zero interest rates are ground zero and globally we're beyond that with NIRP.

Asset deflation is the main concern at the moment. Tie that in with consumer inflation and you get a double whammy affect.

I've pulled out of the rat race for the moment to see how this plays out. I have my front row seat and plenty of popcorn. I watch with interest.

Too late, theyre already here.

Who are they?

The question is more about whether our levels of debt are sustainable, not how much we have.

As i and others have mentioned, there's been a range of factors that have increased our ability to both attain and service our debt over the past

30 years.

Cheers,

Redom

As i and others have mentioned, there's been a range of factors that have increased our ability to both attain and service our debt over the past

30 years.

Cheers,

Redom

The biggest debt fuel binge in history where greed overtook common sense. The day Nixon closed the gold windows the bankster took the gloves off and it was away to the races.

Some call this a success story but time will show it be what it really is... a disaster in the making.

Things started to break in 08 and have been declining ever since. The first signs of the impending correction.

Those that think there may be even a small chance of a repeat are deluding themselves.

We have so much debt now that we have to lower the cost to accumulate more debt. Zero interest rates are ground zero and globally we're beyond that with NIRP.

Asset deflation is the main concern at the moment. Tie that in with consumer inflation and you get a double whammy affect.

I've pulled out of the rat race for the moment to see how this plays out. I have my front row seat and plenty of popcorn. I watch with interest.

I agree we are fortunate to be living in these time, as were the generations who saw the invention of the steam engine, the internal combustion engine, iron, oil, creation of capital markets and many others, compared to all previous generations.We are indeed blessed to be part of the "Lucky Generation" and amazingly most of us don't even know it. We are the generation of investors in the property and sharemarkets who have ridden a 33-year credit boom, an engorgement of debt, an access to money previously unseen that created a golden wave of investment returns between about 1974 and 2007.

However, our generation won't be as fortunate as the future generations who will have access to cancer cures, living active lives til ages >150, space travel, almost free power and many other things that we will miss out on.

They will also look back in disbelief that we had to work for 40 hours a week, and were able to buy houses for less than $1M.

Those who worry about the future need to get some perspective, and see the exponential improvements as each generation builds on the previous ones.

To quote Winston Churchill

When I look back on all these worries, I remember the story of the old man who said on his deathbed that he had had a lot of trouble in his life, most of which had never happened.

Who are they?

The people from OS buying up here.

They will also look back in disbelief that we had to work for 40 hours a week, and were able to buy houses for less than $1M.

Those who worry about the future need to get some perspective, and see the exponential improvements as each generation builds on the previous ones.

To quote Winston Churchill

When I look back on all these worries, I remember the story of the old man who said on his deathbed that he had had a lot of trouble in his life, most of which had never happened.

Great post Keithj, although i'm not sure that future generations are working less than previous ones...

The question is more about whether our levels of debt are sustainable, not how much we have.

There's never been a question about it. Babylonians figured that out 4000 years ago.

As i and others have mentioned, there's been a range of factors that have increased our ability to both attain and service our debt over the past

30 years.

None of which are sustainable.

You claim an interest in economics. This Econ 101 stuff

However, our generation won't be as fortunate as the future generations who will have access to cancer cures, living active lives til ages >150, space travel, almost free power and many other things that we will miss out on.

Check your meds

Those who worry about the future need to get some perspective, and see the exponential improvements as each generation builds on the previous ones.

The challenge for the next generation(s) is will they even have a job.

NEW TECHNOLOGY AND THE END OF JOBS

There are two sides to the technology/progress story. None of which are looking particularly good for the average Joe.

Why? Did you sneak some when he wasnt looking?

Not into hallucinogenics

Could use some Prozac though

All pointless debates to be honest. At the end of the day, the believers will keep investing, the doubters will keep avoiding. Recent history has proven the former won, the latter lost.

Will it continue to be the case? There are examples all over mainland Europe now of countries/generations of people who will spend at least 10 years - if not 20 years - in the wilderness with no jobs, no growth prospects, no rising asset prices. 25 years ago, Japan also entered the same wilderness and never recovered. On the opposite end, there are examples all around the world of economic and property markets crashing but powering back up and onwards in a short time such as USA, China, Hong Kong, Singapore, UK, Canada, Norway etc.

There are many structural shifts that carried Australia in the past 30 years. Most people picked them. Dual income families, immigration, globalisation, financial deregulation etc. Does that mean it's all over?

For me, we have yet to see what I believe will be the biggest paradigm shift for Australia in 200 years - and this is the Asian Century, something that a lot of people seem to forget. It's not just about immigration, which is a significant driver in and of itself. It's also about trade. The combined GDP of China, Korea, Indonesia, India and Japan will probably eclipse USA combined with Europe some time in our life time. How will Australia - being the only western country with rule of law, democracy blah blah blah in proximity and in the same timezone - position itself to benefit from this? How will it affect profitability, social well-being, salaries, employment rate? How does that impact house prices? This is arguably a phenomenon that is much more powerful than anything we have seen in the past 30 years, even more powerful than dual income families or financial deregulation.

Another interesting shift is downsizing. Can a 1000sqm inner city land in Sydney really justify $4m? Probably, if Australians of the next generation accept the fact that living in a 100sqm townhouse is the norm, you can think of the inner city house really as costing $400k ($4m divided by 10). People talk about Sydney being one of the most expensive cities in the world. I'd love to see how Sydney land in Mosman stacks up on a per sqm basis versus Paddington in London, TriBeCa in New York, Hiroo in Tokyo, Deep Water Bay in Hong Kong or JingAn in Shanghai.

At the end of the day, who cares. Some will believe and agree with me. Others will try to pick holes in what I say. We can all take pride in winning an argument on the internet, or take pride in making a difference to our real lives.

Will it continue to be the case? There are examples all over mainland Europe now of countries/generations of people who will spend at least 10 years - if not 20 years - in the wilderness with no jobs, no growth prospects, no rising asset prices. 25 years ago, Japan also entered the same wilderness and never recovered. On the opposite end, there are examples all around the world of economic and property markets crashing but powering back up and onwards in a short time such as USA, China, Hong Kong, Singapore, UK, Canada, Norway etc.

There are many structural shifts that carried Australia in the past 30 years. Most people picked them. Dual income families, immigration, globalisation, financial deregulation etc. Does that mean it's all over?

For me, we have yet to see what I believe will be the biggest paradigm shift for Australia in 200 years - and this is the Asian Century, something that a lot of people seem to forget. It's not just about immigration, which is a significant driver in and of itself. It's also about trade. The combined GDP of China, Korea, Indonesia, India and Japan will probably eclipse USA combined with Europe some time in our life time. How will Australia - being the only western country with rule of law, democracy blah blah blah in proximity and in the same timezone - position itself to benefit from this? How will it affect profitability, social well-being, salaries, employment rate? How does that impact house prices? This is arguably a phenomenon that is much more powerful than anything we have seen in the past 30 years, even more powerful than dual income families or financial deregulation.

Another interesting shift is downsizing. Can a 1000sqm inner city land in Sydney really justify $4m? Probably, if Australians of the next generation accept the fact that living in a 100sqm townhouse is the norm, you can think of the inner city house really as costing $400k ($4m divided by 10). People talk about Sydney being one of the most expensive cities in the world. I'd love to see how Sydney land in Mosman stacks up on a per sqm basis versus Paddington in London, TriBeCa in New York, Hiroo in Tokyo, Deep Water Bay in Hong Kong or JingAn in Shanghai.

At the end of the day, who cares. Some will believe and agree with me. Others will try to pick holes in what I say. We can all take pride in winning an argument on the internet, or take pride in making a difference to our real lives.

This is a list of local businesses from 100 years ago.The challenge for the next generation(s) is will they even have a job. None of which are looking particularly good for the average Joe.

It's clear that as we've innovated things have changed. The wheelwright & buggy proprietors are no longer with us, however the House Agent & Valuators are

Today we have a travel agent, and loads of trendy cafes - certainly didn't have any back then. So jobs change as we progress, and it's certainly for the better.

Looking back even further (or just head out to the back blocks of any 3rd world country) and see that almost everyone aged between 8 and 80 is engaged in subsistence farming - not even hairdressers or plumbers out there. If they got access to a barrel of oil, they'd soon have a few trendy cafes and video rental places happening - still full employment, just different jobs.

Attachments

Could use some Prozac though

Antidepressant use is up 400% since 1988. Might be an outlier for how things are actually going. Not everyone is sharing or living the dream it appears.

.... still full employment, just different jobs.

Yep...burger flippers and dunny cleaners. Scratch burger flippers... they're automating that.

You live in a fantasy world Keith. I have no problems with optimism but when it suppresses reality you end up in the twilight zone.

30 years ago they were saying we would be living on the moon, cancer cures were just around the corner, AID's would be cured within 5 years and infinite clean cheap energy was within our grasp.

Too many people watching the Jetsons and thinking that's where we'd be in a few decades.

There are opportunities, there always are but the challenges are getting bigger and more complex.

We're like a plague of locusts on this planet. At the current rate of destruction and pollution your future is looking more and more like some mad scifi movie.

30 years ago they were saying we would be living on the moon, cancer cures were just around the corner, AID's would be cured within 5 years and infinite clean cheap energy was within our grasp.

Too many people watching the Jetsons and thinking that's where we'd be in a few decades.

There are opportunities, there always are but the challenges are getting bigger and more complex.

We're like a plague of locusts on this planet. At the current rate of destruction and pollution your future is looking more and more like some mad scifi movie.