Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The 3 decade success story - Housing

- Thread starter Redom

- Start date

More options

Who Replied?And in 20yrs, $2mil

With rents on a much slower ascent, imagine how awesome the yields will be by then!

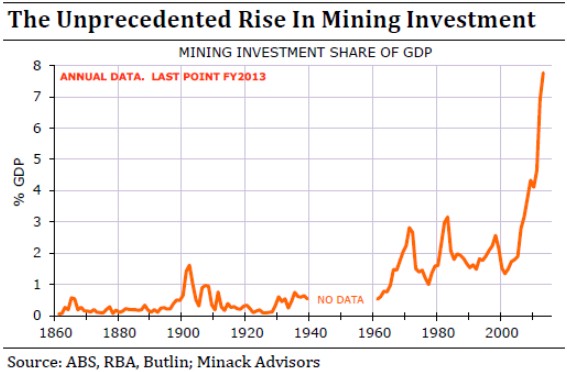

Sure, but it's not likely we see a contribution from mining to economic growth like this again for some time...However, the next mining boom is less than 10 yrs away... India is expected to overtake China as the largest coal importer by 2025. All that investment will really pay off over the next couple of decades.

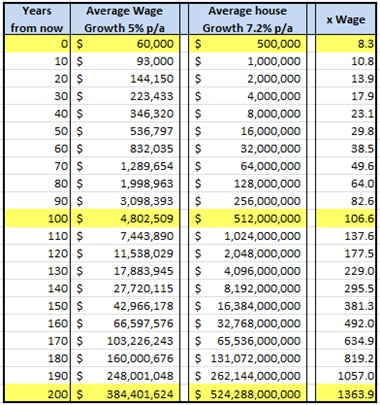

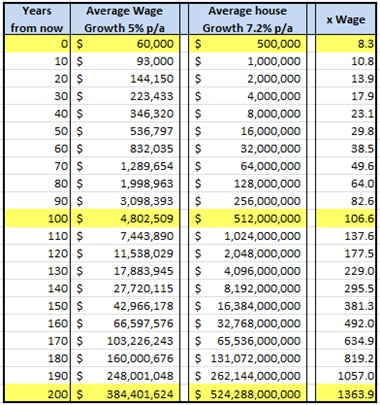

All you need is this one chart to map the future of house prices:What will Syd be in 10-20yrs?

http://aussiehouseprices.blogspot.com.ar/2011/02/never-ending-capital-growth.html

And wage growth is already around half that rate, not that it will slow prices so you'll need to adjust the multiple of price to income higher.

.

All you need is this one chart to map the future of house prices:

http://aussiehouseprices.blogspot.com.ar/2011/02/never-ending-capital-growth.html

And wage growth is already around half that rate, not that it will slow prices so you'll need to adjust the multiple of price to income higher.

The wage growth column in that table is representative of 4.5%, not 5%, wage growth, so it's not quite as bad as the table makes out. Nonetheless, it's going to take some pretty impressive collective household incomes and long-term low interest rates to keep up with that capital gain trend, not to mention the increasingly poor yields that decrease serviceability. Interesting times ahead!

Of course not, how do you think the average house will reach a 1000x multiple of an average wage without other input?So all houses are bought with wages?

You know full well that your table ignores compositional changes. We have discussed many times before, yet you continue to raise red herrings.Of course not, how do you think the average house will reach a 1000x multiple of an average wage without other input?

Here's a snippet from 4 yrs ago....

The composition of the statistical population of houses in Sydney has changes every time a new suburb (or house) is built. My granny forebearers bought the cheapest crappiest house in 1900 a whole 15km from the CBD for peanuts. Today that house hasn't moved an inch in 110 year. However, Sydney has moved - instead of covering a 15km radius, it now covers a 50km radius. There are 10x(?) as many houses - the composition of Sydney's statistical population of houses has changed. Her house is no longer the cheapest crappiest least desirable house in Sydney, it is in the top 10% of houses. It's managed to grow faster than the average, because cheaper houses have been added to Sydney.

That's what I meant when I said above that there's a difference between a specific house that an SSer buys and a citywide average that has cheaper houses added all the time.

The theorists who look at only averages or medians may be right - median house prices may not double in 10 years. However, NOBODY buys the medians, because many of the houses that will make up the median in 10 yrs time haven't been built yet. Therefore the headline median is irrelevant to property investors. Property investors buy specific houses, that slowly get further from the periphery, and relatively more desirable.

Right on keithj, which is why when average house prices are 1000x multiple of average incomes Sydney will probably have a 300km radius.

First home buyers will just need to suck it up and spend 6 hours travelling each way to work from the mortgage belt. Just who do they think they are expecting to buy inner suburbs (150km radius from CBD) anyway? Talk about an entitled view... they'll be just like today's kids, wasting all their money, probably on space travel & the latest iPhone ear implant. If they saved their money prudently for 30 years, maybe they'd have enough money to get on the property ladder.

First home buyers will just need to suck it up and spend 6 hours travelling each way to work from the mortgage belt. Just who do they think they are expecting to buy inner suburbs (150km radius from CBD) anyway? Talk about an entitled view... they'll be just like today's kids, wasting all their money, probably on space travel & the latest iPhone ear implant. If they saved their money prudently for 30 years, maybe they'd have enough money to get on the property ladder.

So all houses are bought with wages?

No, but lets do the numbers on a median priced IP being rented out in 100 years time with those table numbers.

Purchase price is $512M, so with a 20% deposit of $102M coming from either your equity wins up until then or the $4.8M salary you've saved every penny of for 21 years. Assuming the former, that means a $410M loan at 2% (let's be generous and say interest rates have bottomed here after nearly a century of ZIRP) and therefore an annual interest bill of $8.192M.

You rent it out and charge 100% of a median income earner's income (who needs food and entertainment anyway?), pulling in $4.8M in rent. That leaves you to foot the remaining $3.392M interest bill (ie. 70% of a median income), PLUS rates, insurance, depreciation, maintenance and management fees. Not to worry, because negative gearing will allow you to write all this off and then some and pay no tax, leaving you to live in luxury on the < 30% income you have left. That does of course assume you already own your own PPOR, because you're 70% short on the rent you need to rent a median place anyway.

Somewhat facetious I know, but does this really sound like a sustainable long-term investment regime to anyone?

I think you're missing the point at the other end of the compositional change.Right on keithj, which is why when average house prices are 1000x multiple of average incomes Sydney will probably have a 300km radius.

How many 1/4 blocks are there in the inner city today compared with 50 yrs ago ? All the 1/4 acre blocks get put to a higher use - a 6 pack, or Harry Triguboff buys a couple of them and whacks up 150 apartments. So this 1000x income median house/strawman has never existed and will never exist - the land will be put to a higher use.

This concept of putting land to it's highest use has 2 effects on the median price - 2 expensive 1/4 acre blocks get removed from the stats, and 150 relatively cheap apartments get added. Everyone is a winner - the 2 owners get their $Ms, and a bucketload of FHB get below a median price PPOR in the inner city.

That simplistic table you quoted makes various assumption that bear no relation to reality - static population and no change of land use are the 2 most obvious ones.

Hi, and anyone who thinks this is specific to Australian cities should take a look at the cost of housing in Kuala Lumpur and Singapore.

I just sent some cash to help my godson buy an apartment in Singapore His real earnings are somewhere around 30 thousand a year.

The apartment he's buying? Costs over a million.

Go figure the wage multiples!

KY

I just sent some cash to help my godson buy an apartment in Singapore His real earnings are somewhere around 30 thousand a year.

The apartment he's buying? Costs over a million.

Go figure the wage multiples!

KY

keithj, your whole "compositional change" red herring falls apart if you were to simply look at an area that's seen little change over the last 15-20 years and compare price to income ratios (local income to local prices) over time in that specific locale. I'd go to the trouble of documenting some Australian examples, but I know it won't change your mind.

If you're saying that the concrete examples I provided of compositional change doesn't take place, then you certainly won't change my mind.keithj, your whole "compositional change" red herring falls apart if you were to simply look at an area that's seen little change over the last 15-20 years and compare price to income ratios (local income to local prices) over time in that specific locale. I'd go to the trouble of documenting some Australian examples, but I know it won't change your mind.

Of course compositional change happens. I'm just saying it's not the main driver of prices rising faster than incomes.

Excellent, then we are in complete agreement that median prices don't double every 10 years. And that your table is based on flawed assumptions.

You don't need to tell me. The chart (and two subsequent posts) was intended to parody what some on here believe with conviction, maybe you should tell them!Excellent, then we are in complete agreement that median prices don't double every 10 years. And that your table is based on flawed assumptions.

How long before the median price in Melbourne is $1 mill?

10 years...

I'm just saying it's not the main driver of prices rising faster than incomes.

Hobo-jo, interested in your thoughts on why this has happened (similar to the drivers i mentioned in OP or different?) and whether it's nearing/reached an upper bound?

Certainly by international standards, we are quite unusual on this metric.

Keithj - good point about the compositional changes - the RBA did a great essay/speech a couple years back talking about how this is changing. Pretty sure the PC have followed it up by looking at supply side factors that restrict compositional change from happening (e.g. super/pension test encouraging PPORs).

Cheers,

Redom

I just sent some cash to help my godson buy an apartment in Singapore His real earnings are somewhere around 30 thousand a year.

The apartment he's buying? Costs over a million.

Sorry..don't mean to hijack the thread. But any idea on how much would it costs to rent such apartment? Just curious about the yields in Singapore.

Cheers,

Oracle.

Sorry, I didn't get the parody, it came across to me as a genuine belief in the assumptions underlying that flawed table.You don't need to tell me. The chart (and two subsequent posts) was intended to parody what some on here believe with conviction, maybe you should tell them!

As we have both agreed previously, stratified medians are a better measure of prices - and IMO they are far more likely to double in the next 10 years - as others have mentioned.

You don't need to tell me. The chart (and two subsequent posts) was intended to parody what some on here believe with conviction, maybe you should tell them!

Time will tell...see you in 10 years if you're still around and we can discover who's the one eating humble pie.

Last edited: