Hi all,

While I know that this is a property investment forum, i'm guessing many people also have share portfolios as well.

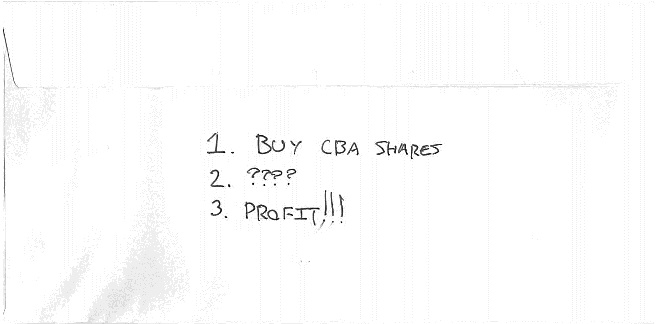

What five blue chip, high yeilding stocks would you have as part of a share portfolio? I'm thinking from the ASX Top 20 only.

Focus would be on stability, growth, and income.

Cheers

Al

While I know that this is a property investment forum, i'm guessing many people also have share portfolios as well.

What five blue chip, high yeilding stocks would you have as part of a share portfolio? I'm thinking from the ASX Top 20 only.

Focus would be on stability, growth, and income.

Cheers

Al