Hi all.

This is a copy of my latest blog entry from the Australian Property Forum.

I think it should interest most people here.

I believe it demonstrates quite clearly that Australia does not have a property bubble.

Cheers, Shadow.

This is a copy of my latest blog entry from the Australian Property Forum.

I think it should interest most people here.

I believe it demonstrates quite clearly that Australia does not have a property bubble.

Cheers, Shadow.

USA, Ireland, UK, Spain and Japan Property Bubbles versus Australia.

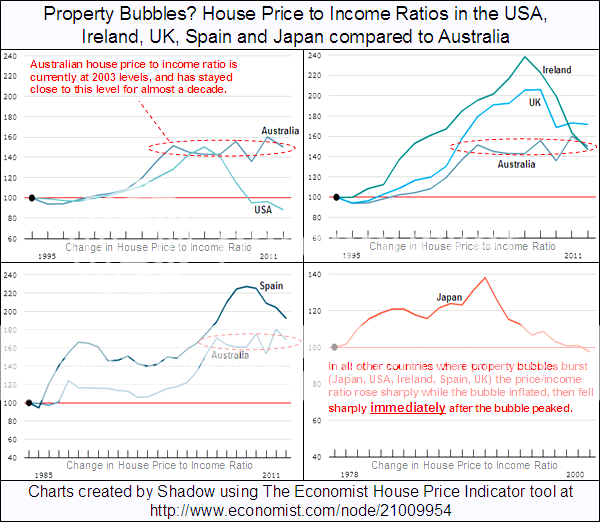

Property bears often claim that Australia has a housing bubble, and they compare Australia to other countries that are known to have had housing bubbles that did burst. Such countries include the USA, Ireland, UK, Spain and Japan. Each of these countries had a confirmed housing bubble. Those housing bubbles were confirmed because they burst, and that is the only way to confirm a bubble. Bubbles can only be confirmed beyond doubt in hindsight, after they burst (because they burst).

However, there are indicators that may be used to identify the absence or presence of a potential bubble. We have enough experience of housing bubbles that burst in other countries to be able to examine the characteristics common to most confirmed housing bubbles.

The housing bubbles in USA, Ireland, UK, Spain and Japan had something in common. They were all characterised by a sharp rise in the house price to income ratio as the bubble inflated, followed almost immediately by a sharp fall in this ratio as the bubble collapsed after prices peaked.

The charts below illustrate this phenomenon quite clearly.

We can use this pattern (the sharp rise in the price/income ratio as the bubble inflates, followed immediately by a sharp fall as the bubble collapses) to determine whether Australia is likely to have a housing bubble at the present time. In Australia, the house price to income ratio did rise sharply until it reached a peak in 2003. At this point one would normally expect the ratio to collapse, if this was indeed a bubble. Instead, the house price to income ratio has remained close to that 2003 level for almost a decade. Now in December 2011, the ratio is still where it was in 2003. This is not normal bubble behaviour. Bubbles (not just housing bubbles, but all asset bubbles) are normally characterised by a sharp rise followed almost immediately by a sharp fall after prices peak. A house price to income ratio that doesn't fall shortly after a peak might be a good indicator for the absence of a property bubble.

Therefore, either Australia does not have a housing bubble, or we have a new type of bubble - a special/different form of property bubble never experienced before. I suspect the former explanation is the more likely. Either way, it is obvious from the charts that Australian property does not necessarily follow the path set by the other countries that the housing bears like to compare us to. Their claims that Australia has a property bubble just like USA/Ireland/UK/Spain/Japan, and that Australian property must crash just like those countries, are clearly unfounded, because we have not experienced house price changes that mirror anything like the changes in those other countries. The present house price to income ratio in Australia has held close to 2003 levels for almost a decade and there is no reason why that ratio needs to suddenly collapse. The current ratio appears to be sustainable.