Nothing wrong with high LVR loans as long as people have a table work history and can service them in my view. These loans only got a bad name because in the us banks handed them out to people with no job. The reality is it doesn't matter whether it's 80 percent or 95 if the borrower loses their job they will probably default either way regardless of credit history.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

We're building towards a home construction boom

- Thread starter Shadow

- Start date

More options

Who Replied?Building approvals smash forecasts, up nearly 19% over the year... http://www.smh.com.au/business/the-economy/building-approvals-smash-forecasts-20131031-2wjjf.html

+1, IV; I've been rattling on about this little forgotten factor for ages...sorry mate but this is simply not true at all.

Instead its because our consumer mugs and institutional debt buyers wont buy securitised debt at any price under any circumstances.

More difficult securitisation process compared to pre GFC, more stringent lending practices.

If the Banks are not freely lending, and you are not a really solid credit risk currently, you aint buildin' or buyin' nuttin', mister.

Last edited:

www.theage.com.au/victoria/city-glut-to-weigh-on-house-prices-20131015-2vktr.html

So does this mean that the median price in melbournec is going to be subdued compared to Sydney for the next five years for example, while the good properties on blood blocks or good locations will be booming just like Sydney, but not showing up on the city stats due to inner city apartments bringing the average down

I think so

Is Melbourne bracing for a boom?

I am yet to settle on my 4 unit deve site in Melb and prices have jumped by $30,000, I know development sites are definitely moving as builders are jumping in, more competition pushing prices north.

This is pretty much what happened in Perth 18 months ago when I jumped into this market, one of my sites rose $100K in 7 months because builder/developers/investors are competing for the same stock.... nothing new, its the old trick.... supply vs demand, its the right time to be jumping into certain markets and then of course its what you buy that will dictate how much money you will make

Sydney apartment boom will be biggest ever

Sydney's skyline, especially the inner city, is set for a redesign as the city's biggest apartment boom arrives.

This peak will put more cranes in the sky than past peaks. Listed developers, private groups and cashed-up offshore developers are primed to deliver new off-the-plan apartment stock.

The boom follows a decade of undersupply combined with population growth, a property market upturn and keen investors wanting to take advantage of low interest rates.

Kim Hawtrey, associate director at forecaster BIS Shrapnel, said new apartment approvals were almost on par with the last peak, in 2003, when annual approvals hit 23,000 in NSW. 'We're close to exceeding that and will easily go beyond it next year. We think it will peak at 25,000 in 2016,' he said.

As interest rates fall, the credit crunch eases, and house prices start rising again, I expect a new construction-led boom to kick off in Australia, probably around 2010-2011.

Adjusted for adjusted adjustments eventually the adjusted date will eventuate.

edit:

from the ABS

DWELLING UNITS

PRIVATE SECTOR HOUSES

edit:

from the ABS

That's for Australia as a whole, not Sydney specifically (where I said the boom would kick off).

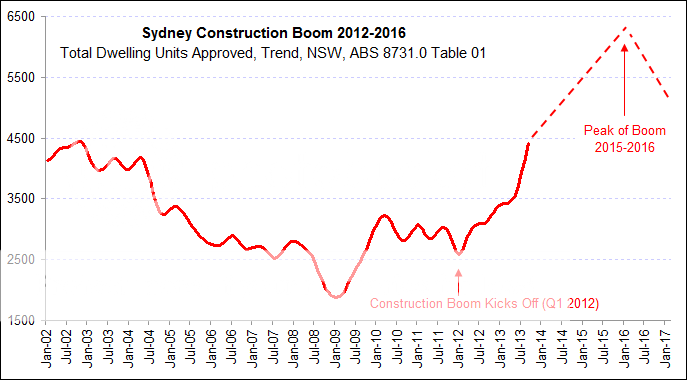

But it does confirm the early 2012 start date - cheers.

Now that the construction boom is undeniably here, I expect some pedants to start nitpicking about early-2012 not being close enough to 'probably around 2010-2011'.

Where did you mention Sydney in the post linked?That's for Australia as a whole, not Sydney specifically (where I said the boom would kick off).

http://somersoft.com/forums/showthread.php?p=441496#post441496

Predicted in 2008 for 2010/2011, that's 2-3 years forward. Recent construction activity indicates some strong growth in construction being seen now, 2-3 years late, i.e. the timing is almost 100% later than predicted. I wouldn't really call that close.Now that the construction boom is undeniably here, I expect some pedants to start nitpicking about early-2012 not being close enough to 'probably around 2010-2011'.

That's for Australia as a whole, not Sydney specifically (where I said the boom would kick off).

But it does confirm the early 2012 start date - cheers.

Now that the construction boom is undeniably here, I expect some pedants to start nitpicking about early-2012 not being close enough to 'probably around 2010-2011'.

Not nit-picking, I don't keep tabs on new builds etc, I am very simple, just supply vs demand, Syd market (West) in particular started moving about 2 years ago (2011 -), around the same time as Perth started rising. I was looking at both markets at this time, Property unity (BA) can certainly confirm this I am sure.

There certainly was not as much competition at that time but nonetheless it was rising.

I was wrong on timing, I admitted it, have no problems admitting it. Shadow just keeps squirming to avoid it.When's that recession hitting us Hobo? How about starting a new 'we are going to be in a recession soon' thread.

Where did you mention Sydney

Post #14 of this thread, August 2008...

'I reckon Sydney is set to boom next. Sydney has gone nowhere for the past 5 years... prices are well below trend... the median house price is 15% down on the 2003/2004 peak in real terms. Construction activity is currently at record lows and population growth is very strong.

Predicted in 2008 for 2010/2011, that's 2-3 years forward. Recent construction activity indicates some strong growth in construction being seen now

The data shows the current strong growth phase kicking off in early 2012, which I would argue is close enough to 2011 to be considered 'around 2011'.

Remember - I didn't say the construction boom would peak around 2011 - I said that's when it would all kick off.

Cheers, sounds about right.Syd market (West) in particular started moving about 2 years ago (2011 -)

I was wrong on timing

Wrong on timing? There has to actually be a recession for you to only be wrong on timing. You were just plain wrong.

I really don't understand why you are so smug about a home construction boom.

Increased construction increases future supply.

If there is a future problem that really effects demand, then watch that increased supply negatively impact on prices.

Increased construction increases future supply.

If there is a future problem that really effects demand, then watch that increased supply negatively impact on prices.

Yes, I already pointed this out in 2007-2008 when I first predicted the construction boom.I really don't understand why you are so smug about a home construction boom.

Increased construction increases future supply.

If there is a future problem that really effects demand, then watch that increased supply negatively impact on prices.

I said if it creates an over-supply, then this could eventually cause or exacerbate a crash, as per Ireland, USA, Spain etc.

Smug? Moi?

http://somersoft.com/forums/showthread.php?t=44666

'Unfortunately, in the process, we may sow the seeds for our eventual property crash. House prices in Australia may be quite high already, but so far there has never been any trigger for a real crash. However, there is a fair chance that we will make the same mistake as the US... we may build too many houses during our forthcoming construction boom, creating a massive glut of property late next decade, just as the baby boomers start to die off, which will further increase supply and reduce demand. This is what may finally trigger the inevitable crash.'

Yes, I already pointed this out in 2007-2008 when I first predicted the construction boom.

I said if it creates an over-supply, then this could eventually cause or exacerbate a crash, as per Ireland, USA, Spain etc.

Smug? Moi?

http://somersoft.com/forums/showthread.php?t=44666

'Unfortunately, in the process, we may sow the seeds for our eventual property crash. House prices in Australia may be quite high already, but so far there has never been any trigger for a real crash. However, there is a fair chance that we will make the same mistake as the US... we may build too many houses during our forthcoming construction boom, creating a massive glut of property late next decade, just as the baby boomers start to die off, which will further increase supply and reduce demand. This is what may finally trigger the inevitable crash.'

So the whole ironic point about this whole thread is BOTH you and hobo could end up being right.

You because you get your construction boom and hobo of the subsequent housing crash

Shadow is already wrong. It's not hard to find posts where he was claiming victory on the construction boom in 2009, over two years before his new claim that the boom kicked off in Q1 2012...So the whole ironic point about this whole thread is BOTH you and hobo could end up being right.

You because you get your construction boom and hobo of the subsequent housing crash

http://somersoft.com/forums/showpost.php?p=605286&postcount=75

He has already predicted a crash for 2016:

http://somersoft.com/forums/showpost.php?p=441496&postcount=1

Following the construction & price boom that will take Sydney's median price to $1.25 million:

http://somersoft.com/forums/showpost.php?p=362901&postcount=8

When Shadow finds himself wrong, he just changes the goal posts.

At least I take it on the chin and move on.

I don't recall ever having predicted a housing crash (although it would be silly to dismiss the possibility).