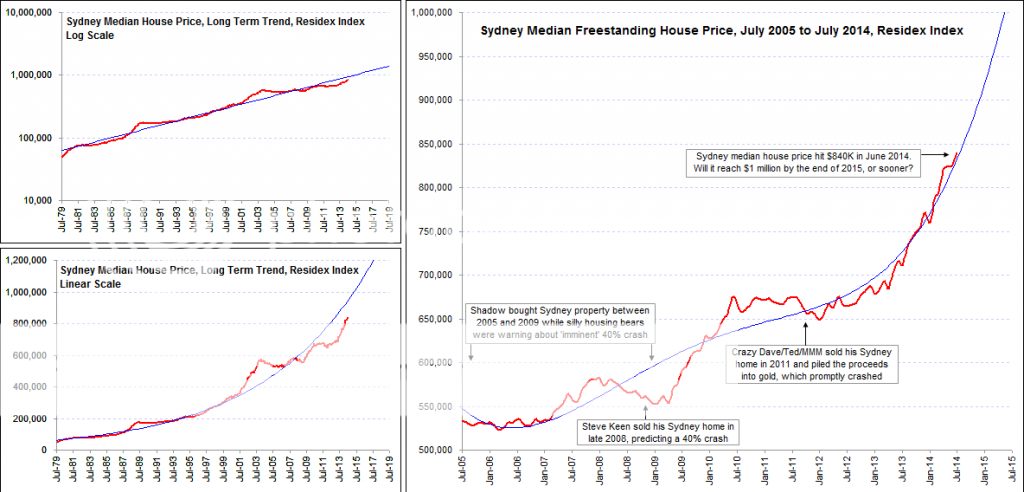

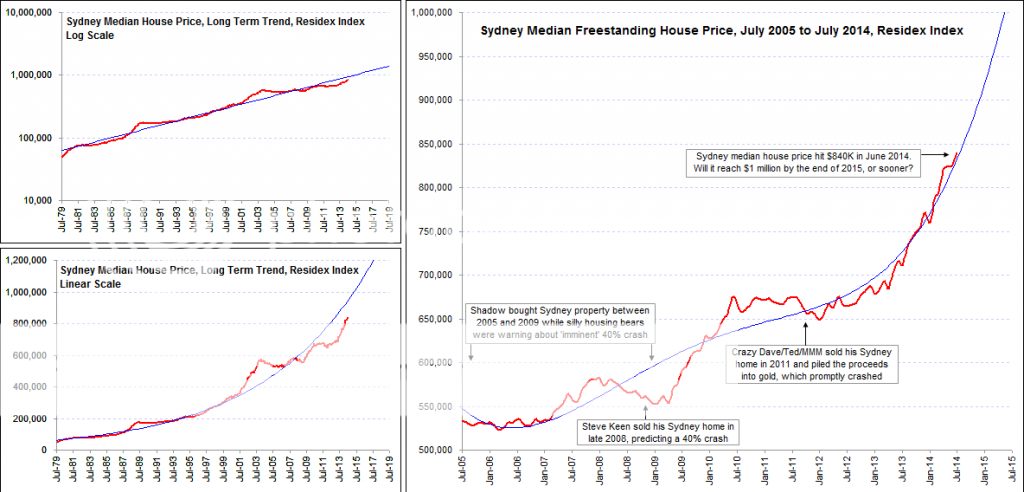

The Sydney median house price hit $840K in July as measured by the Residex index.

That's an increase of $130K in just a year.

Sydney house prices are now up nearly 30% since 2012 and up 53% since 2009.

Only another 19% growth is needed to hit $1 million.

With 18 months to go (from July), will the Sydney median house price hit one million dollars by the end of 2015, as measured by the Residex index?

That's an increase of $130K in just a year.

Sydney house prices are now up nearly 30% since 2012 and up 53% since 2009.

Only another 19% growth is needed to hit $1 million.

With 18 months to go (from July), will the Sydney median house price hit one million dollars by the end of 2015, as measured by the Residex index?