Sydney median auction result yesterday $1.1 with 85% clearance rate and good volume. Getting silly when an average house in ryde sells for $1.6

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Will the Sydney median house price reach $1 million by the end of 2015?

- Thread starter Shadow

- Start date

More options

Who Replied?Saw an episode of Selling Houses Aus last night - focus on a dumped-out period house in Haberfield, near Sydney.

The joint got the usual quick make-over by the team, but in the end it was still just a 3 bed home with one bath, a dumpy shed/garage, no pool or views.

Admittedly it was not far from CBD, a period home with cornices, lead light etc, but still a very old house structurally.

I've lived in these types of houses - unless you throw some serious reno money at them, they are drafty, cold and hard to heat (they did no heating improvements on this place) and ongoing repairs galore.

That was 40 Kingston Street - that sold last August.

A period house on 700 m2 in the Inner West - good buying !

The market there has moved on quite a bit since then.

Kingston st is prime Haberfield real estate. Walk to shops and city buses. No flats in the conservation area.

Never found that federation houses were cold or drafty unless they were poorly maintained. In fact they were the most technologically advanced homes of the time incorporating cavity brickwork, adequate ventilation, natural lighting, separation from adjoining buildings, ventilated cornices & brick vents for escape of gas and often internal bathrooms.

Up to $912K in January... less than 10% growth needed now to hit $1 million...

http://i187.photobucket.com/albums/x308/LPShadow/Sydney_Residex_Trend.png

http://i187.photobucket.com/albums/x308/LPShadow/Sydney_Residex_Trend.png

The log graph is the most telling .

Clearly shows that Sydney has been undertrend for the last four years and has only just got up to its long term trend line .

With each previous boom it peaked comfortably above the long term trend before going sideways for a while , so if history repeats we're in for another 1-2 years of growth and in the last two cycles that period has been the period of strongest growth..... and if that happens , eat my equity hobo ....

Looks like we might make that 1 mill mark . I think I voted no , but now I'm thinking differently .

Cliff

Clearly shows that Sydney has been undertrend for the last four years and has only just got up to its long term trend line .

With each previous boom it peaked comfortably above the long term trend before going sideways for a while , so if history repeats we're in for another 1-2 years of growth and in the last two cycles that period has been the period of strongest growth..... and if that happens , eat my equity hobo ....

Looks like we might make that 1 mill mark . I think I voted no , but now I'm thinking differently .

Cliff

Sydney auctioneers stunned at super results as 800 homes go under the hammer

Property frenzy in Sydney. Doing the math, this is definitely not the result of a 25 basis point drop in interest rates.

Property frenzy in Sydney. Doing the math, this is definitely not the result of a 25 basis point drop in interest rates.

Time to offload your B and C grade properties in Sydney.

Time to offload your B and C grade properties in Sydney.

why? still money to be made I reckon

Yea maybe, but can't be too greedy yea. It's like when things fall, you buy a bit every now and then.

Actually this time....the A,B, and C stuff....

The clock just struck mind night...if you are Cinderella...you better get in carriage before the carriage and horses into pumpkins and mice.

The clock just struck mind night...if you are Cinderella...you better get in carriage before the carriage and horses into pumpkins and mice.

Time to offload your B and C grade properties in Sydney.

Actually this time....the A,B, and C stuff....

The clock just struck mind night...if you are Cinderella...you better get in carriage before the carriage and horses into pumpkins and mice.

Yes and if you are running late, you may lose a lot more than just a shoe on your way out..

Actually this time....the A,B, and C stuff....

The clock just struck mind night...if you are Cinderella...you better get in carriage before the carriage and horses into pumpkins and mice.

Sorry Sash but not the way the resi market works IMO. There will be a clear turning point which will be evident to those who follow the market then 6 months to get out then followed by media reports of a bad property market about 6 months after that which will come as a shock to the general public.

When is the turning point (12 + months from here ).

I might have voted maybe , but I think 19 % in that time is pushing it .

I think 930 - 960

I would have for yes for 2016

Cliff

What are your thoughts now Cliff?

Sorry Sash but not the way the resi market works IMO. There will be a clear turning point which will be evident to those who follow the market then 6 months to get out then followed by media reports of a bad property market about 6 months after that which will come as a shock to the general public.

When is the turning point (12 + months from here ).

I'm with you Marty although sash has proven me wrong before.

Yep...the turning point is about now....early next year will be bad reports. The trouble is human greed keeps pushing in the hope of more returns...

I know..I know...I am doomsayer....what can I say?

I know..I know...I am doomsayer....what can I say?

Sorry Sash but not the way the resi market works IMO. There will be a clear turning point which will be evident to those who follow the market then 6 months to get out then followed by media reports of a bad property market about 6 months after that which will come as a shock to the general public.

When is the turning point (12 + months from here ).

What are your thoughts now Cliff?

See above

The log graph is the most telling .

Clearly shows that Sydney has been undertrend for the last four years and has only just got up to its long term trend line .

With each previous boom it peaked comfortably above the long term trend before going sideways for a while , so if history repeats we're in for another 1-2 years of growth and in the last two cycles that period has been the period of strongest growth..... and if that happens , eat my equity hobo ....

Looks like we might make that 1 mill mark . I think I voted no , but now I'm thinking differently .

Cliff

Cliff

Yep...the turning point is about now....early next year will be bad reports. The trouble is human greed keeps pushing in the hope of more returns...

I know..I know...I am doomsayer....what can I say?

Gee sash you're almost going overboard with the negativity ...

Hobo hasn't hacked your login

I don't know how long this will go on but I think that pepole who predict a certain date or year as a turning point etc are fooling them selves . People were predicting a GFC FOR MANY YEARS prior to it actually happening , in fact for as long as I've been interested in investing.......

Lots of people were talking about underlying economic problems but the reality is that many Issues are also frequently raised as problems that will cause a crisis . I remember the Japanese banking system was going to cause a global collapse ...

Cliff

Whooaahh...doc......

I was almost bang on the money about the mother of all booms in Sydney around 2014.....now I calling a bust around 2018-2019...its gotta happen....

I intend to profit on it...so its okay to break my bubble (get the pun )

)

I was almost bang on the money about the mother of all booms in Sydney around 2014.....now I calling a bust around 2018-2019...its gotta happen....

I intend to profit on it...so its okay to break my bubble (get the pun

Gee sash you're almost going overboard with the negativity ...

Hobo hasn't hacked your login

I don't know how long this will go on but I think that pepole who predict a certain date or year as a turning point etc are fooling them selves . People were predicting a GFC FOR MANY YEARS prior to it actually happening , in fact for as long as I've been interested in investing.......

Lots of people were talking about underlying economic problems but the reality is that many Issues are also frequently raised as problems that will cause a crisis . I remember the Japanese banking system was going to cause a global collapse ...

Cliff

I intend to profit on it...so its okay to break my bubble (get the pun)

Machan, a bubble is a bubble. If you can profit from it, more power to you.

I'm well aware that I could be wrong, my guesses are little more than a punt based on policy I expect and data I'm observing.I don't know how long this will go on but I think that pepole who predict a certain date or year as a turning point etc are fooling them selves . People were predicting a GFC FOR MANY YEARS prior to it actually happening , in fact for as long as I've been interested in investing......

I think we'll see a crack down on foreign buying, changes to negative gearing & potentially some controls on investor lending (macro-prudential) announced this year, if not implemented.

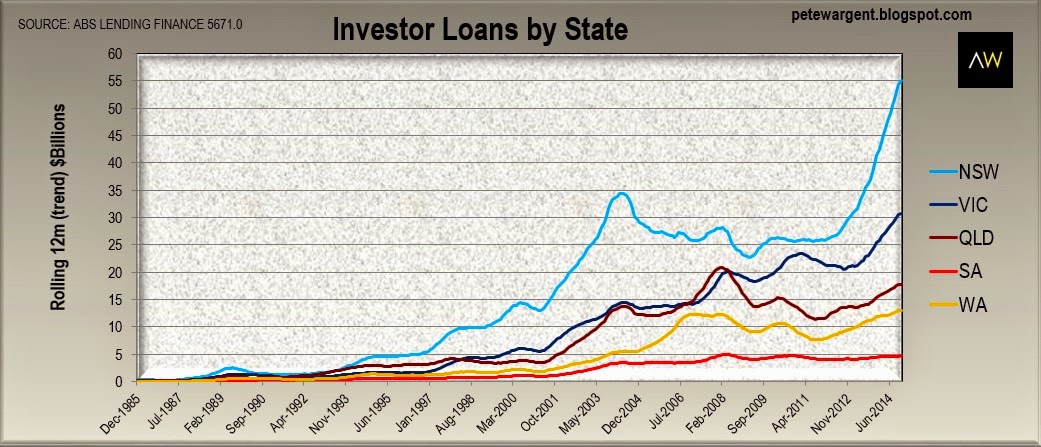

At the same time we've got investor involvement in the market bursting at the seams, not something that can go on ad infinitum. So my guess is for a nominal peak this year, but if there are no policy changes/crackdowns and RBA keeps cutting, then I'm open to the idea this madness could be extended

http://petewargent.blogspot.com.au/2015/02/sydney-investor-activity-turning.html