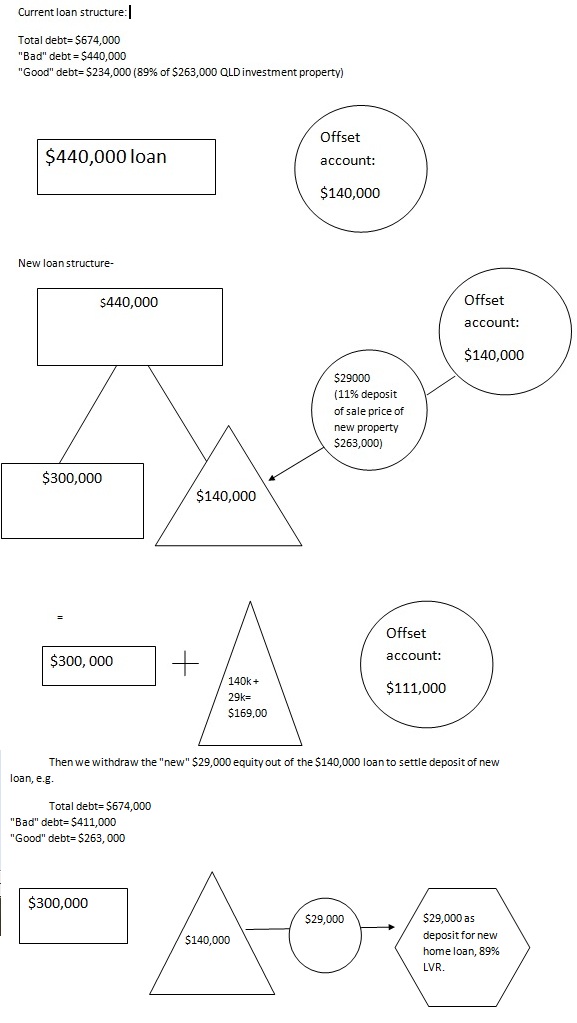

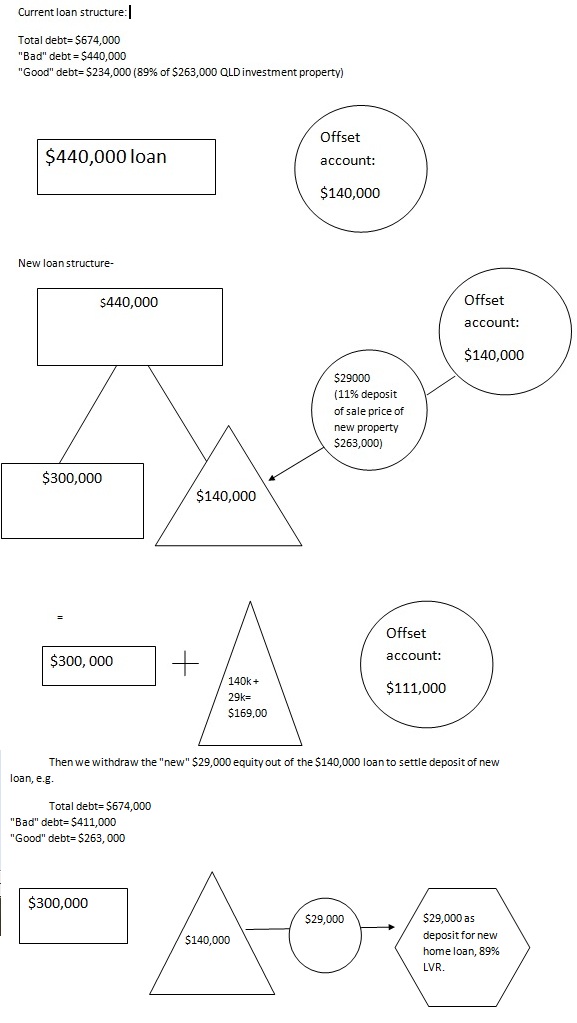

Been reading up on debt recycling after going through a couple of threads here and this is my understanding applied to my own situation. Feedback more than welcome!

Briefly, I currently have a loan for $440k for my PPOR, and arranging finance for IP that costs $263,000. I've received unconditional approval for 89% LVR for the IP. I have stashed all spare money into offset against the PPOR and there's currently $140k in there. After the current IP purchase, I intend to make another one within the next 6 months using the same debt recycling method. Now I'm trying to apply debt cycling and made some very amateur clip arts-

Have I understood it or am I completely off track?

Briefly, I currently have a loan for $440k for my PPOR, and arranging finance for IP that costs $263,000. I've received unconditional approval for 89% LVR for the IP. I have stashed all spare money into offset against the PPOR and there's currently $140k in there. After the current IP purchase, I intend to make another one within the next 6 months using the same debt recycling method. Now I'm trying to apply debt cycling and made some very amateur clip arts-

Have I understood it or am I completely off track?