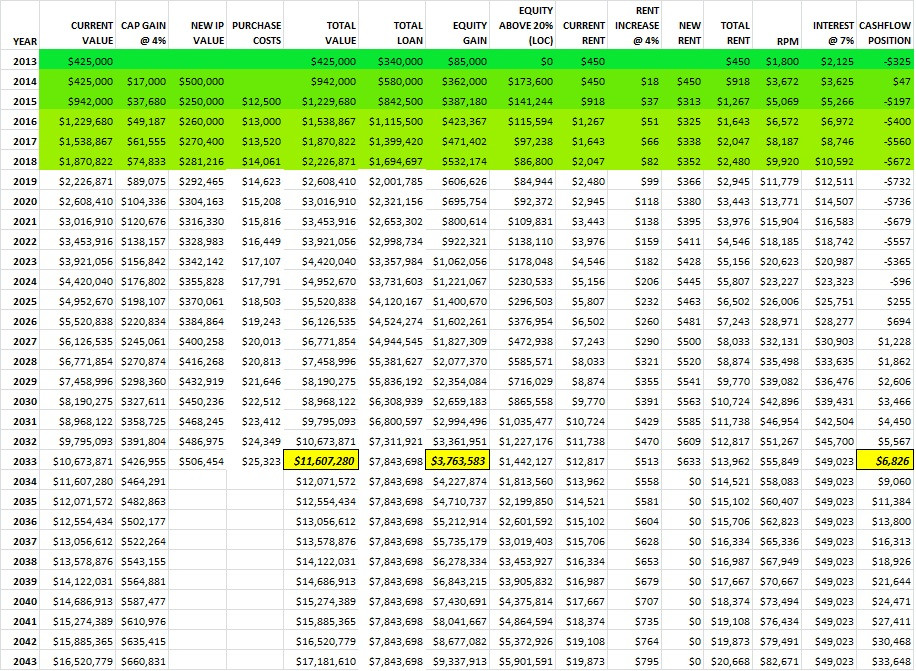

So i thought i would post a picture of my property plan/goals '20properties20years' its basic but can show people that dont understand the benefits of buying and holding and the effects that compound capital growth and rental increases have.

I have allowed for 4% growth each year and 4% rental increases per year, which i think are fair assumptions. I have allowed for average interest repayments of 7.5% which is also inclusive of property management fees and repairs, also fair assumption.

There are alot of interesting threads that show peoples plans and progress for individual projects but not so many that show peoples long term goals. I'll try keep this updated with my thoughts, changes i make, questions i have and general progress.

The first project i have undertaken is a retain and build which will hopefully be complete this time next year. I have had the benefit of having a good deposit to help with this due to current income from FIFO work and previous savings.

I have used as a rough guide, 250000 for property purchase price and 6% yield.

This is flexible but atleast the minimum. Ideally whilst i dont have many commitments and a strong income i would like to get ahead and maybe do a few more development projects and possibly a couple of purchases per year.

If cashflow ever does become an issue i plan on LOE and using a LOC to cover rental shorts. At the moment i am Focusing on understanding the Tax and Structuring aspects of Investing.

I'll keep this updated when new things happen or i think of something else to say.

Please share your thoughts, any advice appreciated!

----------------------------

The Picture above i have done from an excel spreadsheet with formulas i nplace so people can change house prices, rents, repayments etc as they wish. I'll upload a link when i figure out how, there are probally a few similar to this already on the forums but another wont hurt