I went to a property meeting last night and got an idea about reducing my non-deductible PPOR loan and essentially slowly converting it into a deductible loan for investment purposes, using my PPOR as security.

I have in the past heard about using a line of credit to pay your expenses, but I never quite got it. Is this what it's all about? Have I just reinvented the wheel?

My idea is to have all my income going into my PPOR loan. This includes renal income from IPs and salary. I then open up a line of credit which I use to pay all my IP expenses like rent, insurance, council rates, etc.

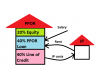

As I'm paying off my PPOR loan, I increase my LOC, shifting from a non-deductible loan to a deductible one while maintaining a total LVR of 80%.

Once my PPOR loan is paid off, I convert the entire loan from a LOC to a standard loan.

Will this work?

My actual case is a little bit more complicated, as I have a fixed loan against my PPOR and an offset account, plus I don't think that my lender does LOCs, so it might have to be a second fixed or variable loan with its own offset account. This will make it a little bit more difficult to increase my deductible loan once my funds in my secondary offset are depleted, but the theory is the same.

I have in the past heard about using a line of credit to pay your expenses, but I never quite got it. Is this what it's all about? Have I just reinvented the wheel?

My idea is to have all my income going into my PPOR loan. This includes renal income from IPs and salary. I then open up a line of credit which I use to pay all my IP expenses like rent, insurance, council rates, etc.

As I'm paying off my PPOR loan, I increase my LOC, shifting from a non-deductible loan to a deductible one while maintaining a total LVR of 80%.

Once my PPOR loan is paid off, I convert the entire loan from a LOC to a standard loan.

Will this work?

My actual case is a little bit more complicated, as I have a fixed loan against my PPOR and an offset account, plus I don't think that my lender does LOCs, so it might have to be a second fixed or variable loan with its own offset account. This will make it a little bit more difficult to increase my deductible loan once my funds in my secondary offset are depleted, but the theory is the same.