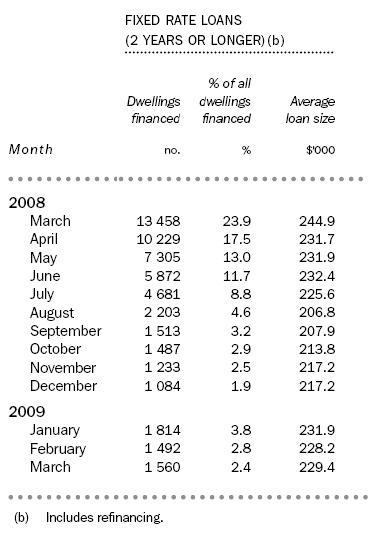

The recent ABS Housing Finance Commitments shows the proportion of fixed rate loans taken out for new mortgages and refinances for the last year. From Table 9 on p17.

In March 08 ~24% of new loans were fixed rate, in March 09 only 2.4% were fixed.

Why do such a large proportion of people fix when fixed rates are above the long term SVR average, but such a small proportion fix when they are below the long term SVR ?

Is it because the fixed rate on the day was lower than the SVR a year ago & vice versa now ?

In March 08 ~24% of new loans were fixed rate, in March 09 only 2.4% were fixed.

Why do such a large proportion of people fix when fixed rates are above the long term SVR average, but such a small proportion fix when they are below the long term SVR ?

Is it because the fixed rate on the day was lower than the SVR a year ago & vice versa now ?