tax

-

M

Transfer of PPOR to Spouse (WA)

Hi All Our PPOR is in my name currently in WA. We rented it out in Jan 10 (its our only property) and we are renting in QLD. We got married in Nov 09. Problem is its positively geared and as its in my name am I liable for the 100% of the tax due? Her income is significantly lower than...- mark213

- Thread

- ppor spouse tax transfer

- Replies: 11

- Forum: Accounting and Tax

-

N

Awesome IP accountant needed NSW Central Coast?

Hi There! We have an IP in QLD and we are on the hunt for a new accountant we can go see as we have just moved to the Central Coast north of Sydney. Can anyone recommend someone who is great with IP's? Many thanks Neaka- neaka

- Thread

- accountant central coast nsw reccommendation tax

- Replies: 1

- Forum: Accounting and Tax

-

N

How to supply expenses to accountant after renovation?

Hi There, Just hoping for some advice re. supplying details of our expenses after we recently renovated our investment property. I am completely dumb when it comes to knowing whats claimable and whats not (which is why we have an accountant) but i do like to make it as easy as possible for...- neaka

- Thread

- accountant claiming receipts spreadsheet tax

- Replies: 2

- Forum: Accounting and Tax

-

C

Cgt Help??

Hi Guys. I am about to start my second renovation... i have all intention of selling this project on completion. (8 weeks) I was going to start a company and buy the property though that.. My impression was that instead of paying CGT on the Profit, i would just pay the 30% company tax...- cnewport

- Thread

- capital gains cgt renovation tax

- Replies: 7

- Forum: The Buying/Selling Process

-

S

DIY Tax for Trust

Hello, Wondering if anyone has lodged their own taxes for their DT? Just curious, as when starting up a trust and only having one maybe two properties - trying to save on costs as much as possible when its still fairly simple. Would still hire an accountant to do it for the more...- SmiTTy2008

- Thread

- diy tax trust

- Replies: 12

- Forum: Accounting and Tax

-

L

drawinng funds from equity....best to use offset account???

hi guys, im new to the forum. ive got 1 IP in QLD and have now moved down to NSW. just wondering, say ive my IP has a loan for $200k, i have equity of $100k, i want to draw out $50k for personal use ie. debt consolidation, holiday, car or whatever but i also want to draw out a little extra...- lowie

- Thread

- equity tax

- Replies: 1

- Forum: Accounting and Tax

-

B

Strategy for upgrading & investing at the same time

Hi. I have started reading up on property investment materials available online and books but I still don't know how to apply the concepts to my situation. Different authors seem to have different views on debt on PPOR and investment properties when you upgrade. The only commonality is that...- babysteps

- Thread

- investment property mortgage insurance private sale tax upgrade

- Replies: 8

- Forum: Property Investment - Other

-

J

Unit or not for HDT?

We just set up a new Property investor trust through Chan & Naylor few months ago, and are going to start our property investment soon. I read lots of articles, and know that our trust is one of the HDT, I also notice about the TD 2009/17 and read some discussions in the forum, but I cannot find...- Jasmine

- Thread

- discretionary hdt loan tax unit

- Replies: 7

- Forum: Accounting and Tax

-

B

Stamp duty as a tax deduction in the ACT - but purchased off the plan

I am struggling to find information on this online, and the ATO aren't being particularly helpful. I'm sure someone else has come up against this so figured I would ask. I have purchased a unit off the plan in Canberra. Purchased in 2008, stamp duty paid in June 2009. However, the unit is...- BigKev

- Thread

- act deduction stamp duty tax

- Replies: 10

- Forum: Accounting and Tax

-

F

Tax on Rental income

Hi, I need clarification.. If I'm a private individual with one IP.. (1) is the total rent for the year added to my earned income - then taxed at the marginal rate?...or (2) is it assessed seperately..ie income less expenses..in a seperate tax return? What is the rate of tax on...- fATICAN

- Thread

- rental income tax

- Replies: 29

- Forum: Accounting and Tax

-

B

BIG Brisbane Meeting / Jun 30th / Martin Ryland

Better Investing Group Meeting 30th June, 2009 Guest Speaker Martin Ryland Hello everyone! This month we have Martin Ryland to talk about our favourite subject TAX! :D He will be discussing the following: - Converting your PPOR to a rental property, tips and tricks. - Converting a rental...- BIG

- Thread

- martin ryland rental tax

- Replies: 0

- Forum: Meeting Point

-

L

Recommendation for Property Tax-Accountant in Sydney

My partner and I owns two investment properties in Sydney (one negative-geared and the other positive-geared). We're looking for a capable tax-accountant who specialise in real-estate. We have a friend who owns multiple positive-cashflow properties. She's also looking for an accountant who...- leiw16

- Thread

- accountant property sydney tax trust

- Replies: 3

- Forum: Accounting and Tax

-

F

Simple Income Tax Questions - Laptop & IP Travel Expenses

Hi, For the tax experts on here, I have a couple of questions. a) Laptops to my knowledge are depreciable over 3 years. Is this 33% per year or different (sliding scale) rates per year? (I am aware that you then have to apply a % that was work related to this figure). b) My wife and I...- fmx_rider

- Thread

- income tax

- Replies: 7

- Forum: Accounting and Tax

-

T

IP offset account tax implications

Hi folks, long time reader first time poster. I've just returned from a visit to my accountant ... and he's totally freaked me out. This is why: I have an investment property with an interest-only investment loan @ 80% LVR. There is an offset account attached to the IP loan. Am I able to put...- tdh78au

- Thread

- investment property offset tax

- Replies: 55

- Forum: Accounting and Tax

-

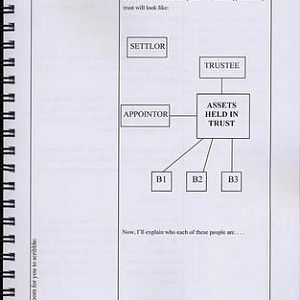

Dale's trust picture

Supporting this thread: http://www.somersoft.com/forums/showthread.php?postid=51014#post51014- always_learning

- Media item

- battles dale gatherum-goss structure tax trust

- Comments: 0

- Category: Forum Posts