Unfortunately the 'problems being fixed' as you have put it is rather just kicking the can further down the road. Are the US or PIIGS going to be in any better position to reduce their huge debts (or even slow the appreciation of them) 12 or 24 months down the track than they are now? Seems unlikely.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold price over $US1600/ounce

- Thread starter Ajax

- Start date

More options

Who Replied?Unfortunately the 'problems being fixed' as you have put it is rather just kicking the can further down the road. Are the US or PIIGS going to be in any better position to reduce their huge debts (or even slow the appreciation of them) 12 or 24 months down the track than they are now? Seems unlikely.

i have alot more confidence in the US than i have in Europe (with the exception of Germainy, i missed this opportunity, but investing in German shares would have been a great strategic opportunity).

As the US economy recovers expect to see tax revenue increase significantly.

However i do agree that at this point in time there is no structural problem in holding gold. The underlying catalysts are still there, so the major trend should continue.

The Euro is hardly a "confidence inspiring" example of a common currency. The next reserve currency will have some sort of backing and it is difficult to thinkof anything other than gold being acceptable. This experiment with totally fiat currencies has failed but the transition to the next one will wreack havoc on many nations and individuals.US dollar will collapse within 1-2 years.

Amero will replace the currency for Canada, US and Mexico...

Wonder what this will do to the AUD.

Try not to among the casualties. Own gold.

The Euro is hardly a "confidence inspiring" example of a common currency. The next reserve currency will have some sort of backing and it is difficult to thinkof anything other than gold being acceptable. This experiment with totally fiat currencies has failed but the transition to the next one will wreack havoc on many nations and individuals.

Try not to among the casualties. Own gold.

been saying it for forever and a day and only now do people see the light.

the new reserve currency will be gold backed but the USD wont go away, it will just devalue.

i see the citizens of the US being forced to use the USD locally while any international dealings require the Amero or whatever they decide to call it.

after all, if the US can ban it's own citizens from trading CFDs on it's own stock exchange, they can do anything.

The mechanics on how to sort the US system are no different from every other time,and btw China would suffer more if the US came to a standstill and so would Australia and every other country down the line..Unfortunately the 'problems being fixed' as you have put it is rather just kicking the can further down the road. Are the US or PIIGS going to be in any better position to reduce their huge debts (or even slow the appreciation of them) 12 or 24 months down the track than they are now? Seems unlikely.

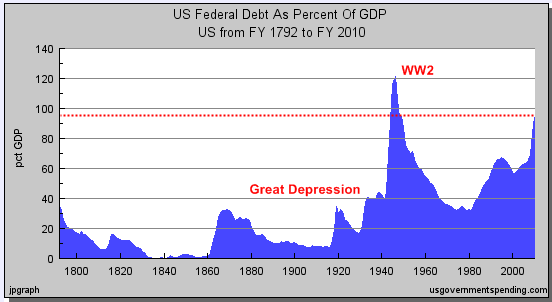

Which time would that be specifically? The situation now is a lot more dire than any other time in history. Their debt to GDP a lot higher than it was before the great depression and even then it took them decades to really recover (and the current debt to GDP doesn't take into account off balance sheet liabilities). They no longer have the manufacturing base they used to either...The mechanics on how to sort the US system are no different from every other time,and btw China would suffer more if the US came to a standstill and so would Australia and every other country down the line..

I agree China and others down the line will suffer.

I guess I have a fairly grim outlook on the global economy in general, but that doesn't mean I'm not going to try and take advantage of the opporunities that present themselves.

I was standing at the petrol pump a few hours ago and one item that stood out to me was while loooking at the fit off ,, pumps the hose everything was made in the US,not China,not Germany,so they still hold the higher ground in several areas and always will,once they stop their worldwide mini wars the tide will turn,orWhich time would that be specifically? The situation now is a lot more dire than any other time in history. Their debt to GDP a lot higher than it was before the great depression and even then it took them decades to really recover (and the current debt to GDP doesn't take into account off balance sheet liabilities). They no longer have the manufacturing base they used to either...

I agree China and others down the line will suffer.

I guess I have a fairly grim outlook on the global economy in general, but that doesn't mean I'm not going to try and take advantage of the opporunities that present themselves.

Last edited:

ora different scenario that is unthinkable happens,then semi-autos will be worth more than "Gold".

Where do I buy them?

If you take things to their logical conclusion we are all doomed, resistance is futile. Maybe you just need enough gold to buy a few cases of good wine: The more gold, the better the wine.

Which time would that be specifically? The situation now is a lot more dire than any other time in history. Their debt to GDP a lot higher than it was before the great depression and even then it took them decades to really recover (and the current debt to GDP doesn't take into account off balance sheet liabilities). They no longer have the manufacturing base they used to either...

I agree China and others down the line will suffer.

I guess I have a fairly grim outlook on the global economy in general, but that doesn't mean I'm not going to try and take advantage of the opporunities that present themselves.

The USA has been in this situation before, was it after WWII, i cant remember the exact timing, but google some long term graph, i'm sure its there.

In regards to off balance sheet liabilities, there is alot of scaremongering about this as well, i cant remember the details, but some of these liabilities represent dollar claims many years out into the future (but not discounted to NPV terms).

Yes things are worrysome, yes debt levels are too high, yes if things go unchecked it could really become catastrophic.

Sometimes the market can 'forget' things for a time, but do you really think the market is in 'forget me' phase at the moment.

Could you define "passive" please? The three most commonly used adjectives here are "positive, neutral, negative". A gold brick is "neutral", JUST as dependent on, but no less than, "neutral" property on capital gain to maintain our interest.

If you think "aggressive" is the reverse of passive (I'm not sure it is) near month futures is far more un-passive than property. Buying shares in a producing miner (whatever the commodity) taps into rising incomes during periods of rising prices. That's tempered by the fact that miners are big users of commodities themselves. No such thing as a free lunch, as we've been told.

it's not the commodity it's what you do with it. If you borrowed 100% LVR for a bar of gold in 1979 and just sat there and watched it...well I can't imagine that being good. aggressive is taking $1600 and investing it in a business that returns 100% return on capital per month. Do that since 1979 and then go buy a gold bar.

yes you can go trade gold etc.. my point is that buy'n'die gold is fine when you have plenty of money, but if you really want to get ahead you have to go a little harder

i believe the gold story and would love more, but to tie up my working capital in it would be madness

it's not the commodity it's what you do with it. If you borrowed 100% LVR for a bar of gold in 1979 and just sat there and watched it...well I can't imagine that being good. aggressive is taking $1600 and investing it in a business that returns 100% return on capital per month. Do that since 1979 and then go buy a gold bar.

yes you can go trade gold etc.. my point is that buy'n'die gold is fine when you have plenty of money, but if you really want to get ahead you have to go a little harder

i believe the gold story and would love more, but to tie up my working capital in it would be madness

Well gold is non-income producing which means it has to basically earn a lot more in capital gains to even be on par with other investments.

Well gold is non-income producing which means it has to basically earn a lot more in capital gains to even be on par with other investments.

correct. tho gold has a good pedigree at least. in any mania tho it doesn't matter what the subject matter is, just make sure you own it and get out somewhere on the up!

correct. tho gold has a good pedigree at least. in any mania tho it doesn't matter what the subject matter is, just make sure you own it and get out somewhere on the up!

Stock and standard rules of any ponzi scheme

Well gold is non-income producing which means it has to basically earn a lot more in capital gains to even be on par with other investments.

But no where near as much as -ve geared property.

Public debt alone:The USA has been in this situation before, was it after WWII, i cant remember the exact timing, but google some long term graph, i'm sure its there.

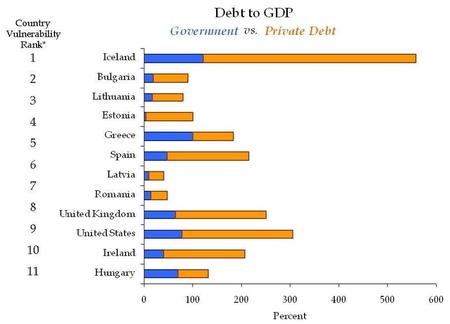

Private and Public (does not include off balance sheet figures):

Overall the US is up there with the worst of the PIIGS:

When something increases X5 in 8 years you don't need to be a genius and "time" your entry.

You have to be smart enough to be on board though

On another note

Assuming the US inflates its debt away, whats the scenario or strategy there though for investors?

But no where near as much as -ve geared property.

Well if you bought property with 100% cash it would be returning income more than gold

Well if you bought property with 100% cash it would be returning income more than gold

If you pay cash it isn't neg geared, which is the comparison I made. My statement holds true.

Paid up property has not increased X5 so it is still true that Au has greater cap gain.