This has turned into a longer post than I planned. Sorry.

House price rises and inflation

The long term studies of house prices, such as the

Herengracht Index or Shiller's research suggest they're linked to general inflation, or slightly (less than half a percent) above it.

I know that most posters here don't agree with that, but bear with me for a second.

Melbourne's prices rose by 11.1% in the last quarter of 2009, according to the RBA figures that Player quoted. That's equivalent to five years' growth at the expected trend (inflation at 2.1%), and against a background of tightening credit.

Like Intrinsic_Value, that strikes me as smelling a bit funny.

Where are we in the cycle?

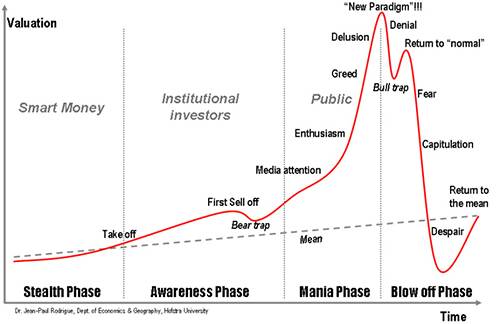

Dr. Jean-Paul Rodrigue came up with this diagram of the lifecycle of a bubble. (Stolen from

Tiberius Leodis's blog.)

The majority of posts would suggest that we're somewhere in the

Awareness or maybe start of the

Mania phases. But we could equally as well be in the

Bull Trap of the

Blow Off Phase, or even approaching the peak of a

New Paradigm.

It depends if the dip in prices at the end of 2008 or 2009 was the turning point in a cycle, or just a blip. And apparently it's hard to pick out the start and end points of a cycle until after the fact.

Then again, all charts, property clocks and other methods of divining the future might be inaccurate, and we're deluding ourselves about our predictive abilities.

Credit

Credit

I keep on hearing stories on this forum about the increasing difficulty in borrowing money, and that the banks are tightening up their lending practices. That sounds eerily familiar to the UK in 2007 and 2008, shortly before the recession hit.

(A wider problem is that businesses here can't borrow short term to cover project costs, and that's what's really damaged the economy.)

Economist posted a few comments about how the carry trade was funding Australia, and others have expressed a concern that the country is highly dependent on foreign borrowing. This could actually be a real problem, as this comment from an

article (on Japan) highlights.

Fitch, one of the leading rating agencies, places Japan top of the list in terms of financing flexibility. The agency uses factors such as net annual debt issuance (as a proportion of the total), size of the economy, the proportion of debt held by non-residents and the stock of financial assets to determine its rankings. By these measures Greece, Portugal and (more surprisingly) Australia are at the bottom of the table.

I suspect that the availability of credit is going to determine how the Australian economy fares over the next few years. Unfortunately I also believe that there's going to be a lot of paying down of debt and austerity for much of the world over the next decade, so it might not be pretty.