He is referring to the $7,000 FHOG which was introduced in 1983. Does anyone have evidence of the likely effect of recent government assistance/legislation inflating housing prices? I am interested in the NRAS properties but suspect that their prices are over valuation.Well, he's wrong on one point.

He says the FHG was first introduced in 1983. We built our first home in 1974 and received about $1200 in a first home grant. We bought carpets for the lounge and main bedroom. Maybe it was called something different and has slipped under the radar.

Marg

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Huge article from Steve Keen on why prices are going to crash

- Thread starter Peter 14.7

- Start date

More options

Who Replied?The majority of posts would suggest that we're somewhere in the Awareness or maybe start of the Mania phases. But we could equally as well be in the Bull Trap of the Blow Off Phase, or even approaching the peak of a New Paradigm.

Excellent post Graemsay. I posted a similar graph previously on another thread. I strongly believe we are in the 'Return to normal' part of the Blow off phase and people are likely to get a massive shock/wake up call in the next 6-24 months. I believe the peak of the 'return to normal' phase has actually surpassed the 'New paradigm' phase due to the massive artificial government stimulus causing this overshoot.

If you look at all the numbers, it just doesn't add up. And no matter how you justify Australia as the 'lucky' country that has escaped the GFC, there is no way with the global economy being in the terrible state that it is in that Australia (which is essentially a proxy of China's economy) cannot be affected. There is definitely a significant degree of 'blind' optimism going on at the moment which makes for an extremely risky environment.

I agree with some other posters on this forum (a definite minority), it would be prudent for investors to think about decreasing LVR and reducing debt as much as possible to decrease risk as I strongly believe we could be in for an unforeseen (to many) very rough time shortly.

Just my thoughts - WP.

Last edited:

nice lunch HE.

I often wonder if there was an endless supply of money to lend, how high Aussie banks would drive DSRs. Cross generational debt has to be more on the cards.

Anyway, his opinion is that situation is unsustainable

Did he elaborate why exactly it is unsustainable?

- perception of increased risk by foreigners, for the returns Oz banks can squeeze?

- lack of funds?

- better returns elsewhere, like equities?

and credit will be rationed going forward and LVRs, SVRs and IR margins will be the mechanism by which they achieve this. You only have to look at deposit rates to work out the Banks are doing whatever they can to get capital to lend - they just can't get enough, hence the rationing.

Of course, that just increases the risk of price drops anyway so really both arguments end with the same result...

I often wonder if there was an endless supply of money to lend, how high Aussie banks would drive DSRs. Cross generational debt has to be more on the cards.

This has turned into a longer post than I planned. Sorry.

House price rises and inflation

The long term studies of house prices, such as the Herengracht Index or Shiller's research suggest they're linked to general inflation, or slightly (less than half a percent) above it.

I know that most posters here don't agree with that, but bear with me for a second.

Melbourne's prices rose by 11.1% in the last quarter of 2009, according to the RBA figures that Player quoted. That's equivalent to five years' growth at the expected trend (inflation at 2.1%), and against a background of tightening credit.

Like Intrinsic_Value, that strikes me as smelling a bit funny.

Where are we in the cycle?

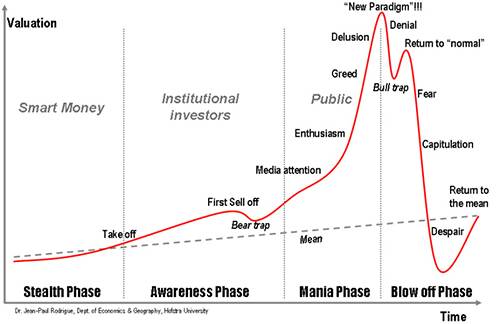

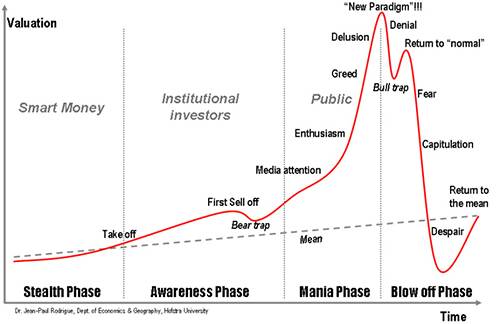

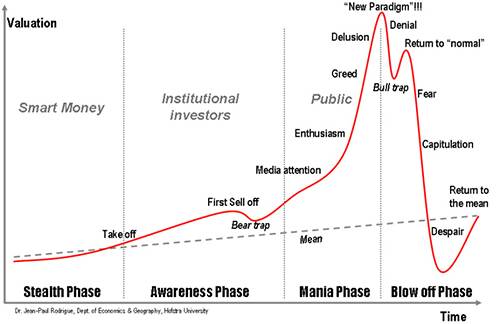

Dr. Jean-Paul Rodrigue came up with this diagram of the lifecycle of a bubble. (Stolen from Tiberius Leodis's blog.)

The majority of posts would suggest that we're somewhere in the Awareness or maybe start of the Mania phases. But we could equally as well be in the Bull Trap of the Blow Off Phase, or even approaching the peak of a New Paradigm.

It depends if the dip in prices at the end of 2008 or 2009 was the turning point in a cycle, or just a blip. And apparently it's hard to pick out the start and end points of a cycle until after the fact.

Then again, all charts, property clocks and other methods of divining the future might be inaccurate, and we're deluding ourselves about our predictive abilities.

.

Well done Kudos to you mate.

That was an incredibly useful chart.

It really says in a picture my main concern at the moment.

There is a time to hold heavy debt levels and times not to. These are not the times to be loading up on debt.

I will go into more detail in a seperate post as it will take a while, but i will explain my thought process in conjuction with this chart.

I am not so worried about the credit side of things. I view the tightening of credit standards as GOOD. Why? because it restricts the ability of 'bubble forces', this acts as a buffer if there is a future correction.

What you dont want to see is easy credit conditions going through the bubble stage followed by tight conditions in the corrective stage, this acts as a double whammy. The tightening of credit into the bubble stage is a positive long term.

I don't think you can stop the rates going back up again,which also kicks in interest payments,but when you look at the system in Australia most of the debt never has to be paid down,Banks only give money out if they think they can get a higher return..willair..This has turned into a longer post than I planned. Sorry.

House price rises and inflation

The long term studies of house prices, such as the Herengracht Index or Shiller's research suggest they're linked to general inflation, or slightly (less than half a percent) above it.

I know that most posters here don't agree with that, but bear with me for a second.

Melbourne's prices rose by 11.1% in the last quarter of 2009, according to the RBA figures that Player quoted. That's equivalent to five years' growth at the expected trend (inflation at 2.1%), and against a background of tightening credit.

Like Intrinsic_Value, that strikes me as smelling a bit funny.

Where are we in the cycle?

Dr. Jean-Paul Rodrigue came up with this diagram of the lifecycle of a bubble. (Stolen from Tiberius Leodis's blog.)

The majority of posts would suggest that we're somewhere in the Awareness or maybe start of the Mania phases. But we could equally as well be in the Bull Trap of the Blow Off Phase, or even approaching the peak of a New Paradigm.

It depends if the dip in prices at the end of 2008 or 2009 was the turning point in a cycle, or just a blip. And apparently it's hard to pick out the start and end points of a cycle until after the fact.

Then again, all charts, property clocks and other methods of divining the future might be inaccurate, and we're deluding ourselves about our predictive abilities.

Credit

I keep on hearing stories on this forum about the increasing difficulty in borrowing money, and that the banks are tightening up their lending practices. That sounds eerily familiar to the UK in 2007 and 2008, shortly before the recession hit.

(A wider problem is that businesses here can't borrow short term to cover project costs, and that's what's really damaged the economy.)

Economist posted a few comments about how the carry trade was funding Australia, and others have expressed a concern that the country is highly dependent on foreign borrowing. This could actually be a real problem, as this comment from an article (on Japan) highlights.

I suspect that the availability of credit is going to determine how the Australian economy fares over the next few years. Unfortunately I also believe that there's going to be a lot of paying down of debt and austerity for much of the world over the next decade, so it might not be pretty.

Did he elaborate why exactly it is unsustainable?

- perception of increased risk by foreigners, for the returns Oz banks can squeeze?

- lack of funds?

- better returns elsewhere, like equities?

Hi WW

He didn't say exactly but he made reference to:

- Tighter credit worldwide remaining a problem

- The fact that insto's who were previously "underweight" Australian exposure are now getting towards the "overweight" side.

- There are just limited sources of funds available and other countries will begin to look more attractive shortly as they improve so our current star lending status will wane.

So he predicted:

- More intense competition for deposits.

- Credit rationing through credit quality, which we have already seen in spades.

This will of course continue to hit developers and businesses hardest so I don't really know what's going to happen. We are choking off new housing (and commercial / industrial) supply at the same time as choking off new credit in the midst of a growing economy, low unemployment and strong immigration.

Could go either way... as always!

He also added that 2009 was a time when everyone was being told the sky was falling in but they were actually feeling alright because:

- The vast majority still had jobs

- IRs had fallen off a cliff

- Things were getting cheaper with the exchange rate.

He went on to say that in 2010 people will be told we dodged a bullet and everything is now fine but actually they will be hurting more because IRs will continue to rise - they expect by around 100 basis points by the end of the year. Consequently, with restrictions on credit and international requirements for banks to hold a lot more capital, some businesses are going to struggle.

In the meantime, with the current price of natural gas and iron ore, there's a boom on in some industries! I don't have a clue where it will end up but either way my focus is on cashflow...

- The vast majority still had jobs

- IRs had fallen off a cliff

- Things were getting cheaper with the exchange rate.

He went on to say that in 2010 people will be told we dodged a bullet and everything is now fine but actually they will be hurting more because IRs will continue to rise - they expect by around 100 basis points by the end of the year. Consequently, with restrictions on credit and international requirements for banks to hold a lot more capital, some businesses are going to struggle.

In the meantime, with the current price of natural gas and iron ore, there's a boom on in some industries! I don't have a clue where it will end up but either way my focus is on cashflow...

IRs will continue to rise - they expect by around 100 basis points by the end of the year.

Nah, nothing as dramatic as that. I reckon it'll only be 1%.

Hi WW

This will of course continue to hit developers and businesses hardest so I don't really know what's going to happen. We are choking off new housing (and commercial / industrial) supply at the same time as choking off new credit in the midst of a growing economy, low unemployment and strong immigration.

Could go either way... as always!

Yes this point is quite correct and it does present the catalyst for those who say we are in for one hell of a boom.

Its basic economics 101, if demand increases but supply is restricted what happens to price? it goes balistic.

So the possibility of 'australia's greatest boom in residential prices' is definately there.

However i would argue that the future bust would also be greater.

Yes this point is quite correct and it does present the catalyst for those who say we are in for one hell of a boom.

Its basic economics 101, if demand increases but supply is restricted what happens to price? it goes balistic.

So the possibility of 'australia's greatest boom in residential prices' is definately there.

However i would argue that the future bust would also be greater.

yes but then in economics 102 they go on to say that prices can't rise without the ability to pay.

goes back to my belief that demand for housign will increase but the ability to buy willbe crimped. Rents will therefore be driven up. If owners of IPs refuse to charge the correct level of rent for the risk they are taking on it appears the market will sort it out for them

yes but then in economics 102 they go on to say that prices can't rise without the ability to pay.

Not really under a capitalist system the market will figure out a way.

Where are we in the cycle?

Dr. Jean-Paul Rodrigue came up with this diagram of the lifecycle of a bubble. (Stolen from Tiberius Leodis's blog.)

The majority of posts would suggest that we're somewhere in the Awareness or maybe start of the Mania phases. But we could equally as well be in the Bull Trap of the Blow Off Phase, or even approaching the peak of a New Paradigm.

Or maybe there is no bubble.

The house price to income ratio in Australia was essentially unchanged between 2003 and 2008. In Sydney, house prices fell 20% in real terms between 2003 and 2008. That suggests we are not in a bubble, yet. Current prices are supported by rising disposable incomes, strong population growth, and restricted supply.

Based on the above chart, 2008 looks like the bear trap year, and prices have now risen well above 2008 levels. If prices do now begin to shoot up as rapidly as suggested on that chart, then we may enter bubble territory. However, prices may just keep on rising gradually at a more sustainable several percent above the general inflation rate, as they have been doing (on average) for the past 60+ years.

Not every boom is a bubble, and a bubble can only be confirmed after it bursts.

i'm all for capitalism but really more debt is not the answer (apart from the fact it simply isn't available). People mention intergenerational loans... well an IO loan is an eternal debt until you reduce some capital, not sure how much more intergenerational you can get

dont get me wrong, i quite agree on your viewpoint as to whether this is intelligent or not.

I was just passing an opinion as to the pricing mechanism.

dont get me wrong, i quite agree on your viewpoint as to whether this is intelligent or not.

I was just passing an opinion as to the pricing mechanism.

yeah that's fine - not sure if I have really made my point that clear. I think what I am trying to say is, you can't bid the price of something up if you have no money. You contend the market will think of something... I am not sure of that, I think they have gone beyond breaking point already (building up since WW2) and that's why we are here now. The market will now hinder bidding, not help it

He went on to say that in 2010 people will be told we dodged a bullet and everything is now fine but actually they will be hurting more because IRs will continue to rise - they expect by around 100 basis points by the end of the year. Consequently, with restrictions on credit and international requirements for banks to hold a lot more capital, some businesses are going to struggle.

I had an interesting lunch today with a developer I've known for decades who works Brissie northern outskirts. He himself is a straight arrow, but has a birds eye view of what is unfolding around the traps.

He blew me away with some of the stuff he told me - two tier marketeering alive and well, developers drawing up dummie contracts to satisfy bank demand for 125% presales, investors driving the market on the fringes representing 70% of sales in some releases in the last 6 months.

His view is loan arrears are growing in his part of the world, and banks and mortgage insurance reps are making regular visits to the area to monitor what's happening at the coal face.

He is as uncertain as everyone else as to what will happen in the next 18 mths.

Or maybe there is no bubble.

Based on the above chart, 2008 looks like the bear trap year, and prices have now risen well above 2008 levels. If prices do now begin to shoot up as rapidly as suggested on that chart, then we may enter bubble territory. However, prices may just keep on rising gradually at a more sustainable several percent above the general inflation rate, as they have been doing (on average) for the past 60+ years.

Not every boom is a bubble, and a bubble can only be confirmed after it bursts.

Hang on Boz, this chart is of a general nature, just like the property clock etc.

You cant extrapolate exact positions from it.

If one could then life would be simple, just write a computer algorithim, to create risk free arbitrage profits. The only problem then, would be everyone else would be doing the same thing, and the surplus profits would be marginalised away.

To some these sought of 'general indicators' present a world of information, to others they dont.

Hang on Boz, this chart is of a general nature, just like the property clock etc.

You cant extrapolate exact positions from it.

If one could then life would be simple, just write a computer algorithim, to create risk free arbitrage profits. The only problem then, would be everyone else would be doing the same thing, and the surplus profits would be marginalised away.

To some these sought of 'general indicators' present a world of information, to others they dont.

that was shadow's post, not mine.

anyway, I can say there are lots of computer algorithm around that make money, but that would be more likely on share market or forex. Probably the High frequency trading Goldman Sachs is using to make money is a computer program

I had an interesting lunch today with a developer I've known for decades who works Brissie northern outskirts. He himself is a straight arrow, but has a birds eye view of what is unfolding around the traps.

He blew me away with some of the stuff he told me - two tier marketeering alive and well, developers drawing up dummie contracts to satisfy bank demand for 125% presales, investors driving the market on the fringes representing 70% of sales in some releases in the last 6 months.

His view is loan arrears are growing in his part of the world, and banks and mortgage insurance reps are making regular visits to the area to monitor what's happening at the coal face.

He is as uncertain as everyone else as to what will happen in the next 18 mths.

Yep, lots of surplus stock and all the old tricks (which never went away, I might add) being ramped up, almost exclusively in the investment market.

We're on to it, by the way

Said it before and I'll say it again: find your own properties, get your own valuations and ignore anyone whose business it is to do it for you.

They are part of the machine.

Hi TF

I just sacked my broker, too negative and I need someone who can help me out today. Finance is without a doubt one of my hurdles at the moment. Still there's always a way, if it means going 60% LVR for a short period of time so be it.

Cheers, MTR

Finance is a problem for a lot of people.

Not that getting finance itself is the problem....just getting it on the terms they are used to or think they are entitled to.

I said here or elsewhere a long time ago that credit-tightening is a subtle thing. Everyone expects "marginal borrowers" to find it difficult, but, of course, they tend to think everyone else is a marginal borrower.

It will continue for some time ,slice by slice(I for one, expect to the see the policy distinction between OOs and investors becoming more marked and, potentially, life being made more difficult for brokers by the majors). There will be the odd headline around increasing LVRs or whatever out of some lenders etc which will get the usual suspects excited about a return to the pre-2007 days, but closer inspection will reveal conditions, credit scoring requirements and various other bits and pieces that will show it is very different version of whatever used to be the case.

We're not in Kansas anymore, Toto.

Last edited: