As a Cairns resident I'm of the opinion that the city is stil very much in the property doldrums despite what the Cairns Post tells us each week. Tourism has suffered with a high $AUD and blue collared skilled workers had left the area in droves in recent times to earn big money in the mining areas. The unit market is particularly bad with exorbitant body corp fees that make units a no go zone in Cairns for investors. As for Aquis, it may help but jobs will be what drives any property recovery as more people will have money to spend and they therefore will look to buy. With a high unemployment rate and an oversupply of properties the doldrums are set to continue for a while longer yet.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

YIKES! Keep an eye on CAIRNS!!

- Thread starter JenJen

- Start date

More options

Who Replied?As a Cairns resident I'm of the opinion that the city is stil very much in the property doldrums despite what the Cairns Post tells us each week. Tourism has suffered with a high $AUD and blue collared skilled workers had left the area in droves in recent times to earn big money in the mining areas. The unit market is particularly bad with exorbitant body corp fees that make units a no go zone in Cairns for investors. As for Aquis, it may help but jobs will be what drives any property recovery as more people will have money to spend and they therefore will look to buy. With a high unemployment rate and an oversupply of properties the doldrums are set to continue for a while longer yet.

Hmmm...

I'm not convinced that your 'opinion' reflects what is actually happening more broadly across the region. Maybe have a look at vacancy rates, stock on the market graphs, demand & supply ratios, rental trends, employment projections, etc. Or better still, read the Herron Todd White month in review, or take a look at the back of the latest API magazine.

In terms of the economy, I find it hard to look at all the activity going on in Cairns, and say that it is and will stay in the 'doldrums'. No doubt it took a big hit after the GFC, more so than other regions not as dependent on tourism. However, as a result of this, a great deal of effort has been put into diversifying the economy. Yes, the unemployment rate is high. So are the number of tourists/travellers and retirees. Also, are you aware that miners actually fly in and out of Cairns? One of the only flights to Weipa is via Cairns.

Yes, the unit market has been particularly badly hit by high body corp fees (insurances), which has been the case across North Queensland, but this is starting to ease, and there is a lot of political pressure and risk mitigation measures are being put in place to bring them down.

When prices across Australia skyrocket, as they have done so in Perth and are now doing so in Sydney in particular, and prices and yields become untenable for investors and homeowners, insurances start to look relatively less concerning.

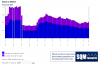

Have a look at the attached graphs. Sure, there is a lot of variance across Cairns, depending on where you look, but I would suggest that, on the whole, the market is definitely turning.

Cheers

Jen

Attachments

any update on the Casino project?

Aquis are at pains to point out that this is an integrated resort that just happens to have a casino, not just a casino.. Having said that, the casino will be slightly larger than Crown in terms of tables.

There is a long way to go yet.. Would be surprised if it is approved this side of Christmas, although they are planning on site works commencing mid 2014 if everything goes to plan.

It is a project of State significance which streamlines the process. Here is the initial advice statement.

http://www.dsdip.qld.gov.au/resources/project/aquis-resort/aquis-initial-advice-statement.pdf

Been keeping an eye on the Yorkeys Knob market and no one with a house is listing.. haven't seen anything new for ages. My agent also has no houses to list for rent either. Very tight market regardless of the resort.

Last edited:

I know nothigng about the cairns market, but is this any good?

http://www.realestate.com.au/proper...ns+north-114980247?rsf=emailalert-propdetails

8 dwellings for $150k+ each seems pretty good

http://www.realestate.com.au/proper...ns+north-114980247?rsf=emailalert-propdetails

8 dwellings for $150k+ each seems pretty good

I know nothigng about the cairns market, but is this any good?

http://www.realestate.com.au/proper...ns+north-114980247?rsf=emailalert-propdetails

8 dwellings for $150k+ each seems pretty good

You would have to see the strata fees which would be horrendous due to high insurance premiums and council rates up there.

Cheapest apartment I saw was $30K returning $180 a week. $5K strata though.. you seriously wouldnt bother. Its still for sale.

I really only look at houses though..

The Lake Street units are mainly on short term leases, according to the Agent. He stated that relatives of people in the Cairns Base Hospital stay there while the relative is having treatment.

He spoke about these when I was enquiring about different units.

They appear to be fairly old and no doubt would need renovating.

Rates, Insurance and maintenance would be very high.

Chris

He spoke about these when I was enquiring about different units.

They appear to be fairly old and no doubt would need renovating.

Rates, Insurance and maintenance would be very high.

Chris

Finally, an update on the Aquis development: http://www.cairns.com.au/article/2013/10/05/248794_local-news.html

Regardless of whether Aquis goes ahead or not, there seems to be a surge of associated developments in Cairns, which I am also tracking.

Cheers

Jen

Regardless of whether Aquis goes ahead or not, there seems to be a surge of associated developments in Cairns, which I am also tracking.

Cheers

Jen

Nelly

If it brings tourists to Cairns it will increase employment. Thereby increasing the need for rentals.

This is what happened previously, when the dollar was more attractive, the flights increased and the number of tourists grew, which then meant southerners were going to Cairns for employment and needed rentals.

During that time my rents increased but once the dollar fell and the tourists stopped coming, southerners went home and rents fell dramatically. One of mine went down by $70 per week.

Chris

If it brings tourists to Cairns it will increase employment. Thereby increasing the need for rentals.

This is what happened previously, when the dollar was more attractive, the flights increased and the number of tourists grew, which then meant southerners were going to Cairns for employment and needed rentals.

During that time my rents increased but once the dollar fell and the tourists stopped coming, southerners went home and rents fell dramatically. One of mine went down by $70 per week.

Chris

Nelly

If it brings tourists to Cairns it will increase employment. Thereby increasing the need for rentals.

This is what happened previously, when the dollar was more attractive, the flights increased and the number of tourists grew, which then meant southerners were going to Cairns for employment and needed rentals.

During that time my rents increased but once the dollar fell and the tourists stopped coming, southerners went home and rents fell dramatically. One of mine went down by $70 per week.

Chris

Not really what I was after. I know they have a KPMG report but does not appear to be available for the public.

You would have to see the strata fees which would be horrendous due to high insurance premiums and council rates up there.

Cheapest apartment I saw was $30K returning $180 a week. $5K strata though.. you seriously wouldnt bother. Its still for sale.

I really only look at houses though..

What you don't see though is that the high insurance premiums are for houses also not just strata. I looked at a $250,000 house and most insurance premiums are $3500+ , so when you compare them to a unit at $5,000, the extra $1500 is for general maintenance of the complex, so the $5,000 per year doesn't seem that bad IF YOU ARE CONSIDERING INVESTING IN CAIRNS (sure, compared to capital cities like Sydney and Melbourne the strata fees are expensive)

What you don't see though is that the high insurance premiums are for houses also not just strata. I looked at a $250,000 house and most insurance premiums are $3500+ , so when you compare them to a unit at $5,000, the extra $1500 is for general maintenance of the complex, so the $5,000 per year doesn't seem that bad IF YOU ARE CONSIDERING INVESTING IN CAIRNS (sure, compared to capital cities like Sydney and Melbourne the strata fees are expensive)

I don't think that the $5k that jusm was talking about even included insurance premiums.

I found this development exciting at first but now think more with a lot of caution. It could cause a bit of a boom during construction but then collapse again. Does anyone know if there is any expert reports on it?

Here is an article today SMH and the reporter raises the same issue as I do. Many would find the KPMG report a good starting point. Or at least some professional input.

http://www.smh.com.au/business/resort-dreamers-keep-casino-chips-close-to-the-chest-20131004-2uzl1.html?fb_action_ids=10202270065859559&fb_action_types=og.recommends&fb_source=other_multiline&action_object_map={%2210202270065859559%22%3A527239507359086}&action_type_map={%2210202270065859559%22%3A%22og.recommends%22}&action_ref_map=[]

What you don't see though is that the high insurance premiums are for houses also not just strata. I looked at a $250,000 house and most insurance premiums are $3500+ , so when you compare them to a unit at $5,000, the extra $1500 is for general maintenance of the complex, so the $5,000 per year doesn't seem that bad IF YOU ARE CONSIDERING INVESTING IN CAIRNS (sure, compared to capital cities like Sydney and Melbourne the strata fees are expensive)

I just insured a $440K 4 x 2 for $2,800 with QBE. You really need to research insurance up there (not on the web) or just use a broker like I did.

Insurance seems disproportinately high for unit/apartment holders.

I found RACQ to be reasonably priced too but ended up going with EBM (QBE) as RACQ wouldn't insure the property because we haven't found tenants for it yet and it will (may) be vacant upon settlement.

RACQ has flood cover whereas EBM does not at the moment but the rep I was speaking to on the phone advised it's being introduced to policies in December I think it was.

RACQ has flood cover whereas EBM does not at the moment but the rep I was speaking to on the phone advised it's being introduced to policies in December I think it was.

I have always found Suncorp to be reasonable, and Terry Sheer (also underwritten by Suncorp, I believe) is pretty competitive for landlord's insurance. If you have a unit there, Suncorp are pretty much the only company to do stata title.

You can go online and adjust the variables to get it down to a reasonable rate. Increase the excess, and get locks on the windows. i got my current house insurance down to $2k, which I think is reasonable.

Cheers

Jen

You can go online and adjust the variables to get it down to a reasonable rate. Increase the excess, and get locks on the windows. i got my current house insurance down to $2k, which I think is reasonable.

Cheers

Jen

Another article on the project in today's news: http://www.cairns.com.au/article/2013/10/15/249187_local-news.html

Cheers

Jen

Cheers

Jen

Another article on the project in today's news: http://www.cairns.com.au/article/2013/10/15/249187_local-news.html

Cheers

Jen

Looking good. I'm heading up there this week to settle on our property and do a bit of maintenance before renting it out. It's been an interesting experience buying in FNQ. Suffice to say I now know a hell of a lot more about termites and termite prevention than I did before

Jen you seem to know a fair bit about the area. Do you know what the planning issues are with putting a second dwelling on an existing block and renting separately? Assume keeping it all on one title. Are the council ok with that or are there issues because the land is zoned single occupancy?

Cheers.

Similar threads

- Replies

- 6

- Views

- 1K