In my opinion and experience, someone who wants to be a devils advocate is often just looking for a reason to be negative and critical rather than actually adding value to the discussion.

I much prefer constructive criticism, not just criticism. I don't want to be told it can't be done - I want to be told HOW it can be done. There is an assumption there that it can actually be done. Once again I point out that if you believe that it can't be done (building wealth through residential property investment) then I suggest perhaps that this is not the place for you?

By my calculations there are nearly 100 members on the site who have over 1000 posts. Of those top 100 posters (which includes yourself), I'm pretty sure you are the only one who does not consider themselves a property investor.

Which leads to the obvious question. Why are you here ? What is it you hope to gain from posting here ?

Could it be because there is not much clarity about where we are in the property cycle, thats leading people to diverging opinions.

I have owned and still own residential investment property. I am still holding it because i cant really be sure either way. Transaction costs of buying and selling residential property coupled with CGT, makes asset timing a very expensive excersise for residential property (in my case i would need my properties to fall by 20-25% odd to justify selling them). Since i can see both

positives:

1) reduced interest rates leading to increased affordability and more importantly increased cash flow for me

especially once i fix my remaining variable interest rate expense

2) insufficient supply relative to underlying demand

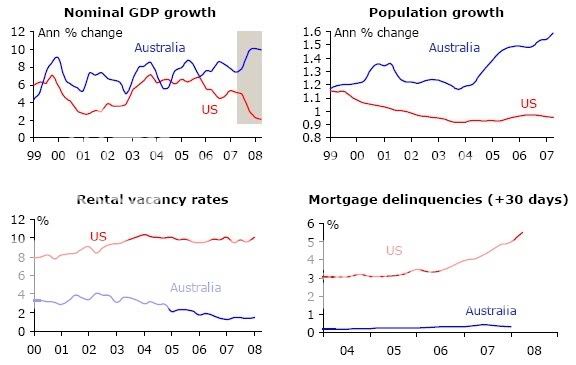

3) negligible loan areas and default rates compared to the rest of the world, even after a period of higher interest rates.

negatives:

1) nominal property prices have risen very fast over the last 15yrs, faster than the long term trend. I am always weary of an asset class whos nominal value rises too quickly. History has shown that over the long term asset classes always revert to the mean (whilst going through significant over and under shoots during this time).

I am doing nothing, just holding what i have already.

Is property a

great get rich slow but with high degree of certaintyopportunity for the average person,

definately.

Is it the right time now to allocating

new money to residential property as an asset class: I dont know (personally i current favour australian shares as an asset class at this point in time). Will i one day expand my property portfolio, definately, when in my opinion it represents the best asset class again to allocate

new savings.