Oh, you bought a house in January ? Congratulations, by the end of this year I'm sure you'll be able to see clearly that you've made the right decision and bought at the right time. We had our correction in the last quarter and anyone waiting for price falls like they had in US and UK is dreaming, although even there in the majority of cities price falls have been greatly exaggerated.

.....

Sorry, but I'm not buying the 'but I can afford it" bit. (maybe if Packer said it I would ) I doubt anyone in his right mind would buy a $500 pair of shoes today if they were going to be able to get them for 40% less tomorrow let alone someone buy a $500,000+ house now if they thought they could get it for 40% off later. But nice try.

Thanks, its a good feeling to finally get what I was looking for, and for a good price. I paid $575k, and an effective mortgage of $50k after offset. Trust me I can afford it, I have enough in shares to pay it out now, but I'll use the mortgage to fall back on if/when I lose my job, and to buy stuff. Its cheap money at the moment.

To clarify, I'm not expecting houses to be 40% cheaper tomorrow, if they do fall that far it will take years. I have been putting in offers on houses for the past 3 years (this was our 7th go), so I have been willing to buy at anytime during the peak, because I don't mind losing money on something I want, just as I do with a TV, holiday or new car.

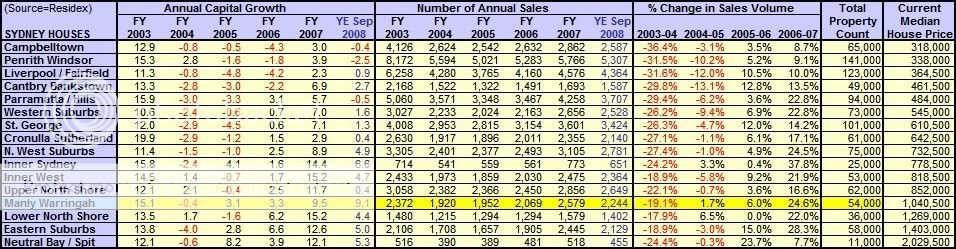

I've generally expected prices to remain flat for a long period, so my strategy has been to get ahead while they do, not to wait for them to get cheaper. On average prices have been flat (+5%) in Brisbane since 2005. 2008 evened out 2007's growth.

Lately with the global economy getting worse than I expected, I've been giving even weighting to up to 40% falls from peak. I'm not 100% sure that will happen, so to wait would be a gamble for me, particularly as my circumstances have changed, we will be losing an income, paying more rent for a bigger place, and my return on cash is falling. I'll be going from saving $9k per month to less than $3k per month. The advantage of waiting is diminished, the cost of buying is small for my personal circumstances ($65pw, plus lost income on my cash).

On top of this I bought a house that would have sold in the peak at $700k-$750k, for $575k. The median may have only fallen 3%, but individual houses have done better or worse than this. Prices in the $600k - $1m range are down on peak prices in the parts of Brisbane I've been watching.

So those $500 shoes are only costing me $415, they may fall as far as $300 in the future, it could take 5 or 10 years. In the mean time I have to rent my shoes from a 'shoe-lord' who is likely to sell up as times get tougher, and get very little return on my very large shoe deposit. I've got $370 in the bank, I'll just buy them now and avoid the risks.