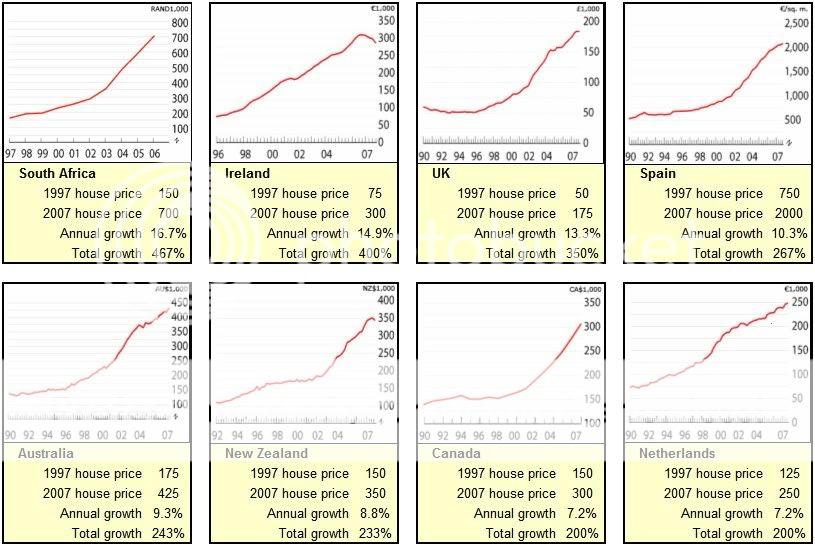

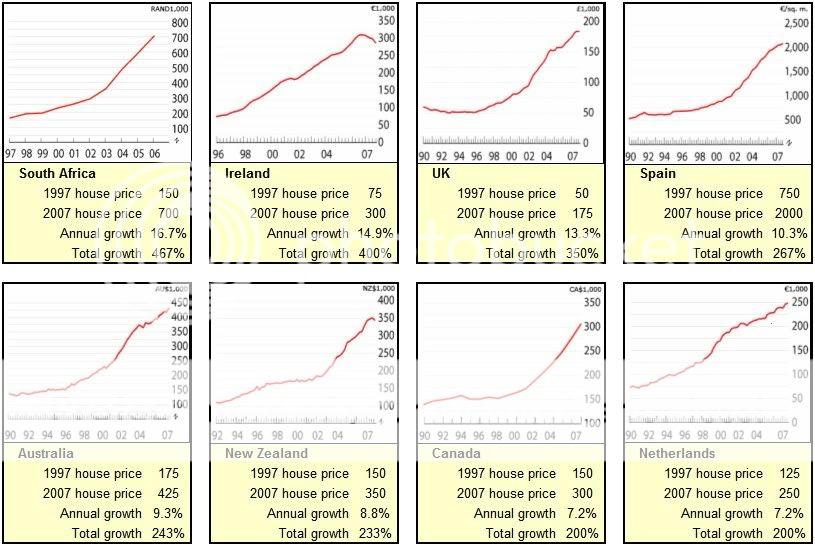

Oh yes, and the UK property boom was considerably larger than ours to begin with...

Cheers,

Shadow.

Hi Shadow - great info. What's the source? Link?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Oh yes, and the UK property boom was considerably larger than ours to begin with...

Cheers,

Shadow.

Hi Shadow - great info. What's the source? Link?

You are correct, they would be renting. That would push the rents up which in turn would push up the house prices. It could take a few extra months but the end result would be the same.

Of the UK :

"I'm surprised by the way public sentiment held positive for so long and then turned on a sixpence. I expected people to gradually come round one by one.

There must have been a trigger, but I'm not sure what it was."

Why arn't people reacting?

Because :

1) Property doesn't go down in Oz it only every goes up.

2) There is an undersupply

3) Rental market is extremely tight

4) the government can and will prevent property from sliding

5) the health of the economy does not effect property prices

6) this is an upward trend due to the influx of FHB.

Population growth is a big one. While the Australian population is growing at 1.7% per annum, the UK growth is only 0.4% per annum, less than a quarter of our growth rate!

But most of the population of Australia don't want to live in 99% of Australia. 90% of the population want to live in a major city (and there's only about half a dozen of them). OTOH, the UK & US are much more homogeneous regarding desirability of location.0.6% (the actual pop growth) of the UK population represents the same number of people as 1.7% of Australia's population. So both countries are adding approx. 350,000 people per annum..... considering the UK is a country the size of Victoria

Meanwhile, using that table, New Zealand has 66% of people living in the two largest cities. This is not preventing a housing bust there.

What does it say about her Government’s management of the economy when, after 9 years of Labour, 46,000 people went to live permanently in Australia last year and only 13,000 came back the other way, making that the largest ever net exodus across the Tasman?

Hang on - 54% in our two largest cities? Sydney = ~4.5 million Melbourne = ~4 million (being generous and rounding up) = 8.5 million.

8.5 / 21 = 40%.

Meanwhile, using that table, New Zealand has 66% of people living in the two largest cities. This is not preventing a housing bust there.

Sure.... different sources will give different statistics - they'll use different population areas. According to wiki - London has pop 7,172,091(12%), and Birmingham 970,892(1.5%) (total of 13.5% in top 2 cities).... and agrees with your figures of 3.8M for Melb & 4.3M for Syd (total of 38%).Yes, the argument is flawed. it's actually 38%, not 54%. Doesn't exactly create much respect for this report does it?

also, we're using percentages again and this might support the argument presented by Keithj, but i could just as well argue that with the Uk having a population of 61,000,000, a population density of 12% represents a much higher figure (7,500,000) than 20% of 21,000,000 (4,300,000). So London is still squeezing in almost twice the amount of people into it's largest city than our largest City, yet their property prices are plummeting.

hang on, i thought it was supply and demand. Surely a growing 7,500,000 population would sustain property prices?

lol

Note - the 2 largest cities in the UK are London & Birmingham. London represents 12% of the total UK population and Birmingham only 7%.

In Australia the two largest cities DO each contain a relatively high 18-20% of the population, though after Sydney and Melbourne this figure drops sharply down to 9% and below. But hey, it was a good use of figures for the argument presented by Keithj.

I have explained this to Shadow before, yet he doesn't seem to take anything on board.

0.6% (the actual pop growth) of the UK population represents the same number of people as 1.7% of Australia's population. So both countries are adding approx. 350,000 people per annum..... considering the UK is a country the size of Victoria - well, you can imagine how Shadow's choice of words is somewhat misleading!

To your argument it matters, but why does it matter overall?It's the percentage increase that matters, not the absolute increase.

Um. Duh? More people. More houses. They were also crying housing shortage before their recession too.You do realise that are a lot more houses in the UK than there are in Australia, right?

Australia has plenty of habitable land. It might be a small amount compared to the size of the total country, but considering the massive size of our island - the UK has less habitable land than we do. Don't be fooled by this misconception. Also, don't be precious about your own idea of what constitues 'habitable'. Plenty of cities around the world are built in deserts (vegas, dubai etc).And that much of Australia is uninhabitable?

This is simply not true Shadow. The largest city in the UK is London with 7.5m pop. The 2nd largest is Birmingham with 3.5m pop. The 3rd largest is Glasgow with 620,000. The list goes on, but all remaining 'cities' contain only a few hundred thousand or less people. Hardly 'cities'. More like 'towns', comparable to regional towns in Australia (mackay, rocky, bendigo etc). In fact, Australia has far more cities with populations over 1 million (7 i think).And that Australia has less cities than the UK?

I'm not sure exactly what you mean, but London population absorbs an extra 80,000 a year, compared to an average 40,000 for our biggest city Sydney. Now population of London is approx. double Sydney. Double the size, double the population growth. Makes sense to me. I don't know why it doesn't to you. ?????By your reckoning, a country with a population of one million people could just as easily absorb half a million new arrivals as could a country of 1 billion people.