more auctions in perth than ever, currently - especially for development sites.

auctions are not a common thing in WA, therefore i call top.

auctions are not a common thing in WA, therefore i call top.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Who said anything about buying ? I'm sitting on the sidelines watching prices go up.

How's Cairns going ? How much has palm cove gone up and what sort of returns can you get for a nice 2-3 BR unit a block back from the beach ?

Cliff

Too much coffee this morning Aaron??

Maybe you don't value your opinion , or that of others , but there are some people on this forum who value the information given on this web site .

Sorry, I value my own opinion so much that I seldom feel the need to review the opinions of RANDOM STRANGERS who try to feed me cherry-picked information.

I don't think most of the regulars on the forum would have a problem with what I said , and would probably appreciate that someone checked ??

SORRY again - I am not one of your regular buddies on this forum. If you had checked your facts, rather than shooting squarely from the hip when you see negative data, you would have seen that our other friend was talking about a different series of clearance rates than you.

BTW . If you don't value , listen to or believe what people are saying , What's the point of being here:roll eyes: or are you just a troll in disguise ?.

And my sincerest apologies about your confusion. I am always interested in finding new data sources and read well-reasoned analysis - no matter which way it falls. Sometimes that well-reasoned analysis comes from self-interested amateurs - thus my presence on this web-forum.

I am not a troll in disguise, although I might have a different opinion to you given I do agree somewhat with the sentiment of this thread - market sentiment could be changing as we write, and your optimism won't change that. At the end of the day, none of this is worthwhile without a well-considered exit strategy. Given my stage in life, I am looking to maintain higher levels of liquidity which means some have got to go - which ones I am yet to decide!

more auctions in perth than ever, currently - especially for development sites.

auctions are not a common thing in WA, therefore i call 'toppy' - about Jan 2006.

At the end of the day, none of this is worthwhile without a well-considered exit strategy. Given my stage in life, I am looking to maintain higher levels of liquidity which means some have got to go - which ones I am yet to decide!

This is what I have been preaching for a long long time, boring I know. However, since investing in the property game I have now been through at least 5 property cycles in 13 years

I am well aware of how important exit strategies are, and it does not matter how old one is, I always have an end plan to manage the risk, that's how I operate with all my buys... what if???. The first property boom taught me that hard lesson. If the market suddenly turns and I am stuck with a property that is going south I could end up with a property worth less than the actual home loan and negatively geared, its no fun waiting for the next boom cycle which could be as much as 7-10 years away. Missing out on other opportunities while my cash is tied up

Back to market sentiment, I just read the Herron Todd Report which was posted here early this week I think? Anyway they have all markets rising, except Tasmania and Canberra. I think their figures are lagging though. I certainly see markets in Perth changing, not dramatically, perhaps certain markets are going sideways.

I believe Melb is a mixed bag, some markets doing OK and some just going sideways. Lets see what happens later in Spring time, usually a good selling time??

The market is rising, yes. But so is the whole Central Coast as it picks up the ripple effect from Sydney.....apparently West Gosford is one of the fastest selling areas at the moment, so this market is rising?

I think from the data, you could exercise caution as the sales volume is low and therefore starts to become SNR.This is a very low entry level, would this be an area you would jump into in this stage of the cycle??

Thanks Seechange

very interesting.

Sydney

I am curious, apparently West Gosford is one of the fastest selling areas at the moment, so this market is rising? This is a very low entry level, would this be an area you would jump into in this stage of the cycle??

MTR

Hi MTR,

I think from the data, you could exercise caution as the sales volume is low and therefore starts to become SNR.

All the same, I think you'd see some growth if you purchased now. (Better to have done so, 12 months ago just before it kicked on, but still not too late IMO).

IRs will have to drop eventually, the RBA is holding a drum of petrol over the fire and we just have to wait for their arms to get tired

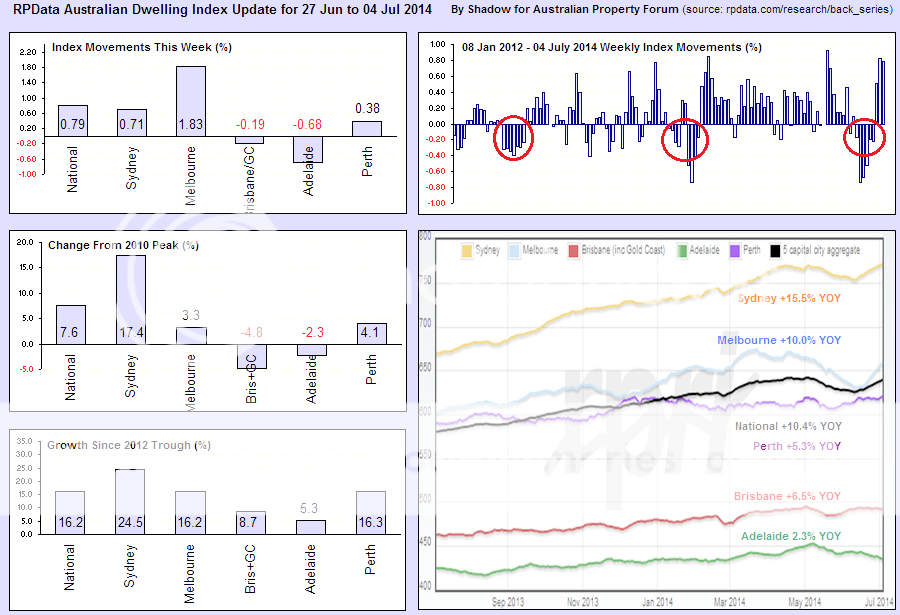

Prices back up in June 1.7 % after a 1.1 drop in May . Personally I think the gloom around the budget had a lot to do with that

LOL. But Glenn has arms of steel. He can hold it there forever!