Hi guys,

New, first time (no property owned).

I'll be honest, I'm making a snap decision here and I know wiith any investment things take time, so I'll ask you to not judge on that forefront (I get it - I'd slap someone taking a similar plunge into shares). But really, I saw the realse for a new estate in Piara Waters - Mason Green by Qube.

It's bordering mason road, wright road, armadale road (doesn't quite stretch to armadale). I am wondering firstly as a new investor, as a basic principle should one look at getting a smaller/average sized lot as a more affordable pricing point from a capital pov relative to rental, than blowing yourself out by getting a large sqm block (say 400+) that may be cheaper on a sqm basis? Would you get more back in terms of postive gearing or positive cash flow by starting smaller and building? Or does one run into problems trying to rent to aspiring families when going to small?

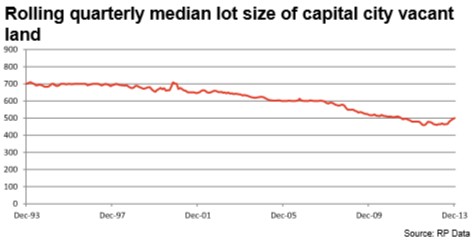

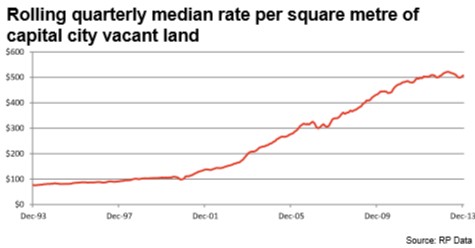

Secondly , what sq/m a lot pricing would one go for? What is reasonable? I did some calcs and many of the 300 to 400 something sqm blocks 680-760 $ /sqm.... not sure what the average is these days.

And lastly for the unitiated who have to make a decision in a few days, what would one look out for in a contract, or in terms of ensuring the land has no hidden nasties? I know, I know this is terribly unprepared... shares are my forte. Just looking for what advice one can give for someone with not much time to make a decision!

I'm only rushing as it's the first stage release... didn't want to potentially miss out in registering my preferences.. Thanks!

Any further links or books that I can quickly scoff down to get the basics into my head for investing/research and purchasing considerations would be much appreciated!!

APologies again for my tardiness... I am well aware! Thanks!

Thanks!

P.S. am I wrong to go by the guide of 1% rental income per week on the house price? So if i go for a $285,000 for around 375 sqm give or take, can I get a 3 or 4 bedroom house up and running on under 200k? To bring a total house and land of under 485,000? Assuming then unfurnished it could rent out at 1% roughly, say $450 (discounting slightly). Would this be an accurate representation when looking to invest?

And would 10m frontage be adequate for a modern 2 car garage out front these days?? Or does 10 m frontages really push design problems/costs up?

New, first time (no property owned).

I'll be honest, I'm making a snap decision here and I know wiith any investment things take time, so I'll ask you to not judge on that forefront (I get it - I'd slap someone taking a similar plunge into shares). But really, I saw the realse for a new estate in Piara Waters - Mason Green by Qube.

It's bordering mason road, wright road, armadale road (doesn't quite stretch to armadale). I am wondering firstly as a new investor, as a basic principle should one look at getting a smaller/average sized lot as a more affordable pricing point from a capital pov relative to rental, than blowing yourself out by getting a large sqm block (say 400+) that may be cheaper on a sqm basis? Would you get more back in terms of postive gearing or positive cash flow by starting smaller and building? Or does one run into problems trying to rent to aspiring families when going to small?

Secondly , what sq/m a lot pricing would one go for? What is reasonable? I did some calcs and many of the 300 to 400 something sqm blocks 680-760 $ /sqm.... not sure what the average is these days.

And lastly for the unitiated who have to make a decision in a few days, what would one look out for in a contract, or in terms of ensuring the land has no hidden nasties? I know, I know this is terribly unprepared... shares are my forte. Just looking for what advice one can give for someone with not much time to make a decision!

I'm only rushing as it's the first stage release... didn't want to potentially miss out in registering my preferences.. Thanks!

Any further links or books that I can quickly scoff down to get the basics into my head for investing/research and purchasing considerations would be much appreciated!!

APologies again for my tardiness... I am well aware!

P.S. am I wrong to go by the guide of 1% rental income per week on the house price? So if i go for a $285,000 for around 375 sqm give or take, can I get a 3 or 4 bedroom house up and running on under 200k? To bring a total house and land of under 485,000? Assuming then unfurnished it could rent out at 1% roughly, say $450 (discounting slightly). Would this be an accurate representation when looking to invest?

And would 10m frontage be adequate for a modern 2 car garage out front these days?? Or does 10 m frontages really push design problems/costs up?