Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Peoples thoughts on Adelaide?

- Thread starter havinago

- Start date

More options

Who Replied?As above $10-15k. If you need a contact for a quote shoot me a PM.

Thanks Brady and Corey.

Anyone interested?

http://www.realestate.com.au/property-house-sa-exeter-118246403

http://www.realestate.com.au/property-house-sa-exeter-118246403

Ah....no, I think it would collapse if I stepped inside

I got a headache just looking at the colour scheme

To niche for me to even seriously consider as an investment.

I got a headache just looking at the colour scheme

To niche for me to even seriously consider as an investment.

Wow thats kinda trippy.

What do the local experts think of this :

http://www.realestate.com.au/property-unit-sa-prospect-119231603

http://www.realestate.com.au/property-unit-sa-prospect-119231603

Just done the street from me actually. Has been on the market a little while i think, and with that interior, might stay there.

Is on a the corner of a reasonably busy interestion, across from a train line and level crossing too. Noisy.

South Australia's total employment, however, has been going backwards for more than half a decade.

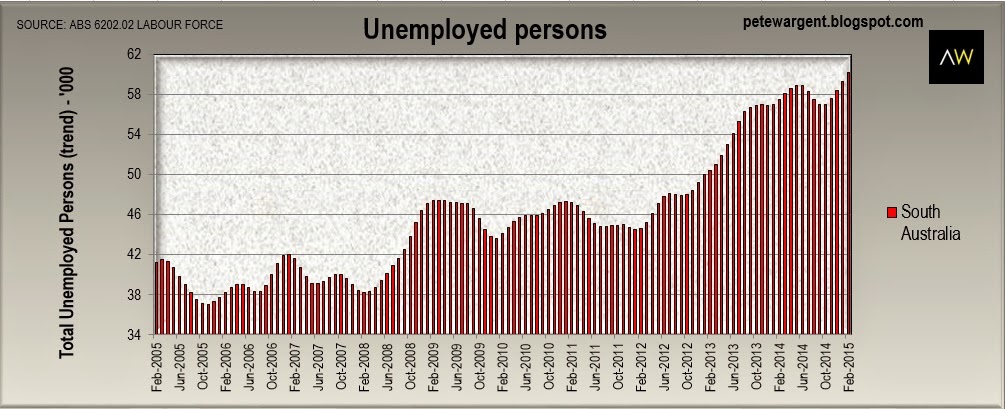

The number of reported unemployed persons on a trend basis in South Australia has increased by more than 35 percent since the beginning of 2012 and South Australia also now has the highest rate of unemployment in the country.

The unemployment rates reported in the Q3 2014 Small Area Labour Markets release suggest that high levels of unemployment have become a serious issue in the Elizabeth/Smithfield-Elizabeth North/Davoren Park areas, now recording by a significant margin the highest capital city unemployment rates in the country.

With the long drawn out retreat of car manufacturing appearing set to drag on for some time yet, this problem appears likely to become worse before it gets better.

http://petewargent.blogspot.com.au/2015/03/jobs-report-so-so.html

Get centrelink payments directly deposited into your account from your tenants?

Yea, it's called Centrepay. A few of mine are on this. They've never been a day late.

When life gives you lemons, make lemonade

Actually I was thinking similar when looking at some properties recently (rent likely able to be covered by two people on centrelink), reduces downside risk I guess.

I think there may be a better opportunity to buy in Adelaide around the climax of the unemployment trend though... likely within the next couple of years.

Actually I was thinking similar when looking at some properties recently (rent likely able to be covered by two people on centrelink), reduces downside risk I guess.

I think there may be a better opportunity to buy in Adelaide around the climax of the unemployment trend though... likely within the next couple of years.

When life gives you lemons, make lemonade

Actually I was thinking similar when looking at some properties recently (rent likely able to be covered by two people on centrelink), reduces downside risk I guess.

I think there may be a better opportunity to buy in Adelaide around the climax of the unemployment trend though... likely within the next couple of years.

That may be the case but it would be hard to pick the bottom, so while the numbers look good I'm going to purchase several more there over the next year hopefully

I'm looking at buying a unit in a good suburb - In or bordering Hyde Park. Something to do up over the next months and rent out and wait for the capital gain.

This contact fell through but is available again

http://www.realestate.com.au/property-unit-sa-hyde+park-119040407

Does this price look like a good buy?

This contact fell through but is available again

http://www.realestate.com.au/property-unit-sa-hyde+park-119040407

Does this price look like a good buy?

I didn't think it looked too bad from the pictures (built 1965) but I have a viewing today.I'd be a touch worried about those huge cracks running down the external wall in the carport. Somethings not quite right there

I can see why someone would, especially those comparing prices here to interstate, but in my eyes it may be worth waiting a little longer.That may be the case but it would be hard to pick the bottom, so while the numbers look good I'm going to purchase several more there over the next year hopefully

Growth looks like it's rolling over (below chart is ABS, RP Data indices suggests we've seen prices drop YTD so far):

Then we've got unemployment rising and likely to only get worse in the near future.

Further more at an Australian macro level conditions are worsening (e.g. GDP, wage growth, commodity prices, etc & all indication from China that things may get worse here with likely implications for us), I think Adelaide will face muted property price growth if not negative in the near future.

On the plus side, interest rates are low and probably going lower which may reduce the severity of any further price falls.

I can see why someone would, especially those comparing prices here to interstate, but in my eyes it may be worth waiting a little longer.

Growth looks like it's rolling over (below chart is ABS, RP Data indices suggests we've seen prices drop YTD so far):

Then we've got unemployment rising and likely to only get worse in the near future.

Further more at an Australian macro level conditions are worsening (e.g. GDP, wage growth, commodity prices, etc & all indication from China that things may get worse here with likely implications for us), I think Adelaide will face muted property price growth if not negative in the near future.

On the plus side, interest rates are low and probably going lower which may reduce the severity of any further price falls.

All valid points but they don't consider potential increases in interest from cashed up people in Sydney looking to leverage off recent large capital growth gains. You could argue that this would only be a small % of the market but investors are generally more interested in the lower end of the market and unless vacancies spike which seems unlikely interest in this market will remain at the lower end IMO

Hobo-jo

Question...

Have you actually been out in the market?

Have you gone to any open homes or auctions?

I'm truely interested to know.

I do attend occasionally (auctions & opens in the area local to where I'm renting), but don't lend much credit to anecdotal observations (my own or otherwise).

Similar threads

- Replies

- 3

- Views

- 5K