I just came across an interesting article in the Financial Times by Gillian Tett, who is one of the best financial journalist's going around (I would highly recommend her book Fool's Gold, which deals with the origins of the sub-prime mortgage crisis), suggesting the US commercial property market is being precariously propped up by low interest rates and banks extending loans. I thought I would share: http://www.businessspectator.com.au/bs.nsf/Article/Commerical-propertys-house-of-cards-pd20101231-CMUYP?OpenDocument&src=is

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US Commercial Property Bubble?

- Thread starter mortgageman

- Start date

More options

Who Replied?Possibly Alex, but the problem will be that if the economy improves there will be pressure on the Feds to push rates up, which may trigger delinquencies in the commercial property market, so it's a double-edged sword. I don't think the risk in this sector approaches anything like the sub-prime mortgage market a few years ago, but it is a worry as an increase in defaults in this market will increase funding costs in Australia.

Regards,

Cameron Perry

Perry Financial Strategies

www.perryfinance.com

Regards,

Cameron Perry

Perry Financial Strategies

www.perryfinance.com

Possibly Alex, but the problem will be that if the economy improves there will be pressure on the Feds to push rates up, which may trigger delinquencies in the commercial property market, so it's a double-edged sword. I don't think the risk in this sector approaches anything like the sub-prime mortgage market a few years ago, but it is a worry as an increase in defaults in this market will increase funding costs in Australia.

US residential mortgages are fixed rate mortgages, though. Are commercial ones? If they're also fixed, increased rates won't matter.

By that logic, ANY defaults will increase funding costs in Australia. If that's the worry, there are plenty of candidates other than US commercial property, with the banks able to borrow from the Fed. Europe would be a much bigger risk, no?

Alex, not all residential mortgages(or commercial mortgages) in the US are fixed rate mortgages, but besides I think you missed the point of the article. The point was that many commercial loans in the States have exceeded their maturity dates and are now highly leveraged due to the drop in prices. The banks over there have agreed to extend loan terms in the hope of a price revival and have been able to do this due to the low rates. Should interest rates rise over the next couple of years, it will become difficult to continue extending loans that have reached maturity dates. If prices go up, there won't be a problem but if they don't there will be heavy losses felt by banks over there, and potentially a meltdown in commercial property prices (I hope not).

I am not arguing about what is the greatest risk to Australia, I wouldn't know, just linking to an article about the position of US commercial property that I found interesting. For what it's worth, I would say that a much higher proportion of our funding comes from the States than Europe and the US commercial property sector is huge. It goes without saying that if this market collapsed it would have considerable repercussions over here.

Regards,

Cameron Perry

Perry Financial Strategies

www.perryfinance.com

By that logic, ANY defaults will increase funding costs in Australia. If that's the worry, there are plenty of candidates other than US commercial property, with the banks able to borrow from the Fed. Europe would be a much bigger risk, no?

I am not arguing about what is the greatest risk to Australia, I wouldn't know, just linking to an article about the position of US commercial property that I found interesting. For what it's worth, I would say that a much higher proportion of our funding comes from the States than Europe and the US commercial property sector is huge. It goes without saying that if this market collapsed it would have considerable repercussions over here.

Regards,

Cameron Perry

Perry Financial Strategies

www.perryfinance.com

Possibly Alex, but the problem will be that if the economy improves there will be pressure on the Feds to push rates up, which may trigger delinquencies in the commercial property market, so it's a double-edged sword. I don't think the risk in this sector approaches anything like the sub-prime mortgage market a few years ago, but it is a worry as an increase in defaults in this market will increase funding costs in Australia.

Regards,

Cameron Perry

Perry Financial Strategies

www.perryfinance.com

i am not overly worried about this.

If the US economy improves, then the commercial property sector will also improve. Capitalisation rates will start to fall, vacencies will drop, rents will stabalise.

Hence the ability to 'wear' higher interest rates will likewise rise.

The main risk that i see are sovereign debts. I still believe that come 2012-2013 there will be effective default on sovereign debts in certain countries.

This may take the form of an indirect default through 'restructuring', but it is never the less an effective default.

Such defaults will have an impact on the interbank rates, this will have a flow on effect to australian banks.

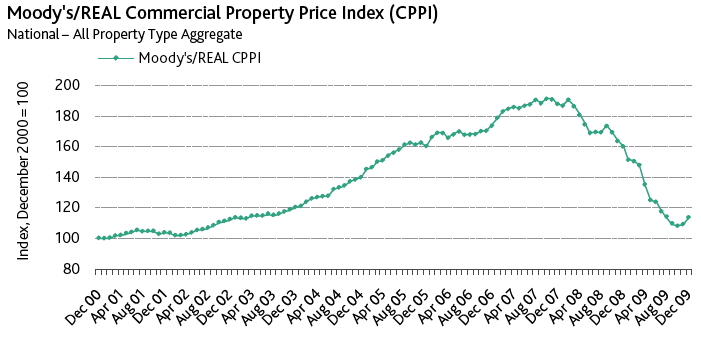

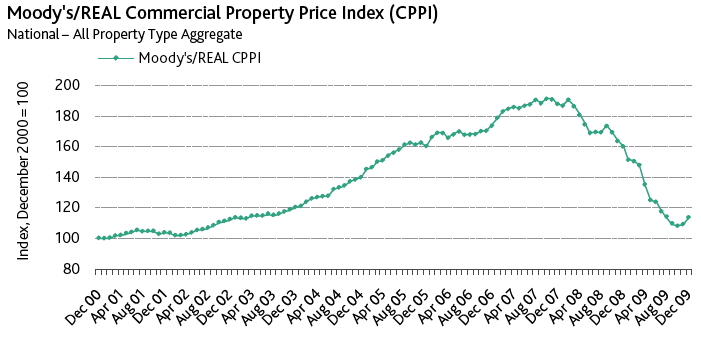

There were continuing signs of recovery in the commercial real estate market in December, according to Moody’s.

The Moody’s/REAL All Property Type Aggregate Index measured a 4.1% increase in commercial real estate prices in December 2009. This marks two consecutive months of price gains, and is the largest monthly increase in the history of the Commercial Property Price Indices (CPPI). However, prices still are down 29.2% over a year ago, 39.8% over two years ago, and 40.8% from the peak.

The Moody’s/REAL All Property Type Aggregate Index measured a 4.1% increase in commercial real estate prices in December 2009. This marks two consecutive months of price gains, and is the largest monthly increase in the history of the Commercial Property Price Indices (CPPI). However, prices still are down 29.2% over a year ago, 39.8% over two years ago, and 40.8% from the peak.

bubble? wtf?

hi all

just a couple of things

coloradorockies

charts are great but the people on the ground are a little better and the us comm market is still a long way to fall the us resi market is still going to fall and with it the comm will drop

so you can look at it as a what if

or you can look at it as when should I buy.

if its a what if well that a crystal ball looking at a market

and this is a very big market

my view is to do a bit of dollar cost averaging and spread across a few areas

not all will fall.

I like charts

but they don't pay the bills

if you want to be a first grade surfer

you need to read the waves and then look at the charts

if you try to use a chart to catch a wave good on you

and I am not a surfer

charts are a historic value

you need a on the ground report and you can't get that from a chart

yes the comm will and is going to get a hit

but you could post that some where in the world comm is going to go down

the US market is not one market its a huge multi layered market

and to say you think the comm is going to go down is like saying I think water wet

yes it is so what

just a couple of things

coloradorockies

charts are great but the people on the ground are a little better and the us comm market is still a long way to fall the us resi market is still going to fall and with it the comm will drop

so you can look at it as a what if

or you can look at it as when should I buy.

if its a what if well that a crystal ball looking at a market

and this is a very big market

my view is to do a bit of dollar cost averaging and spread across a few areas

not all will fall.

I like charts

but they don't pay the bills

if you want to be a first grade surfer

you need to read the waves and then look at the charts

if you try to use a chart to catch a wave good on you

and I am not a surfer

charts are a historic value

you need a on the ground report and you can't get that from a chart

yes the comm will and is going to get a hit

but you could post that some where in the world comm is going to go down

the US market is not one market its a huge multi layered market

and to say you think the comm is going to go down is like saying I think water wet

yes it is so what

Basile and Coloradorockies, you obviously didn't bother reading the article. Of course prices have dropped after the GFC, the point is that they should of dropped much further, but haven't because banks have artificially propped up prices by enabling loan terms to be extended at high LVR's.

mortgageman

yes and no

yes banks are proping them up but because they see there is a bigger wave still to come in the resi market.

the comm will correct still

to what degree no one knows at this stage

the comm was 9 to 10% returns as of 12 months ago its around the 12% net net now

and is this the time to jump in

not unless you have cash

and if you do then throwing it in is not the best way to do it.

there is alot of movements that can be done with comm

right downs

resecuring the principle debt

even rewriting notes

but you have to know the deal and also how you will fund the deal

the comm funding is alot different then here and does have to be alot more structured

from my info the US had the resi debt at 1.5 trill and the comm was at 3 trill

they then redid the numbers and they have the resi possible debt losses at 3 tril but but given a number on the comm

the big problem that no one can put a number on is the stratigic default numbers

the people that are not in default but walk away because they have not chance of the value getting back to the end loan amount

your debt is say 300k but the value from a foreclosure next door has the val at 60k and you have 20 year loan and they don't think in that 20 years the house will be worth 300k

and we are talking 100k to 3 mil houses

the last count was 20mil of houses in this bracket

thats alot of houses

they will hold as long as they see a light at the end of the tunnel

there is no light at this stage

the 20 mil is a guess as no one knows

you can quantify foreclosure numbers or bad debts as people have fallen behind and you can use a formula to work out numbers

but the SD have not defaulted and are in middle america

this is the problem and the reason I think the banks are hold firm on comm

if the comm falls and these people see comm dropping at the rate it should that dam will break and the sd will start walking in and walking away.

will they walk in anyway

my view is yes

for me we have not seen the worse in the us yet

yes and no

yes banks are proping them up but because they see there is a bigger wave still to come in the resi market.

the comm will correct still

to what degree no one knows at this stage

the comm was 9 to 10% returns as of 12 months ago its around the 12% net net now

and is this the time to jump in

not unless you have cash

and if you do then throwing it in is not the best way to do it.

there is alot of movements that can be done with comm

right downs

resecuring the principle debt

even rewriting notes

but you have to know the deal and also how you will fund the deal

the comm funding is alot different then here and does have to be alot more structured

from my info the US had the resi debt at 1.5 trill and the comm was at 3 trill

they then redid the numbers and they have the resi possible debt losses at 3 tril but but given a number on the comm

the big problem that no one can put a number on is the stratigic default numbers

the people that are not in default but walk away because they have not chance of the value getting back to the end loan amount

your debt is say 300k but the value from a foreclosure next door has the val at 60k and you have 20 year loan and they don't think in that 20 years the house will be worth 300k

and we are talking 100k to 3 mil houses

the last count was 20mil of houses in this bracket

thats alot of houses

they will hold as long as they see a light at the end of the tunnel

there is no light at this stage

the 20 mil is a guess as no one knows

you can quantify foreclosure numbers or bad debts as people have fallen behind and you can use a formula to work out numbers

but the SD have not defaulted and are in middle america

this is the problem and the reason I think the banks are hold firm on comm

if the comm falls and these people see comm dropping at the rate it should that dam will break and the sd will start walking in and walking away.

will they walk in anyway

my view is yes

for me we have not seen the worse in the us yet