Go back to the next rise in property prices location thread. The voted results are still relevant.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Victoria now in recession

- Thread starter Fifth

- Start date

More options

Who Replied?Certainly Melbourne is not the easiest market at the moment. But it's market within markets as always, and having intellectual property will give you homeground advantage.

As the RBA identified, apartments and fringe houses will be hit the hardest. But they predicted it a bit too late. I made this call 3 years ago on this forum. The hit has already set in as I accurately predicted.

As the RBA identified, apartments and fringe houses will be hit the hardest. But they predicted it a bit too late. I made this call 3 years ago on this forum. The hit has already set in as I accurately predicted.

Went over friend numbers yesterday he has $1000 under $3,000,000 in debt, Equity $4M. We played out a number of worst case scenarios of what could bring him unstuck. In the end there was many contingencies he could call upon, so all good.

Peter

I assume you mean $4M in assets (so $1M equity). Cause if its $4M in equity with that debt level he shouldn't have much to worry about.

Yes but what we don't see if the real measure of unemployment.

Full Time Jobs versus Part Time Jobs.

The Types of Jobs.

Even the fact more people are retiring then entering workforce.

I.e. this

http://www.rossgittins.com/2013/02/how-demography-is-affecting-us-right-now.html

Peter

Which is a good point, the headline unemployment rate can stay the same. But if there's an underlying transition from full time > part time / casual, that will hurt both borrowing capacity and confidence.

For sure, I don't know when it will turn - no one does. I just have this feeling about it though. We shall see.

The problem as I see it now is, we have such low interest rates. If house prices try to take off, then the reserve bank is going to move to lift interest rates which will cap growth.

Some might say the reserve will keep rates low for other parts of the economy, but I can't see house prices maintaining growth without some confidence / success in other parts of the economy.

If Liberal takes federal government, which seems like a foregone conclusion at the moment,

then between wielding the axe on public service, new industrial relations laws / boosting 457's etc. and just an all around conservative attitude to spending on projects, I can only see the problems locally getting worse.

The candle for me would be boosted immigration / foreign investors.

Everyone I deal with and/or know aren't hiring.Which is a good point, the headline unemployment rate can stay the same. But if there's an underlying transition from full time > part time / casual, that will hurt both borrowing capacity and confidence.

They are either laying off, or have done and are going it without as many staff - all industries.

As was said; a fair amount of casual and part-time activity, but not much else.

Builders as a whole are down on work. The paint shop here in our neck of the woods is down, and so on.

One stonework guy I know is busy - he does top-end houses. At the top end there are more folk with less of a problem with finance to spend on renovations.

Personally I think it's way too early to expect Melbourne is nearing recovery.

http://www.macrobusiness.com.au/2013/03/rba-highlights-melbourne-housing-risks/

Macrobusiness, LOL, the permagloom site.

Melbourne is up 6% since mid last year...

Congratulations to those who bought the bottom (to the day) and have now sold?Melbourne is up 6% since mid last year...

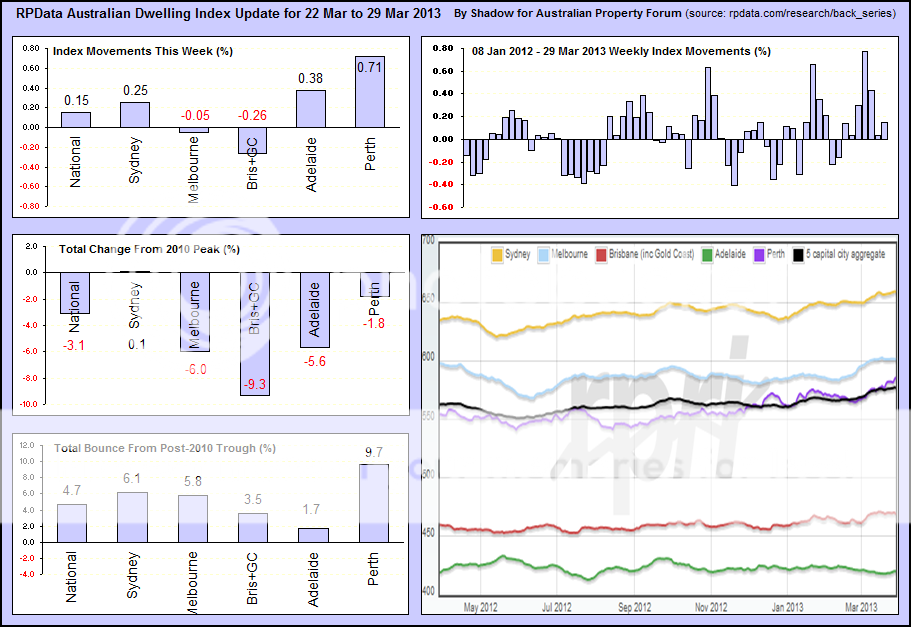

http://i187.photobucket.com/albums/x308/LPShadow/RPDataWeekly29Mar2013_zpsc21cb95d.png

Just highlights the ridiculous nature of watching a daily price tracker.

Congratulations to those who bought the bottom (to the day) and have now sold?

Just highlights the ridiculous nature of watching a daily price tracker.

Don't need to sell. Bought mid last year, now worth at least 25% more, at 80% leverage that's 100% RoE.

Congratulations to those who bought the bottom (to the day) and have now sold?

Just highlights the ridiculous nature of watching a daily price tracker.

That's what we call skill.

I'm not saying there aren't deals out there even in a falling market.Don't need to sell. Bought mid last year, now worth at least 25% more, at 80% leverage that's 100% RoE.

As Shadow said 3 weeks ago when he was gloating about the 6% move, he won't say whether he thinks prices are going higher or lower from here:

http://somersoft.com/forums/showpost.php?p=1005887&postcount=53

What does that tell you? He is just trolling with the daily number which means nothing.

Weren't you talking about building some $2m apartments a few years ago around the peak of the Melbourne market? How's that coming along? Is the "25% increase" on the land you've bought to start this project?

Weren't you talking about building some $2m apartments a few years ago around the peak of the Melbourne market? How's that coming along? Is the "25% increase" on the land you've bought to start this project?

Nope that's not the one I was talking about. That one should be progressing shortly - can't really rely on land value increases pre-construction as there won't be much valuation uplift in that.

melbourne CBD market (where i invest) is definately showing signs of upwards support compared to 6 months ago.

Things were getting close (to where i would divert back into residential property), but just as they were getting close, the market has gained support again, and up goes the prices.

Looks like i will have to find altenative green pastures.

Things were getting close (to where i would divert back into residential property), but just as they were getting close, the market has gained support again, and up goes the prices.

Looks like i will have to find altenative green pastures.

Nope, picking up apartments from distressed sellers in SEQLD and West SYD.

CF+

Peter

do you mind going into more details.

As an old timer, together with your invesment accumen i respect your insights.

Just highlights the ridiculous nature of watching a daily price tracker.

The monthly and quarterly data says the same - we're talking about the cumulative change since mid 2012 (nobody is making a big deal of a single day's movement, that's just a silly strawman).

So do you think Melbourne prices go lower or higher from here Shadow? Do you think the nominal bottom is in for Melbourne?

Do you have an opinion to share on the Victorian property market/state of it's economy or are you just here to provoke a reaction?

Yes, I think the bottom has passed for Melbourne (and nationally). We have entered a new up cycle which is likely to continue for as long as interest rates remain around current levels.

There might still be time for you to buy your old house back and perhaps come close enough to breaking even that it won't gnaw at your soul forever.

Don't wait too long. And also get rid of that useless yellow metal before it's too late...

And no, I'm not here to provoke a reaction... in fact I'm deeply offended by the very suggestion.

CSG shouldn't be allowed here anyway, so the point is moot.

where are these job losses Kathryn?With a hold on coal seam gas,and 27,000 jobs reported loss because of it, do you think this will affect the economy a lot?