I'm also interested to understand the implications of the US 700 Billion bailout and now the announcement that the US government will assume other bad debts.........where is the money coming from? what implications will this have for the future?

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

100 basis points RBA cut

- Thread starter plusnq

- Start date

More options

Who Replied?I'm a property bear and regular at GHPC, but if the AUD continues its decline it is positive for property. Remember - at the beginning of the boom the AUD was extremely weak, got to 0.47 USD one day. It made Australian property dirt cheap for expats, migrants and for those who live "internationally". In objective global terms the lower the AUD is the more attractive are the goods that are denominated in it.

Hi Spark,

With respect those of us that live "an intercontinental" lifestyle are a small and exclusive group, more likely to prop up the local drinking and girlie bar economy than the Australian housing market.

Remember the last boom was triggerred by falling rates, introduction of the FHOG, and a flight from the Tech Wreck into bricks and mortar.

Now we have falling rates, and a crap stop market, but yields on property are not as attractive now, as they were then and I think sentiment will take a beating as this unfolds further, especially with rising petrol and decreases in retail sales, construction and the resulting job losses.

With respect those of us that live "an intercontinental" lifestyle are a small and exclusive group, more likely to prop up the local drinking and girlie bar economy than the Australian housing market.

Remember the last boom was triggerred by falling rates, introduction of the FHOG, and a flight from the Tech Wreck into bricks and mortar.

Now we have falling rates, and a crap stop market, but yields on property are not as attractive now, as they were then and I think sentiment will take a beating as this unfolds further, especially with rising petrol and decreases in retail sales, construction and the resulting job losses.

Last edited:

Now we have falling rates, and a crap stop market, but yields on property are not as attractive now, as they were then and I think sentiment will take a beating as this unfolds further, especially with rising petrol and decreases in retail sales, construction and the resulting job losses.

As I said - I'm a bear on property too, but the lower the AUD will go the less bearish I'll become. IF the AUD is low enough for a long enough period (say 0.60 usd, 0.45 eur) , there would be inflation which will lift the price of "all other things", and wages, and rents along with them. RBA has stopped curbing inflation, explicitly. So housing, nominally, will look less overpriced than it currently is. Whether I like it or not, that's my understanding of things...

I'm a property bear and regular at GHPC, but if the AUD continues its decline it is positive for property. Remember - at the beginning of the boom the AUD was extremely weak, got to 0.47 USD one day. It made Australian property dirt cheap for expats, migrants and for those who live "internationally".

Thats true... 25% drop in AUD/CHF (almost there) + 25% drop in Australian property prices = 44% cheaper Oz properties in Swiss francs - nice, would encourage me to buy again, & we should be there soon enough.

Thats true... 25% drop in AUD/CHF (almost there) + 25% drop in Australian property prices = 44% cheaper Oz properties in Swiss francs - nice, would encourage me to buy again, & we should be there soon enough.

You have me confused. You have said many times before that Australian property prices are over valued and will come down. Why would you now consider purchasing property that you have previously said will fall in value?

The system is working: 6-12 months ago growth projections were fine and the RBA responded to inflationary pressures by lifting rates. Now that growth projections and inflationary pressures are soft, the RBA is doing what it’s supposed to do and releasing the brakes. The RBA (and our economy) have lots of room to move if need be.

Meanwhile, we have a progressively worsening housing shortage and a rapid rental correction occurring at the moment. I’m bullish about property.

Meanwhile, we have a progressively worsening housing shortage and a rapid rental correction occurring at the moment. I’m bullish about property.

That will be an interesting one. Mind you the spread between term deposit rates and mortgage IRs has been wafer thin lately. Not sure how they are making much money on that but I guess they haven't had many alternatives.

The 3F's - fees x 3

And volume. Non Banks are down from 25% to less than 10% of market share.

OO loans financed by non banks

Though all this must be getting offset by a lower churn rate on mortgages. Will be interesting to see this qtr's earnings and profit reports.

If their profit isn't substantially reduced, people will be seriously pi$$ed off cos they'll know the "higher cost of foreign wholesale" and overnight spread is a much smaller part of bank business.

Actually, the other thing going in the banks favour at the moment is increased cash deposits, as people bail out of property and stocks. CBA are up 18% for FY08, compared to long term growth of 9%pa. And where's the big risk in cash deposits?

Agree, they pushed the rates up too much and have just realised it was resource business pushing the spending and borrowings, the aveage joe has been crippled for a few years.Personally I think it is an admission by the RB that they were wrong and things are pretty bad out there

Regards

Graeme

Rents Increasing?

For my IPs I am seeing rents go up quicker, than I can move then up.

For instance: My two IP at Melton Vic renting originally 12 months back (when bought) for $240 a week. 3 bed moved to $250 in three months and 3 bed to $250 in 12 month.

I just put up the rent with notice on a 4 bed to $255 when market was $260 to $270 at the time. Keep the tenant I thought. But it now $270 firm for 4 bed.

3 bed is just gone to $250 but really could be $255 or $260 and with a conversion to 3 bed with study ( it is very large living area) I already have a tenant wanting it at $270 move in, in December.

Peter

For my IPs I am seeing rents go up quicker, than I can move then up.

For instance: My two IP at Melton Vic renting originally 12 months back (when bought) for $240 a week. 3 bed moved to $250 in three months and 3 bed to $250 in 12 month.

I just put up the rent with notice on a 4 bed to $255 when market was $260 to $270 at the time. Keep the tenant I thought. But it now $270 firm for 4 bed.

3 bed is just gone to $250 but really could be $255 or $260 and with a conversion to 3 bed with study ( it is very large living area) I already have a tenant wanting it at $270 move in, in December.

Peter

Last edited:

Now that the AUD is off 25 percent we have already had our Australian house price crash. Someone go tell GHPC to put on their party hats.

Your delusional

Has there been news on ANZ and what they'll be passing on?

Cheers,

Jen

ANZ have dropped by .80% see media release 7th October 2008.

http://http://www.anz.com/aus/about/media/mediareleases2008/media.asp?year=2008&type=mr

Regards

Regrow

Interesting concept. Perhaps we could look at something currrency neutral such as median national Australian house prices in ounces of gold.

1995 181oz

2001 310 oz

2003 477oz

2008 492 oz when AUD was 90.9849

2008 425 oz when AUD was 77.3

2008 367 oz when AUD was 70.72

So in ounces of gold deflation has occurred rapidly with house prices falling from a peak of 492 oz of gold when the dollar was at its peak to 367oz yesterday. That is somewhere around prices in 2002 gold terms.

Cheers

Shane

1995 181oz

2001 310 oz

2003 477oz

2008 492 oz when AUD was 90.9849

2008 425 oz when AUD was 77.3

2008 367 oz when AUD was 70.72

So in ounces of gold deflation has occurred rapidly with house prices falling from a peak of 492 oz of gold when the dollar was at its peak to 367oz yesterday. That is somewhere around prices in 2002 gold terms.

Cheers

Shane

ANZ have dropped by .80%

And for the record

so did ST George

Here is their media release.

http://www.stgeorge.com/media/news/archive.asp?id=355

I didn't say I would buy now, the statement was conditional on a fall in prices, which I still expect over the next 12 months. A falling dollar would make it even more attractive.You have me confused. You have said many times before that Australian property prices are over valued and will come down. Why would you now consider purchasing property that you have previously said will fall in value?

If you draw a trend line from 1991 to today, it looks like either gold is expensive or houses are cheap..... waddya reckonMaybe you need to be paid in gold

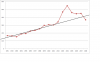

Attached chart shows house prices in oz's of gold.

Attachments

Just read this one

http://www.theaustralian.news.com.au/story/0,25197,24464646-601,00.html

Economists think RBA will cut rates by another 100 basis points

http://www.theaustralian.news.com.au/story/0,25197,24464646-601,00.html

Economists think RBA will cut rates by another 100 basis points