Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much will rates fall?

- Thread starter crc_error

- Start date

More options

Who Replied?I voted 200 points or more, but it will take a few years to play out with the odd extended flat period in the middle.

Given the RBA went up 3% and the banks added another 1% odd in the up cycle, its not too unrealistic to see the down cycle take out at least 2% of those increases.

Cheers,

Michael

Given the RBA went up 3% and the banks added another 1% odd in the up cycle, its not too unrealistic to see the down cycle take out at least 2% of those increases.

Cheers,

Michael

I voted 200 points or more, but it will take a few years to play out with the odd extended flat period in the middle.

I'd say the same.

In relation to the housing boom, I think house prices will fall with interest rates, and not rise until after the rates have hit the bottom.

What time frame are you talking about? I voted 75points and am including yesterday's drop.

I thinking we'll get a couple more and they'll stay the same for a 6-12 months.

All depends on what will happen with the economy, we're in surprisingly good shape compared to a few other economic super powers. Be interesting to see what happens when the demand for resources comes off the boil.

I thinking we'll get a couple more and they'll stay the same for a 6-12 months.

All depends on what will happen with the economy, we're in surprisingly good shape compared to a few other economic super powers. Be interesting to see what happens when the demand for resources comes off the boil.

What time frame are you talking about? I voted 75points and am including yesterday's drop.

I thinking we'll get a couple more and they'll stay the same for a 6-12 months.

All depends on what will happen with the economy, we're in surprisingly good shape compared to a few other economic super powers. Be interesting to see what happens when the demand for resources comes off the boil.

this is what I'm questioning, our economy isn't really doing that bad.. there was a report recently with un expected surge in business spending, so is the RBA going to need to drop rates to much?

This 25 point drop is really only giving back the 'extra' increases the banks passed on to us.. really we haven't seen a rate drop yet..

I went for 175pts but was including yesterdays 25pts. Why? Just feeling more optomistic than usual! sorry, no sound reasoning from me!

Regards Jodie

Regards Jodie

I went for 175pts but was including yesterdays 25pts. Why? Just feeling more optomistic than usual! sorry, no sound reasoning from me!

Regards Jodie

Jodie at the end of the day its just a guess like the rest of us.

Jodie at the end of the day its just a guess like the rest of us.

I think most of these predictions are more like "I hope it will fall 175 pts"

LOL i voted 150 and it seems so did everyone else!

i don't think there's much room to move. weakening interest rates = weakening dollar = higher crude prices = higher inflation.

i don't think there's much room to move. weakening interest rates = weakening dollar = higher crude prices = higher inflation.

This was the hardest poll ever. I could feel that conflict between hope and rational assessment in my own head. And I am not sure which one won. A two percent drop would have a significant impact on my portfolio so I can only dare to hope but I won't be putting it into any serious risk calculations.

Seriously?

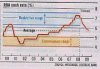

Most financial pundits have 150bp as their starting position over the next few years as shown in the "forecast" section of the attached graph. I personally think the RBA will ease to an expansionary stance before the easing cycle is over which is at least 200bp lower than today.

I guess the D&G really has prevailed at present...

Cheers,

Michael

Most financial pundits have 150bp as their starting position over the next few years as shown in the "forecast" section of the attached graph. I personally think the RBA will ease to an expansionary stance before the easing cycle is over which is at least 200bp lower than today.

I guess the D&G really has prevailed at present...

Cheers,

Michael

Attachments

As Ross Gittins says: Be careful what you wish for...I go for 200pts if we all clap our hands we can make it come true!

http://business.smh.com.au/business/yippee-the-bad-times-are-back-20080902-4816.html

But he did also make this good point:Ross Gittins said:But if domestic activity continues its dive, the Reserve will soon stop worrying about inflation, confident that rapidly rising prices and weak demand can't coexist. In this case it will continue cutting interest rates next year, but this would be a sign our luck had finally run out.

Be careful what you wish for.

Unfortunately, as always, the pain will not be evenly distributed. The fortunate will see rates fall as they hold strong jobs and big asset portfolios. The less fortunate with part time or casual work will lose jobs whilst already being in the classes locked out of asset accumulation.Ross Gittins said:Of course, those home buyers confident of holding on to their jobs during what economists euphemistically refer to as a "hard landing" have little to fear. For them the pressure is off.

So, for the majority here, happy days! But, for a lot of Australians: Be careful what you wish for...

Cheers,

Michael.

I voted 200 points or more, but it will take a few years to play out with the odd extended flat period in the middle.

Given the RBA went up 3% and the banks added another 1% odd in the up cycle, its not too unrealistic to see the down cycle take out at least 2% of those increases.

Cheers,

Michael

Good Logic Here, Peter 14.7

I go for 200pts if we all clap our hands we can make it come true!

If we stop spending for 12 months we can make it happen...

I voted 100bp which includes this recent hike, however I think it could be more if the ecomony looks like going into recession.

As interest rates drop, the thing I will be looking at closely are the long term fixed interest rates. When they look attractive enough I plan to lock in for 5 to 10 years.

As interest rates drop, the thing I will be looking at closely are the long term fixed interest rates. When they look attractive enough I plan to lock in for 5 to 10 years.

I'm starting to understand the general populations dislike of investors, but I would really like to lock in 7% fixed interest rates thanks very much.