I'm reading this book right now and I must say it's rather unnerving given the current economic situation...

The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in History. By Harry S Dent.

The idea of the risk to the economy from the retirement of baby boomers has been mentioned on Somersoft but in no great detail for some time. So perhaps a brief refresher might be worthwhile.

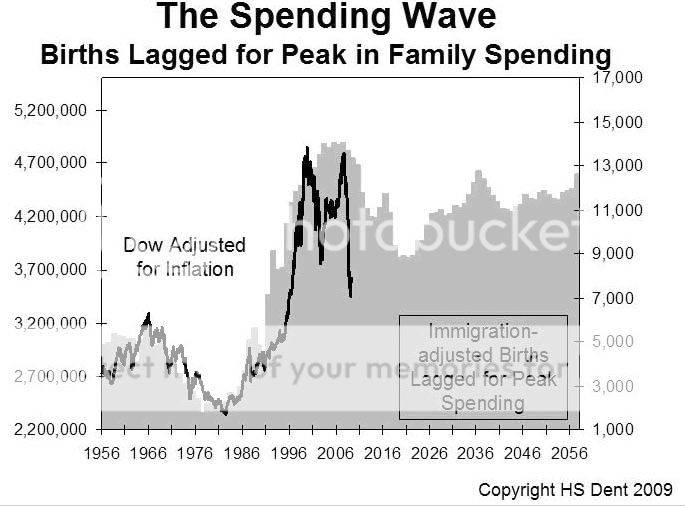

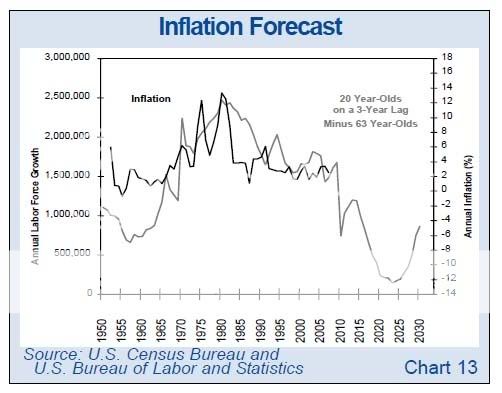

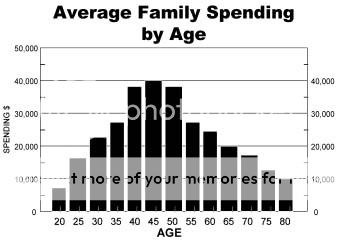

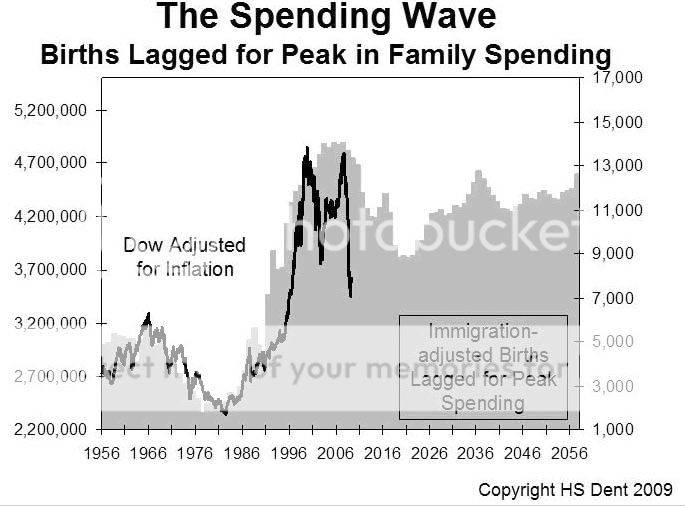

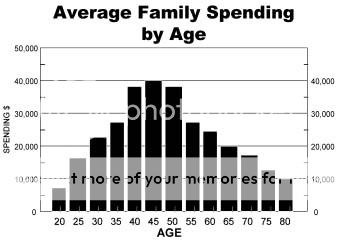

As I am now seeing it, Harry Dent's premise is that while the boom of the 90s and early 2000s were caused by easy & cheap money, that easy money was in turn created because of demand from the large number of baby boomers entering their peak spending years (reliably 46-50 years old). And indeed the stagflation of the 70s was caused by the drop in the number of people in their peak spending years (46-50 years after birth numbers dropped throughout the 30s and early 40s).

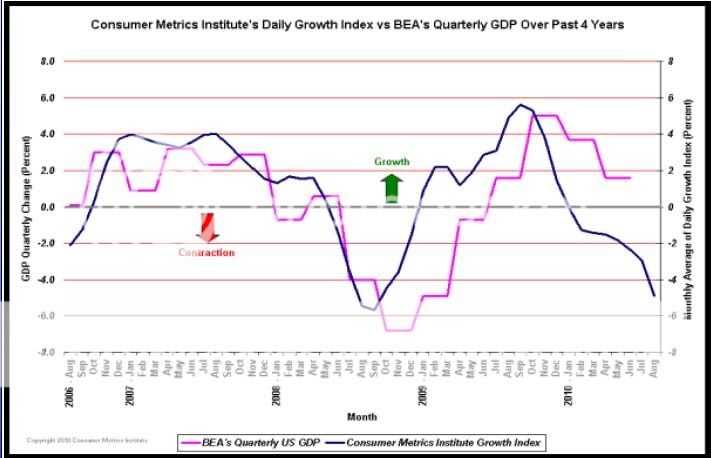

The unnerving part is Mr Dents forecast for the future. According to his reading of the baby boomer tea leaves, their peak spending years are over as of 2010-2012, and that countries who had post WW2 baby booms will go into a ten year plus depression (see charts). If he's right, no amount of rates easing or printing money can solve the problem, only a decade of deflation.

Japan went through the 'Lost Decade' (now two decades), of deflation for much the same reasons. Unfortunately I couldn't find a graph online which shows the correlation of Japans Nikkei index with the dropoff in consumer spending.

China's and India's birth cycles are different to Aus, US, UK & Europe. So for this reason Australia may be sheltered somewhat, but China can't continue grow as fast as they have been, if the world goes into depression.

Dent began making these forecasts in the 90s I think. He successfully forecast the decade long boom of the 90s. Though the Dow fell short of hitting his later forecast of 40,000 by 2006, he did get the direction and timing right.

Below: The grey chart is US Births lagged by 50 years for peak spending. It seems to show that peak spending at 50 years of age coincided with stagflation, then the boom of the 90s/2000s, and will result in an extended depression, before a recovery.

The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in History. By Harry S Dent.

The idea of the risk to the economy from the retirement of baby boomers has been mentioned on Somersoft but in no great detail for some time. So perhaps a brief refresher might be worthwhile.

As I am now seeing it, Harry Dent's premise is that while the boom of the 90s and early 2000s were caused by easy & cheap money, that easy money was in turn created because of demand from the large number of baby boomers entering their peak spending years (reliably 46-50 years old). And indeed the stagflation of the 70s was caused by the drop in the number of people in their peak spending years (46-50 years after birth numbers dropped throughout the 30s and early 40s).

The unnerving part is Mr Dents forecast for the future. According to his reading of the baby boomer tea leaves, their peak spending years are over as of 2010-2012, and that countries who had post WW2 baby booms will go into a ten year plus depression (see charts). If he's right, no amount of rates easing or printing money can solve the problem, only a decade of deflation.

Japan went through the 'Lost Decade' (now two decades), of deflation for much the same reasons. Unfortunately I couldn't find a graph online which shows the correlation of Japans Nikkei index with the dropoff in consumer spending.

China's and India's birth cycles are different to Aus, US, UK & Europe. So for this reason Australia may be sheltered somewhat, but China can't continue grow as fast as they have been, if the world goes into depression.

Dent began making these forecasts in the 90s I think. He successfully forecast the decade long boom of the 90s. Though the Dow fell short of hitting his later forecast of 40,000 by 2006, he did get the direction and timing right.

Below: The grey chart is US Births lagged by 50 years for peak spending. It seems to show that peak spending at 50 years of age coincided with stagflation, then the boom of the 90s/2000s, and will result in an extended depression, before a recovery.